Every time the Reserve Bank of India (RBI) changes the policy repo rates, there is a flurry of activity as banks recalibrate their lending and deposit rates accordingly. But, usually, there’s a method to the madness. When policy rates go up, lending rates are the first to follow suit, and when policy rates go down, the deposits get hit first. In both cases, the borrowers and depositors are left at a disadvantage.

Asymmetrical Rate Transmission: Little Room For Manoeuvre

It may not be viable to change the lender each time the repo rate changes, but you can select them using the transmission criteria by looking at historical rate changes

The good news is that the gap is slowly closing compared to data from previous years. Let’s understand why such asymmetry exists.

The Asymmetry

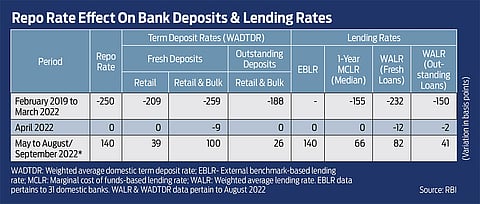

According to the latest bi-annual monetary policy report released in September 2022, between February 2019 and March 2022, the repo rate reduced by 250 basis points (bps). One bps is equal to 0.01 per cent. In the same period, rates on fresh deposits (weighted average for retail and bulk) reduced by 259 bps, while the weighted average lending rate on fresh loans reduced by 232 bps, and the rates on outstanding loans fell by 150 bps. The rate cut on existing loans is much less than the reduction in deposit rates.

What this means is if, say, both your lending and deposit rates were 9 per cent each, the lending rate reduced to 6.68 per cent for fresh loans and 7.50 per cent for existing loans, but the rate for fresh deposits (retail and bulk) fell to 6.41 per cent. In other words, you earned less on your deposits compared to what you paid on the loans.

In a rising interest rate scenario, between May and September 2022, when repo rates went up 140 bps, the deposit rates added 100 bps, but the lending rates were up 82 bps for fresh loans and 41 bps for existing loans.

So, in the same example, while the deposit rate went up to 7.41 per cent, lending rate rose to 7.50 per cent for fresh loans and 7.91 per cent for existing loans. Here, too, you earned less on your fresh deposits than your payments on loans, fresh or existing.

The reduction in interest rates was higher for deposits between February 2019 and March 2022, but the increase is almost equal to the hike in interest rates on existing loans. But, still, you are earning less on deposits and paying more on existing loans.

The asymmetry has not gone unnoticed, and RBI has been closely tracking rate transmission. In its latest monetary policy announced on December 7, 2022, RBI said, “The pace of transmission of monetary policy actions to lending and deposit rates has quickened in the current tightening phase, beginning May 2022. The weighted average lending rates (WALRs) on fresh and outstanding rupee loans have increased by 117 bps and 63 bps, respectively, during the period May to October 2022. On the deposit side, the weighted average domestic term deposit rate on fresh and outstanding deposits increased by 150 bps and 46 bps, respectively, during the same period. We are keeping a close watch on this process of transmission.”

The gap seems to be closing now, according to this latest data. It also indicates that banks moved to raise the deposit rates after a lag compared to increase in the lending rates during same period. While recuperating the rate transmission gap is important, it is also important that the same is done without a significant time lag.

Another asymmetry is the lack of benefit for existing depositors.According to experts, the current repo rate is higher than the highest fixed deposit (FD) interest rates offered by most banks in 2021. There is no mechanism to transmit the benefit of higher repo rates to existing FD investors. On the other hand, the existing borrowers have to bear the burden of increased interest rates. Even if they switch from old to new FDs, they have to bear hefty penalty charges.

What Explains The Asymmetry?

Ideally, the impact of changing repo rate should also reflect in fresh deposit rates (since existing deposits would usually be on a fixed rate), but that doesn’t happen immediately or in the same quantum usually.

So what explains this? Experts point out that deposit rates are affected by several factors, including the demand for credit, the liquidity in the market, the cost of funds, etc. So, even if the cost of funds is high, the bank may not increase the FD rates if the demand for credit is low. Or if there is a liquidity crisis in the market, deposit rates may go up even if the cost of funds doesn’t change much.

“Unless the deposit is linked to the repo, there is no mandate that the bank has to pass on the changes to the repo rate to the deposit rates. The banks still determine the deposit rates based on the liquidity and credit demand,” says Adhil Shetty, CEO, BankBazaar.com.

Currently, most banks link interest rates on loans to external benchmarks. Since most banks have adopted repo rate as the external benchmark, whenever RBI increases or decreases it, the interest rate on the repo-linked lending rates change faster, say experts.

Says Damodaran C., senior vice-president and chief risk officer, Federal Bank, “While changes in the repo rate is transmitted to loan customers whose accounts are linked to repo immediately due to regulatory guidelines, deposit pricing still continues to be driven by market demand and supply and, hence, not symmetrical to loan pricing.”

Also, transmission to non-repo-linked rates is poor. From February 2019 to March 2022, while the repo rate fell by 250 bps, MCLR-linked loan rates fell only by 155 bps. Further, from May to September 2022, when the repo rates went up 140 bps, MCLR rates rose only by 66 bps, shows RBI data.

Explains Damodaran: “Lending and deposit rates depend on the ALM (asset-liability management) profile of each bank. The Indian banking industry has predominantly floating rate loans and fixed rate deposits. The floating rate internal lending benchmarks (base rate, MCLR, etc.) used by the banks mainly depend on its cost of funds and related operating costs. Even if the repo rate is revised, the revision in deposit rates by the bank may come with a lag. The lag in the deposit rate revision will impact the lending rates too which is linked to floating rate internal benchmarks.”

Experts also clarify that the pass-through for rates may vary from bank to bank, depending on the reset period, subject to RBI’s specified maximum period. Some banks review the lending rates as and when they get revised, and others review them quarterly.

The pass-through of deposit rates depends on the liability profile, credit-deposit (CD) ratio and the growth prospects of the individual bank. Banks offering floating rate repo-linked FDs usually pass on the rate changes faster to such deposits. However, only a few banks currently offer such FDs.

What Should You Do?

“When lending rates rise faster than deposit rates, the gap between the two widens. When this happens in sync with rising inflation, people get lower returns from their investments but end up paying higher interest on borrowings. In such cases, they may either want to use their investments to offset the higher lending rates or look at alternatives to FDs which can give better returns,” suggests Shetty.

Every time rate changes, it’s not possible to change your lender, but you may assess which one fares better on the transmission criteria by looking at historical rate changes in loans.

When you open FDs during a low interest rate regime and expect rates to go up, you could scout for floating rate term deposits. Alternatively, you could stick to shorter-term deposits, so you can earn better returns when rates rise. Depositors should wait for a reversal signal in the interest rate cycle before choosing longer-duration FDs.

The author is a Financial Journalist With Inputs from Outlook Money