Before Anuj Karan Sharma left for higher studies in Australia, he had to make a small extra arrangement: Buy insurance.

Shield Your Future

After securing admission in foreign universities insurance is a critical expense for Indian students

In 2016, after securing admission in Torrens University’s three-year Bachelors of Business Administration program in Information Technology, the 21-year-old immediately bought a $ 1,600 (Rs 1,08,800) overseas student health cover from NIB, an Australian insurance company. The insurance covers medical costs, doctors’ visits, prescription medicine, pathology tests and accidents.

Sharma’s plan will expire three months after he completes his course in August next year. “I am happy that I bought the insurance. I paid the premium and the insurance firm will pay the rest in case of a medical emergency,” he says.

Student insurance has become a critical component of overseas education expenses. Today, many foreign universities do not admit students without travel and health insurances while some countries have already made it mandatory for obtaining visa. Countries that require insurance for filing visa application include the US, the UK, Canada and Australia, among others. There are, of course, institutes that do not require students to buy insurance, but experts say it is advisable to buy one even if there is no mandate for compulsory coverage.

According to Bhaskar Nerurkar, Head of Bajaj Allianz General Insurance, many countries prefer insurance cover for their overseas students. “This saves a large amount of medical bills, besides providing several additional covers,” he says. Medical cost difference for treatments between India and developed markets can be as high as three to four times.

Apart from medical emergencies, insurance is available for baggage loss, pre-existing illness, cancer screening, and mental illness more benefits.

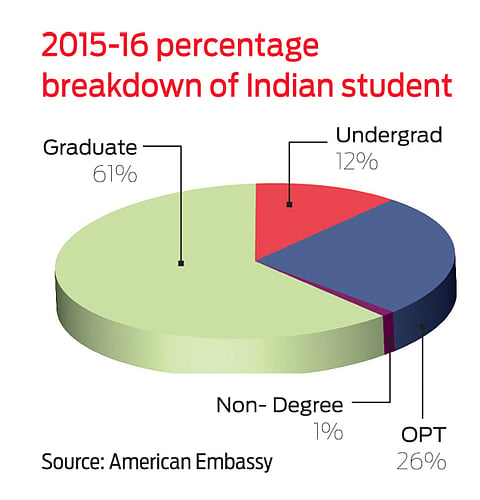

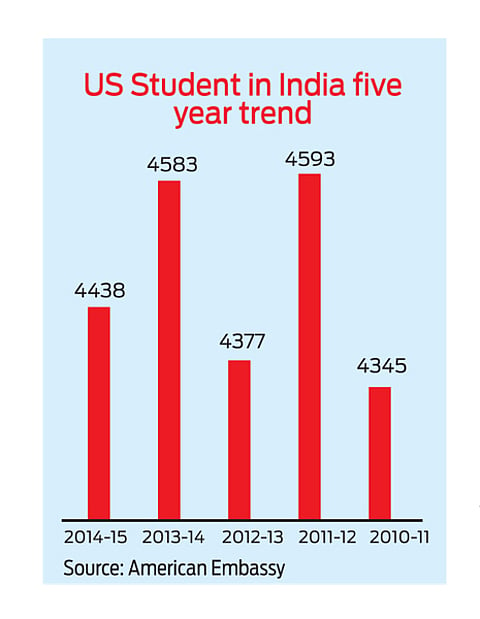

The need for insurance is steadily increasing as more students are seeking foreign degrees. An estimated 5,86,183 Indian students are studying outside India, according to figures released by the external affairs ministry in December 2017. In addition, India sends the second highest number of overseas students to the US for academic degrees. The number of overseas Indian students in the US has doubled to more than 186,000 in the last five years, according to Open Doors, an information resource company that tracks international students in the US.

Cheaper in India

Given India’s demographics, economic growth and admission pressures for higher degree courses at home, more students are likely to go abroad for their education in the future.

Ilma Hasan has recently got admission and partial scholarship for a two-year Masters course in Journalism and International Public and Affairs in Columbia University, New York. “If the university provides insurance well and good, or else I have to look for an insurance plan before I leave,” says Hasan.

Most insurers generally offer tailor-made covers to fit university requirements. For students like Hasan, buying the right insurance plan that offers low premium and high coverage is important. Opting for an insufficient or substandard insurance plan can be risky, as medical costs are far higher in the west than in India.

Rakesh Jain, Executive Director and Chief Executive Officer, Reliance General Insurance says, international student insurance in India is cheaper compared to the developed markets. The insurance provides round trip coverage, including baggage loss or delay. Besides, Indian insurers provide a $50 (`3,400) deductible compared to $400-500 (Rs 27,000-34,000) deductible offered by international insurers. Deductible is an amount paid out the pocket of a policyholder before insurance providers pay at the time of seeking claim.

KG Krishnamoorthy Rao, Managing Director and Chief Executive Officer, Future Generali India Insurance says, a basic insurance plan would cost an estimated $2,000 (Rs1.36 lakh) in the US, whereas the same plan would cost Rs $300-$500 (Rs20,400-34,000) at home. In monetary terms, it is also advantageous to buy a plan before leaving, as the premium would be paid in Indian rupees whereas the sum assured would be in US dollar or an equivalent currency. Student insurance is offered in the age group of 16-35 years.

Variety pickings

Several insurers have launched special packages. Bajaj Allianz General Insurance, for example, offers four plans – Prime Silver, Elite Silver and Companion Travel Care – for an insured sum of Rs34 lakh (US $ 50,000) and Prime Maximum for an insured sum of Rs6.8 crore (US $ 10,000,00)

Tata AIG General Insurance provides a range of Student Guard Overseas Health Insurance: Plans A for Rs34 lakh, Plan B for Rs68 lakh and Ultimate for Rs1.7 crore of the sums insured. Reliance General Insurance, on the other hand, offers a standard plan for Rs34 lakh, a silver plan for Rs68 lakh and a platinum plan for Rs3.4 crore of the sums insured, respectively.

The premium depends on the plan you choose and number of months or years insured for. If one chooses longer period of coverage, the premium will be higher, and vice versa. For instance if a student is travelling to the US with a Tata AIG General Insurance Student Guard Overseas Health Insurance Plan of Rs34 lakh insured sum, it will cost Rs2,846 for 30 days, Rs5,374 for 60 days, Rs15,931 for 180 days and Rs29,273 for 365 days respectively. This clearly shows that premium difference is based on policy period. Some companies like Reliance General Insurance offers month-wise option plans, whereas others such as Tata AIG General Insurance offers plans according to number of insured days.

One of the major hindrances for policy holders, however, is the delay in securing claims. To avoid claim rejection, Rao says that “students must consider several factors like standard covers, special covers, sum insured, exclusions, global tieups and claims processing systems before buying insurance”.

India insurers are currently simplifying the rules for accessing claims swiftly. Students can send an email or call a toll free number, and some companies also offer multilingual specialists for guidance.

The young population in India is growing. Demand for better higher education is exerting pressure on Indian education system and this has resulted in more and more students opting to study abroad.

For a student, starting life in a new country is an exciting journey. To be able to pursue education goals without worries, insurance is a good support to rely on during moments of crises.

nirmala@outlookindia.com