Neither a borrower nor a lender be’, the bard famously said. But in today’s world, for most of us, loans are essential. They help us get an education, buy a car, get a house, go on a holiday or buy that phone. They are also useful in times of need—paying for a medical emergency or making urgent repairs to a house. Used judiciously, credit is a friend; handled imprudently, it turns into a debt monster.

The psychological burden of debt is heavy. It comes with stress, anxiety, sleeplessness and much more. That is what happened to Shekhar Nandi (name changed), who is 43 years old now. In 2017, he had taken a personal loan of Rs 25 lakh to pay for his medical treatment as his health insurance was not enough. Nandi’s salary and savings also got exhausted. He felt helpless. “There would be nights when I would just stare at the ceiling until the wee hours of the morning, thinking about ways to pay off my loan, while my family would be asleep next to me. I would break into cold sweats and get a strange tingling sensation in my stomach due to anxiety. At that time, my wife was not working as she was looking after our daughter who was three years old. I didn’t want to pass on the tension to them at the time so I kept my troubles to myself.” Even as he was grappling with one loan, in 2019, Nandi had to take a credit card loan, which went up to Rs 9 lakh.

The reason for taking debt could be a critical need or a misguided decision. In either case, the debt needs to be paid back. “Having debt is not a problem. Debt becomes a problem if it is spiralling out of control. The amount is not as important as the fact that you are unable to repay it or, more importantly, have a plan in place to repay it in full,” says Adhil Shetty, CEO, Bankbazaar.com, a financial services website.

According to the most recent data from the Reserve Bank of India (RBI), “credit to the personal loans segment continued to expand at a robust rate and grew by 14.3 per cent in December 2021 vis-à-vis 8.8 per cent a year ago. Housing remained the prime driver of overall growth in the segment.”

With the economy looking up and the interest rates on loans being low for the time being—a scenario that is likely to change soon—it may be time to chart out a debt repayment plan.

Look For Signs Of Danger

Having multiple loan accounts, taking more credit to pay for existing loans and failing to make payments as per schedule are some of the early signs of a deepening debt trap.

“There are multiple signs to reveal a debt trap beginning with only the minimum payment of card dues month on month for the last 1-2 quarters,” says Neeraj Chauhan, CEO, The Financial Mall, a financial supermarket for wealth management and financial planning. There are various other indicators that you should pay heed to—getting regular calls from recovery agencies for payment, frequently using balance transfers from one lender to another, high-interest rate borrowings like personal loans or credit card rollovers or having are more than 30 per cent of the total borrowings.

“You may see that lenders are rejecting your loan applications due to poor credit score; you have no savings or liquid investments left; and/or there are frequent fights at home over money and so on,” adds Chauhan.

If you observe even two out of the above mentioned indicators in the last three months, here are some effective debt management strategies that can be utilised. Depending on various factors, you can even adopt a mix of strategies.

Budget, Budget, Budget

Budgeting is the fundamental step of debt management, and it is also the only panacea for getting out of a debt trap. “By budgeting your monthly expenses, you can more effectively track where your money is going and where you can afford to spend it. Every month, parcel out the savings and see how much you have left to spend on necessities,” says Hemant Beniwal, director at Ark Primary Advisors, a financial planning firm. “A budget will help you live within means and pay off expensive loans like personal loans and credit cards,” he adds.

In addition, having a budget helps cultivate financial discipline and break the habit of overspending or impulsive buying. “You avoid using credit cards and consumption loans beyond your repayment capacity,” says Beniwal.

When Nandi decided to break out of his debt trap, his first step was budgeting. He took account of all his resources, and allocated each one to a particular need. He became financially disciplined and forced himself to think positively. A promotion and a raise helped improve matters. The moment Nandi’s salary would get credited, he would put away a big part of it into savings and investments. Along with this, Nandi and his family chose to follow a simple lifestyle. Though he had always wanted to buy a car, he deferred any such purchase till the overall financial conditions improved.

All these measures helped and things started looking up slowly for Nandi. Meanwhile, his wife took up a job and the second income helped support the household and their child’s expenses.

