Any dialogue about women’s empowerment cannot be complete without mentioning the need for financial inclusion as it grants women the power to live life on their own terms, meet their needs and achieve their goals without having to depend on anyone. Even in this day and age, knowledge of basic financial concepts remains elusive for most women.

Watertight gender roles have kept women away from financial decision-making and the majority of them have depended on their parents, brothers, or husbands to manage finances. While the number of women who contribute to household finances has increased significantly in the last decade, they rarely take investment decisions by themselves. Lack of awareness about financial tenets is a major cause of the lopsided participation of women.

Roadblocks

There are multiple reasons behind the dismal trends of women’s financial inclusivity. Traditionally, women’s involvement with financial matters in households has been limited to maintaining the household budget and any kind of participation beyond that is seldom encouraged.

Women lack knowledge of basic financial concepts as opposed to men and this too is rooted in patriarchal perceptions that young girls will eventually grow up to get married and their primary responsibilities will entail caregiving and managing the household. Boys, on the other hand, are groomed to be money savvy from a young age. This idea stays with many women and they feel more comfortable entrusting money decisions to the male members of the family and thus the cycle continues.

Often women also refrain from participating in money management exercises because they do not have the means or the confidence to visit banks and financial institutions by themselves. This is especially true in demographics where patriarchal notions about women’s role in society persist.

The Need To Embrace Equity

Women’s participation in equities is especially poor as they are conditioned to have lower financial risk tolerance than men and lack of knowledge about financial market terminologies.

However, equity allocation is a prerequisite if women truly want to attain financial independence. Limiting investments to a few asset classes that carry little to no risk can deprive them of wealth-creation opportunities in the long run even if they save and invest diligently.

Active involvement in financial markets can provide women the means to accumulate and maintain their assets, establish sources of income, prepare for unforeseen circumstances, and also participate in the economy.

This propel them to better socio-economic positions with significant improvement in the quality of their lives. Besides, it can also have positive trickle-down effects on households, communities, societies, and the economy.

A study published by the International Monetary Fund in 2018 stated, “greater inclusion of women as users, providers, and regulators of financial services would have benefits beyond addressing gender inequality. Narrowing the gender gap would foster greater stability in the banking system and enhance economic growth. It could also contribute to more effective monetary and fiscal policy.”

The Silver Lining

Thanks to the advent of digitization, many women are taking baby steps towards financial inclusion. Last-mile internet connectivity at cheap rates has enabled countless women to learn the basic concepts of personal finance and also access a host of financial resources. Digital financial portals also eliminate the need for women living in patriarchal set-ups to step out or get in touch with brokers for investments.

The younger generations of women are bringing about a change by deciding to take matters into their own hands when it comes to money management.

Banks and financial institutions can also aid in making more and more women become financially savvy by widespread educational campaigns and by bringing more women professionals into the financial services sector so that first-time women investors can feel comfortable in approaching them.

Paving the way for women investors

The ForHER campaign by Aditya Birla Sun Life Mutual Funds has set an example with its unique approach to creating awareness among women investors. Recognizing the massive gap that exists in the financial services industry with respect to women-friendly services and initiatives, Aditya Birla Sun Life Mutual Funds has developed a repository of content that aims to empower women investors with the right information about financial concepts so that they can confidently manage their finances.

The campaign has a trove of dedicated website content, podcasts, articles, and modules tailor-made for women investors on a wide variety of topics including equity investments. This has been done with the aim to make women shed their inhibitions of equity investing and embrace it for their financial security.

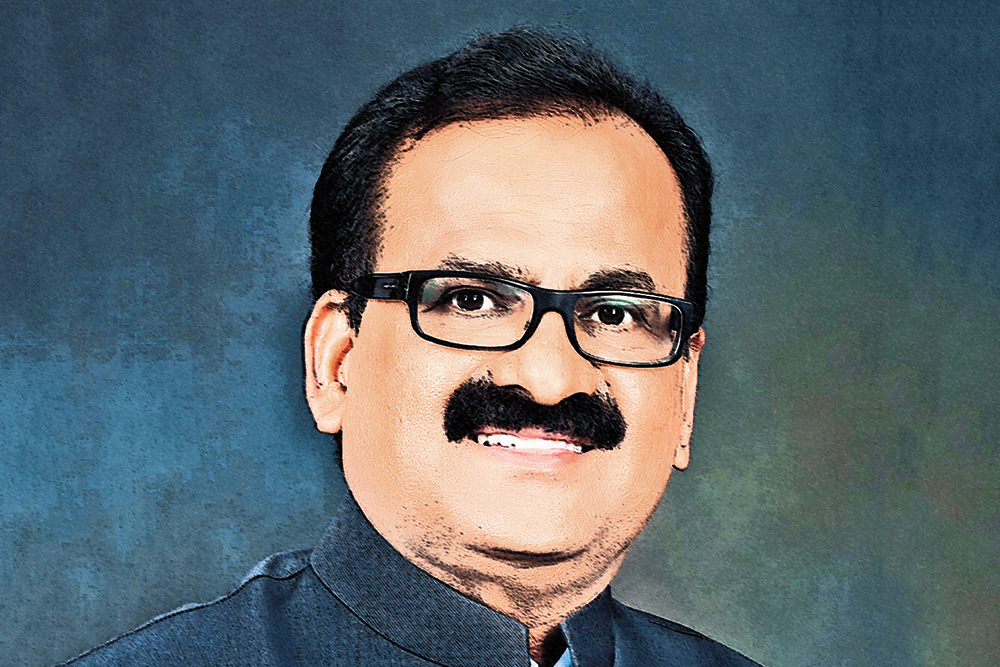

K S Rao Head - Investor Education & Distribution Development, Aditya Birla Sun Life Asset Management Company Ltd

Disclaimer

“Mutual funds are subject to market risks. Read all scheme-related documents carefully.”