When a reign of disorderliness gripped the world last year, we took some time to realise the woes, reorganise ourselves, and revive with renewed vigour. And, eventually, the indomitable resilience of human being triumphed over the ravager. The regaining was slow, yet steady, and systems were restored at last.

Times’re Sour. Time’s For A SIP

As economy limps back to normalcy, investors smell a safe haven in SIPs. Assets under SIP MFs have touched historical highs and market stays bullish

The wobbly markets in the post-Covid world sees a stomping triumph of systematic investments with retail investors driving the assets under management (AuM) under the SIP category of mutual funds to a record high of Rs 4.67 lakh crore. Over the past five years, the AuM recorded a 30 per cent yearly growth. Discontinuation of systematic investment plans, commonly called SIPs, fell to its lowest at 6.6 lakh in the last one year.

The investment tool, offered by mutual funds, allows the investor to allocate a fixed sum of money in a chosen scheme periodically at pre-determined intervals. It can be once a month, instead of making a lump-sum investment at one go. SIP instalments can be as small as Rs 500 a month.

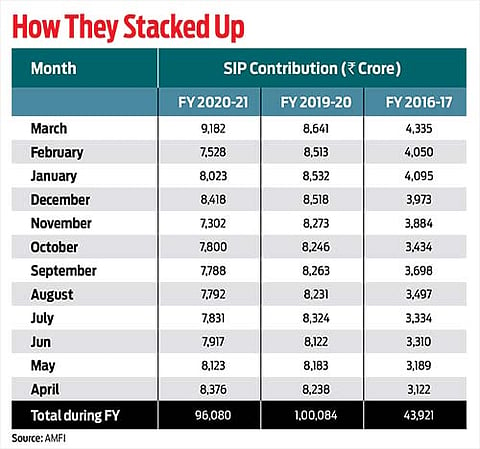

Funds collected under SIPs more than doubled to Rs 96,080 crore in 2020-21 from Rs 43,921 crore in 2016-17. Also, the monthly SIP contribution recorded a healthy growth of 2.52 times to Rs 8,819 crore in May 2021, as against Rs 3,497 crore in August 2016. Between January and June this year, SIPs contributed more than Rs 50,000 crore. The number of new SIPs registered every month saw a near-three-fold rise to 15.48 lakh in May 2021 from 5.88 lakh registered in April 2016.

“SIPs are one of the most investor-friendly investment tools,” says Ashwin Patni, Head of Products and Alternatives, at Axis AMC.

With the second wave of the pandemic receeding, the equity markets went into wild movements. Amid this overwhelming uncertainty, SIPs emerged as the safest option for the investor to rest assured about his money. Experts suggest raising SIP contributions, when stock prices are down, instead of withdrawing investments and losing out on returns. During a crash, the same amount of money buys more units. Investors may also reduce their SIP contribution or temporarily stagger their investments when the market reaches a zenith. They can reap the maximum if they control their emotions and adjust their SIP investments based on the overall market movements.

NS Venkatesh, Chief Executive at the Association of Mutual Funds in India (Amfi), believes investments in SIP were on the rise as markets moved up over the last several weeks and investors jumped in to ride the euphoria in the hope of capital appreciation. “Rising investment in SIPs will continue, at least for a year, since they (investors) are not timing the market,” he predicts. In addition, awareness campaigns conducted by Amfi over the past several months have also started yielding results.

The downs in the markets had made the investors risk-shy and the ups wooed them back. “They (investors) were driven out and pulled back in by market sentiments,” says Patni of Axis AMC.

Some investors stay put with their SIP investments because, they feel, these are more like recurring deposits. For them, SIPs offer the hope of earning returns higher than bank rates and they can beat inflation. “Changing the amount one invests in SIPs strategically, say every month, can enhance your returns,” indicates Nilanjan Dey, Director at Wishlist Capital.

In step with the evolving market dynamics, the investment tools, too, need to transcend to a higher plane. “It is the time for ‘SIP Plus’ – an enhanced tool for the optimiser,” Dey says. “The time for value-added SIP is here, thanks to innovative strategies that are rapidly becoming part of the smart investor’s arsenal.”

This ‘enhanced tool’ – more like a top-up – is being used by investors wishing to avail opportunities presented by the market. The trend is catching up fast. A top-up is a concept that seems to have been borrowed from the realm of insurance and can be utilised to augment a traditional SIP’s buying power. The investor can use it these days to acquire more units at a specific time of the year, coinciding with the investor’s receipt of bonuses or increments. For example, a portion of the compensation received by investors can be ploughed back to pick up additional units of SIPs that add to the assets.

There can be a tactical stoppage, but not a termination, that comes useful when the market scales highs. The investor can decide to hold back his SIP instalments as the number of units that can be purchased would just be fewer. As stocks turn pricier, the same amount of money will buy the investor fewer units through SIPs. It would be better to hold the funds for some time till the market has softened.

“The issue here is strategic in nature. Investors are expected to use SIPs very smartly in the days to come. The old-style SIP, thus, is set to evolve shortly,” says Dey. “Take any equity fund where a SIP buys fewer units when the market is high and more units when the market is low. Uncertain markets with frequent highs and lows are best dealt with in this manner.”

But, what seemed perfect till recently has now gone through a lot of scrutinies. Newer modes of systematic allocation are the way forward. SIPs, even in their flexible form, embody a friendly technique that retail investors can adopt well.

