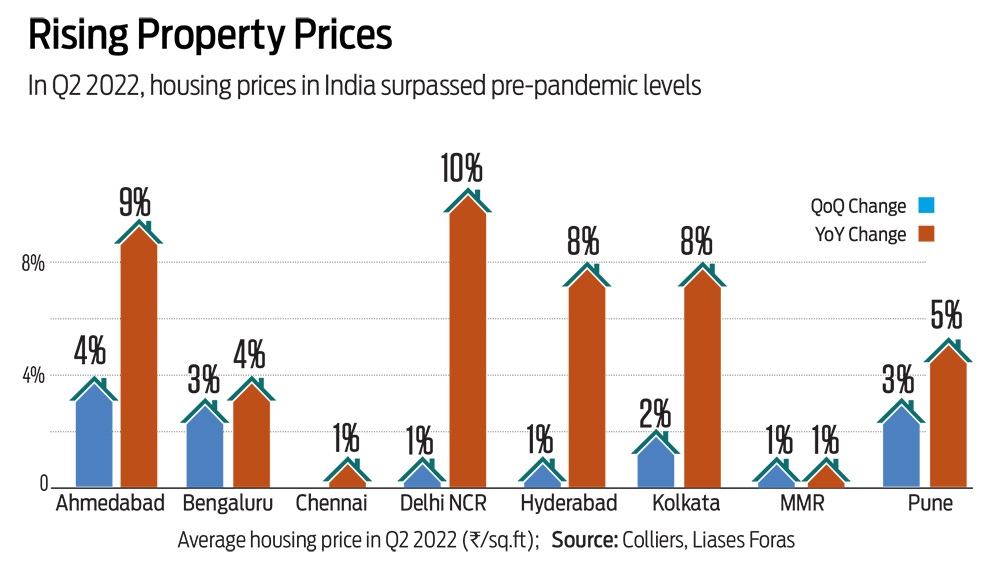

After a slump of more than two years, the real estate industry is looking up to brighter days again. According to Credai’s Housing Price-Tracker released in August 2022, housing prices in India surpassed the pre-pandemic levels in the second quarter of 2022. The average residential prices rose 5 per cent annually in this period.

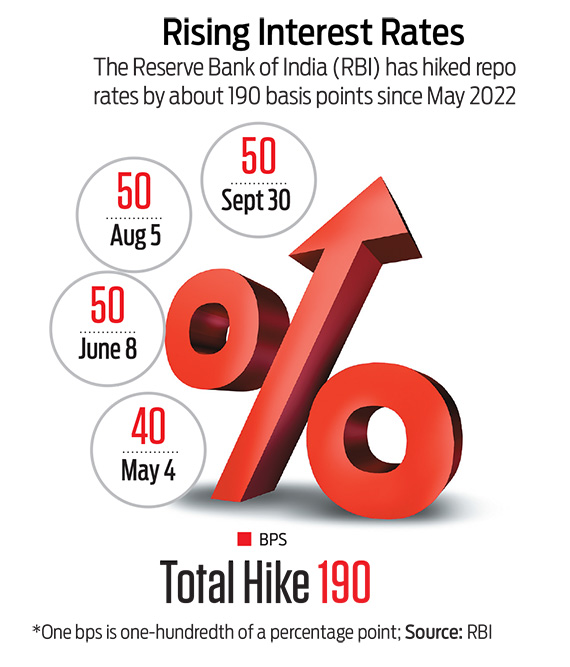

For buyers, this means paying more, at a time when interest rates on home loans are rising. Since May 2022, the Reserve Bank of India (RBI) has raised repo rates by 190 basis points (bps). One bps is a hundredth of a percentage point. So, can homebuyers turn to affordable housing, which also comes with certain incentives? Let’s explore.

