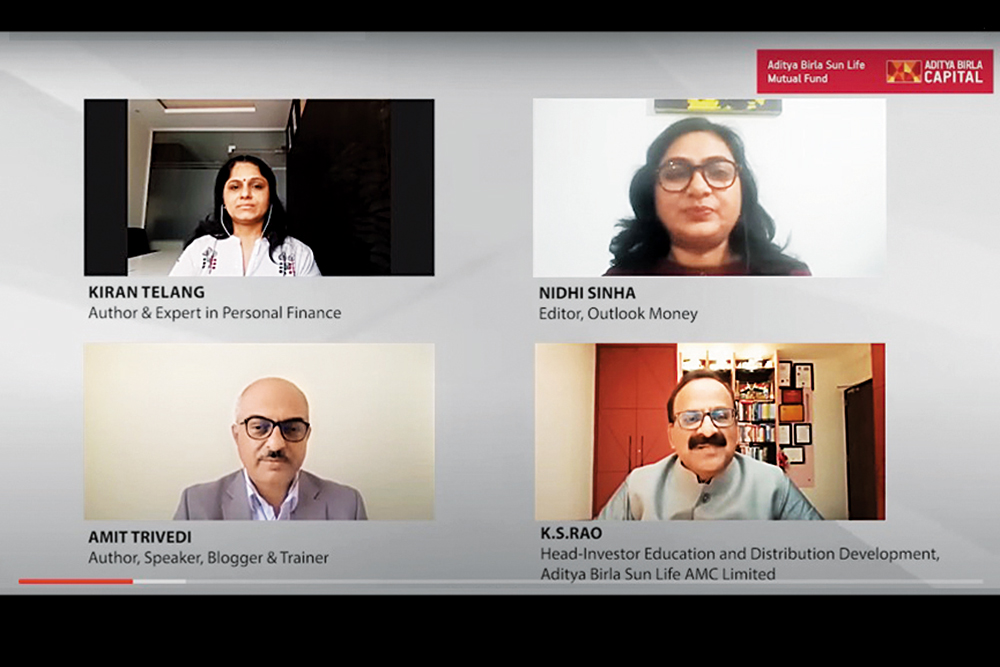

Union Budget 2023 laid special emphasis on the new tax regime, as it made several announcements related to that. In a post-Budget panel discussion, experts threw light on what these announcements mean for the tax payer and how they should navigate their investing journey in the light of the changes. The experts who were part of the discussion were K.S. Rao, head, investor education and distribution development, Aditya Birla Sun Life Mutual Fund; Amit Trivedi, financial advisor and blogger; and Kiran Telang, a Sebi-registered investment advisor. The discussion was moderated by Nidhi Sinha, editor, Outlook Money.

Main Takeaways

Rao found the Budget a pragmatic one, which paved the way for the next 25 years of “Amrit Kaal”. “Finance Minister Nirmala Sitharaman took every opportunity to ensure macroeconomic stability. It also focused on growth and job creation, and it especially focussed on the youth. I would call it a RRR Budget, which stands for rail, road and relief,” said Rao.

On the personal finance front, there were many changes. First, the life insurance premium of Rs 5 lakh and above will become taxable so insurance will become less attractive, market-linked debentures will also lose their sheen, impetus to new regime which may make many tax-saving investments unattractive, international investing will come with higher tax deducted at source (TDS) etc., Rao explained.

Old Vs New Tax Regime

Telang acknowledged that the Budget has gently nudged taxpayers towards the new tax regime. “The proposed new regime definitely offers that taxpayers can look at. I get a feeling that lot of people will move to the new tax regime. Those earning up to Rs 7 lakh will definitely move as they will have to pay nil tax,” she said.

The planner added that those with income above Rs 15 lakh will have to ensure that they ae claiming a deduction of Rs 3.75 lakh to choose the old regime versus the new regime. The latter doesn’t allow any deductions, though the Union Budget 2023 introduced standard deduction of Rs 50,000 even under the new regime.

The new tax regime is the future. “I get a feeling that you know this is something like that gas subsidy, where the government first requested people to give it up before removing it completely. So, eventually the old tax regime will be phased out.”

Though the new tax regime, the government is also working towards reducing compliance and hassles for the taxpayers, said Trivedi.

The Need For Advice

Now that people won’t have the nudge to make tax-saving investments, they may have to do it on their own and advisory will, therefore, become important.

“I always tell my clients that the tax benefit is an added benefit, and they should look at their portfolio holistically. This budget has given a fillip to that thought. The government has in a way given more money in the hands of people,” said Telang.

Rao added that investors and taxpayers will now have to grow up and make their own decisions. “ELSS may not seem very interesting for many people and this area may be of a little concern,” said Rao, adding that equity investing is very important for requisite growth. “Whether you get the tax incentive or not, you should invest in equity mutual funds,” he said.

“This government is putting the responsibility on citizens. In the old regime, certain deductions were available but in a way they were defined under certain Sections of Income-tax Act. Basically, somebody was dictating if you invest in X instrument, you would get a deduction,” said Trivedi.

That definitely encouraged people to invest, but the downside was that some of the people who are taking the putting the cart before the horse and they were looking at tax saving first and accordingly choosing the investment instruments, said Trivedi, adding that in that sense the old regime was not completely beneficial for the taxpayers.

Now, financial educators definitely have a larger role to play, said Trivedi.

Boost For The Retired

Trivedi appreciated the government’s move to increase the investing limits under the Senior Citizen Savings Scheme and post office monthly income schemes.

“Now if you look at a senior citizen couple, they would be able to park a reasonable amount of their retirement corpus, which can give them a suitable amount of retirement income to live comfortably,” he said.

However, he cautioned that it is also important to park money in instruments other than fixed-income products. “The interest from these instruments may not always be able to protect senior citizens against inflation. Given increasing longevity, seniors should also have a diversified portfolio,” Trivedi added.

Telang said the scheme launched for women, Mahila Samman Savings Certificate, was more of a token gesture by the government, though details of the scheme are awaited.

To watch the complete interview, visit: www.outlookmoney.com