SIP makes an exception to the regular investment options in case of a default in paying instalments or discontinuing with the plan. The asset management companies that issue the systematic plans do not fine an investor for discontinuing with the investments. Even if an individual cancels a SIP, the capital already parked stays invested. One can withdraw or keep it. In case of any exigency, this can be redeemed in part or in full. In fact, investors can restart a SIP even six months after they have been discontinued. “SIPs offer flexible solutions. You can cancel, temporarily discontinue, or restart as many times as you want,” points out Patni.

Unlike insurance, which offers 15 days for refunds, SIPs do not have deadlines or ‘free-look periods’ as they are popularly termed in insurance. One can also change the frequency of investment freely.

On the investment front, one should look at various combinations to broad base his asset portfolio. These could be hybrid funds, multi-asset funds, pure debt, pure equity or global products depending on age and risk-taking ability. As one accumulates capital, the aim should be towards broad basing the portfolio.

According to Aniruddha Chaudhuri, Head of Retail Business at ICICI Prudential Asset Management Company, SIP inculcates a habit of forced savings and investments that offers safe and steady capital appreciation.

For disciplined investments, one should first invest or save and then spend. For Chaudhuri, credit cards and debit cards are the two asuras – or demons – that hold an immense potential of derailing an investor’s savings and investment plan. SIPs are in a way forced, and one can choose auto deduction that gets debited towards the beginning of a month so that savings come first, followed by expenses – the debit and credit cards.

The pandemic had dawned upon us as one of the worst nightmares in history. The impact on economies led to job losses, salary cuts, and unplanned, emergency expenditures. “This never means that an investor should discontinue with SIPs and withdraw his money prematurely,” says Chaudhuri.

Indeed. One must stick on to his investments and SIPs provide the flexibility to address many exigencies without being disconnected entirely.

Gaurab Parija, Head of Sales and Marketing at IDFC Asset Management Company, sums it up with a note of caution. “SIP is for people without the wherewithal to analyse the stock markets and cherry-pick stocks or those who do not have the time to manage their funds. So it is better left to experts,” he says.

***

Impatient Or Disciplined?

A steady rise in Covid-19 infections, general restrictions to contain its spread and a bleak global outlook resulted in a selling spree in stock markets in March 2020. A consistent increase in SIP discontinuation followed.

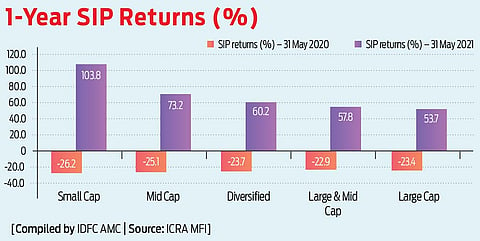

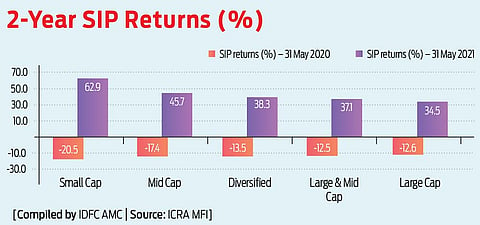

While investors started returning to SIPs after the first wave, the more patient ones did not withdraw from equity markets and continued investing via SIPs. They were a happier lot. Equity markets touched all-time highs soon after the second wave began waning. They reaped double and triple-digit returns over a year and two years, respectively.

Among SIPs, small-cap index (S&P BSE Small-Cap) delivered the highest one-year returns at 104 per cent. The handsome return, when compared to the lows of March 2020, has pushed the index to be among the highest performers. One-year delta returns have also improved the SIP returns over two and three years.

Investors exhibiting patience during challenging times by investing and remaining invested in equity markets via SIPs benefitted significantly after all major indices turned positive. It generated handsome returns over one year and two years.

***

Don’t Compare Apples with Oranges

Many investors learn from their financial planners or from other sources that returns from SIPs over 10-15 years vary between 12 per cent and 15 per cent annually. The returns are not handsome or positive every year, though. Unlike fixed deposits that keep on adding to the capital every year, returns from SIPs are not linear. SIPs in equity funds are affected by market movements. Therefore, the money does not keep rising every single year, it may increase or decrease with the markets in the short run.

The maximum return an investor has earned in any year was 78 per cent in 2009. The minimum return was minus-51.8 per cent in 2008 if one considers Nifty50 returns for 20 years. Although they could be higher or lower depending on market movements on a year-on-year basis, returns average out continually. An effort to compare returns from markets or SIPs with fixed income instruments like bank fixed deposits would be one of the biggest mistakes by any investor.

***

Get Your Basic Maths Right!

SIP is one of the safest ways to invest in a volatile stock market. However, one should consider his entire asset portfolio to decide on the quantum of money that should go into SIPs. In addition, the money invested in provident funds should also be regarded as part of one’s portfolio.

Parija believes in following the age-old formula where the percentage of investment in equity, including those through SIPs, should be 100 minus your age. Hence, portfolios need to be readjusted every year with a bias towards debt funds over time. So, for example, if the goal is 10-15 years, the kitty will last for the subsequent 30-40 years irrespective of whatever happens to the market when the goal is reached.

In an individual’s life journey, the young and salaried almost invariably look at asset allocation based on investible surplus after meeting expenses. Their first mistake! Many make a classic mistake of overcommitting and later not continuing SIPs after being convinced about investing in mutual funds.

“Always commit an amount that you can continue paying over the years. You can always increase them over time,” says Parija.

The sense of saving kicks in mostly after one gets married. However, as one ages, investment in equity and SIP has to sustain, although expenses also grow. Nevertheless, at some stage, the growth in the cost of living is outdone by increased earnings.

Despite numerous advantages of SIPs, it carries an inherent risk like all other market-related products. Therefore, it is best left for financial planner to decide.

debjoy@outlookindia.com