Falling Affordability

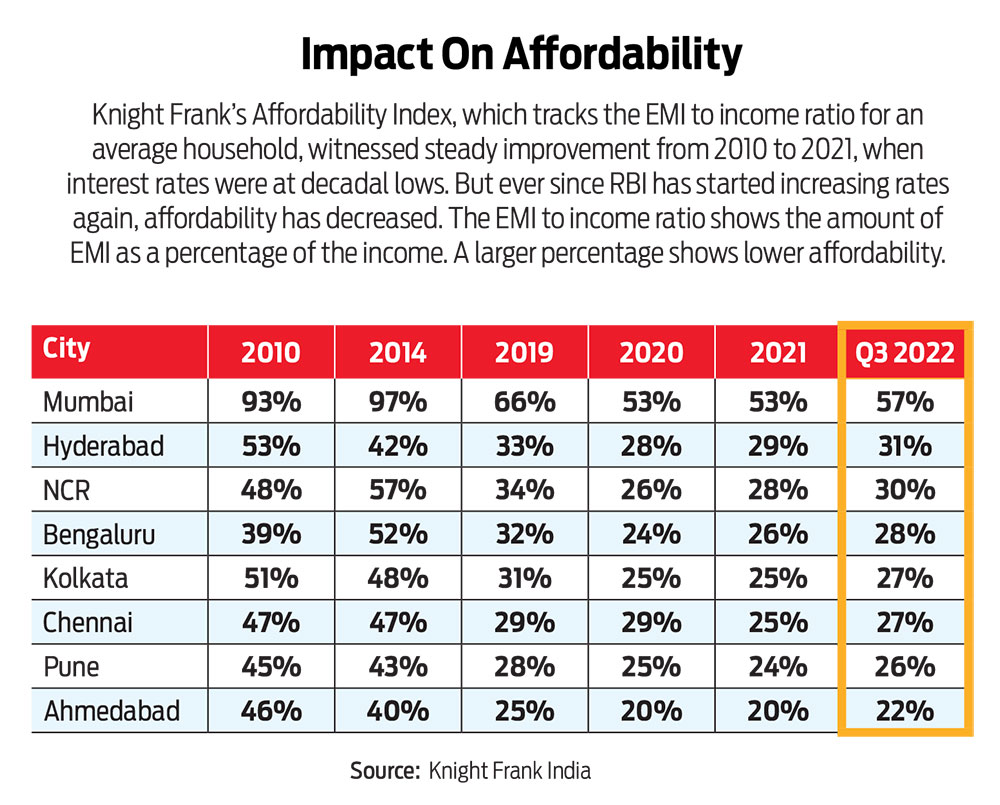

According to a report by global property consultant Knight Frank India, released in October, all markets have seen a decline because of the recent rise in median loan rates. This has also affected purchase decisions. Knight Frank’s proprietary Affordability Index, which tracks the equated monthly instalment (EMI) to income ratio for an average household, shows that home purchase affordability has decreased by 2 per cent, while EMI loads have increased by 7.4 per cent across markets.

“The four successive rate hikes by RBI this year have ended the lowest-best interest rate regime. There’s no denying that it will impact buyers in the affordable segment the most. Residential sales in this segment, thus, may get impacted in the short term,” says Anuj Puri, chairman of Anarock Group, a real estate firm.

A further hike in rates, which seems likely, would further discourage homebuyers in general. Given the mismatch between personal budget and prices, homebuyers may want to look at affordable housing.

The State Of Affordable Housing Projects

Affordable housing, according to RBI, consists of projects that have a floor area ratio (FAR) or Floor Space Index (FSI) of at least 50 per cent, while the units have a carpet area not exceeding 60 sq. mt. FAR denotes the part of a land on which construction is allowed. RBI considers carpet area as defined by the Real Estate (Regulation and Development) Act, 2016, which includes the area that is usable and excludes the area covered by the walls, and any other space outside the walls.

The affordable housing segment (units priced around Rs 40 lakh) took a massive hit during the pandemic. Sales dipped from 38 per cent in 2019 to 31 per cent in H1 2022. Puri says, “The segment was significantly impacted because its target audience took the biggest economic hit in contrast to premium and luxury category buyers.”