Cutting Credit Card Debt

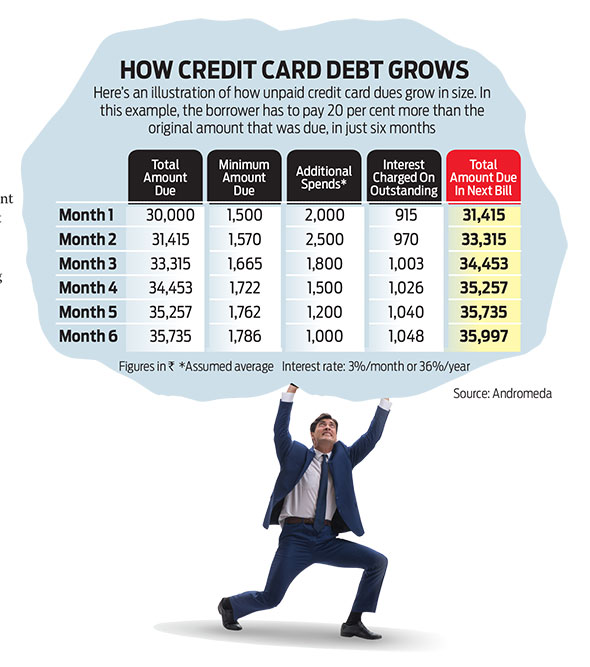

Often, people find themselves facing an ever-growing mountain of credit card debt as it is one of the easiest available and frequently used credit options. “While it is tempting to just get something by paying the minimum amount due on the high credit card bill, it will hurt you severely in the long run,” says V. Swaminathan, CEO, Andromeda and Apnapaisa, a loan distribution firm and its digital arm, respectively (see How Credit Card Debt Grows).

Credit card debt often snowballs due to a person holding too many cards. Try to use only one credit card, or two at the most. The next step is to pay off all the dues of the extra cards. “Immediately cut those cards and inform the bank that you are discontinuing them,” says Beniwal.

For the remaining cards, while it is best to pay in full, you can follow this five-step strategy too: do not overspend; pay more than the minimum due; come to an arrangement with the bank to pay a certain amount every month so that the overall debt shrinks progressively; pay on time; and save up to pay back the remaining amount at the earliest.

Laddering Your Way Out

The method of debt laddering is useful when you have debt from multiple sources, say, credit card plus personal loan plus car loan. This is a versatile strategy, which you can customise. There is no one right way to ladder your debts. “Typically, the most expensive loans must be the first that you pay off,” says Shetty.

For example, if you have two Rs 1 lakh loans running in parallel, one at 15 per cent and the other at 10 per cent, repay the former on priority. However, if the 15 per cent loan is for, say, four years while the other loan is for one year, it may make sense to close the latter first. In that case, the outflow towards the former loan would be about Rs 2,800 and Rs 8,800 for the latter. You could close the 10 per cent loan a few months down the line as the outstanding would be much less. Moreover, once that loan is closed, the total EMI outflow will become significantly smaller and you can increase it to close the other loan faster. “You may even be able to revise the EMI upwards. So, even though it is contrary to the idea of closing the most expensive loan first, it may make more sense to close the less expensive loan in this case,” adds Shetty.

There’s no right or wrong way. The idea is to understand how much has to be repaid, say, each month and figure out an optimal approach.

Opting For Debt Consolidation

“In debt consolidation, you take out a single loan to clear off existing debts such as multiple credit card bills, personal loans, auto loan, gold loan, and so on. Debt consolidation can work extremely well for those individuals who are paying high interest rates on multiple existing debts,” says Swaminathan. With the help of a single loan, the overall interest rate and EMI can be brought down to a manageable amount.

However, take this decision only after careful calculation. Look at the total cost of taking the larger loan—interest rate, processing fees, tenure, and pre-closure charges to name a few. Only if all these add up to being less than the cost of all the other loans will debt consolidation be useful.

Seek Debt Counselling

If none of the above mentioned debt management strategies seem workable, or the debt is too heavy to manage yourself, you could consider debt counselling. “A borrower can opt for debt counselling services and seek professional help if he or she is in a debt trap or is feeling the burden of multiple debts and struggling to repay them,” says Aarti Khanna, founder and CEO, AskCred.com, an artificial intelligence-based credit helpline.

Debt counselling experts give a sympathetic ear and advise borrowers with personalised and structured solutions for a continued period of time to make them feel more reassured and empowered. Their services extend to acting as facilitators between the borrower and the lending companies to work out a mutually acceptable payment plan.

Thanks to all the measures that Nandi took, he has brought down his credit card debt to Rs 1 lakh and paid off 90 per cent of his personal loan.

If you are feeling hemmed in by the walls of debt, take stock and take action. All it needs is financial discipline and a little bit of help.

meghna.maiti@outlookindia.com