At present, there have been hardly any new launches in the segment, unlike in 2019, when it had the highest share—40 per cent—among seven cities surveyed by Anarock at the time. In fact, post pandemic, between January and September 2022, the new supply share dipped to 21 per cent of the total 2,64,800 units launched in the top seven cities.

Adds Puri: “The developer’s profit margins are wafer thin. Amid rising input costs (cement, steel, labour, etc.), it has become difficult for them to launch budget homes since increasing prices in this highly cost-sensitive segment could prove counterproductive.”

However, all is not lost. “The government’s efforts to lower the cost of steel and cement could lead to developers focusing on the affordable segment again. Reduced import taxes on iron ore and steel intermediates has increased domestic raw material availability, lowered steel product costs, and helped stem project cost increases, boosting consumer sentiment,” says Harsh Vardhan Patodia, president, Confederation of Real Estate Developers’ Associations of India (Credai).

Besides, the central and state governments are encouraging home ownership through a range of affordable schemes. Some of these include the Pradhan Mantri Awas Yojana (PMAY), which was launched in 2015, DDA Housing Scheme in Delhi and NTR Housing Scheme in Andhra Pradesh.

Says Sanjay Dutt, joint chairman of FICCI Real Estate Committee, “The potential market size for affordable housing in India (urban) is forecasted to grow about 1.5 times from an estimated 25 million in 2010 to 38 million in 2030.”

Also, supply still exists in the segment even though new launches have taken a hit. According to the Knight Frank Affordability Index, in the Q3 of 2022, Ahmedabad was the most affordable housing market at 22 per cent, followed by Pune at 26 per cent and Chennai at 27 per cent. Any score below 50 per cent is considered affordable by lenders.

What Does It Offer?

Affordable housing comes with a lot of benefits for the homebuyers.

Tax Benefit: Buyers of affordable housing are eligible for an additional tax deduction of up to Rs 1.5 lakh under Section 80 EEA of the Income-tax Act, 1961, on the interest repayment over and above the Rs 2 lakh available under Section 24(b). However, there is a condition attached. The stamp duty (payable, depending upon local laws) of the house should not exceed Rs 45 lakh, and the carpet area should not be greater than the specified areas for metros and non-metros.

According to the Ministry of Housing and Urban Poverty Alleviation, affordable housing is defined on the basis of property size, price, and the buyer’s income. For instance, for metros, this would be any house or flat with a carpet area up to 60 sq. m, while for non-metros, it would be 90 sq. m. The value would be Rs 45 lakh for both.

GST Benefit: The goods and services tax (GST) rate applicable on affordable residential apartments is 1.5 per cent on projects that commenced on or after April 1, 2019, against around 7.5 per cent for other residential apartments, says Apoorv Phillips, tax associate at Sirmacs Consultancy Services, a law firm.

Interest Subsidy: This is mainly available to the lower income group who are eligible for PMAY. The subsidy amount is paid directly to the beneficiary’s account.

Should You Go For Affordable Housing?

If you are facing budget constraints, it makes sense to reconsider the buying decision after reassessing income and expenses. “If one is not able to afford a home that is suitable for one’s family, it would be best to stay in a rented places till one is financially ready,” says Suresh Sadagopan, founder of Ladder7 Financial Advisories, a Sebi-registered investment adviser.

But if affordable housing fits into their budget and needs, it is a good option even in a rising interest rate scenario. “Even if the interest rates go up, the interest subsidy remains and will make the loan affordable. One needs to check whether they fit into the eligibility criteria and whether the area is suitable. If yes in all cases, one can go for it,” he says.

Since affordable housing only includes houses with restricted carpet area, who is it meant for? Those with larger families or needs may find the area unsuitable. “However, many families in large cities (such as Mumbai) are living in very small areas, some as small as 100 sq.ft or less. In that context, 60 sq.m, even though it may not be suitable as a good living place, may work for those who have come to big cities to eke out a living,” says Sadagopan.

A home is often among the biggest investments for individuals. Since it’s not easy to liquidate real estate, it makes sense to assess the suitability of the house as well as your budget before buying one.

harsh@outlookindia.com