Though equity investing has become popular in the last couple of years among the younger generation, real estate remains among the most preferred investment options for Indians.

Traditionally, the demand for residential homes has been the highest, given that the prices of commercial real estate were inhibiting for most investors focused on the sector. That seems to be changing now with other options such as real estate investment trusts (REITs) and REIT-focused mutual funds coming up. They make commercial real estate relatively affordable for retail investors.

As the effect of Covid-19 wanes and offices start reopening, there is renewed interest in commercial real estate. According to a Knight Frank report, the office space saw strong demand in the first half of 2022 (January to June) on the back of a subsiding pandemic and steady economic recovery, despite geopolitical tensions.

Transactions in this space have also grown. A total of 25.3 million square foot of transactions were recorded in the first half of 2022 across eight major cities, a growth of 107 per cent over the same period in the previous year, the report said.

REITs provide an opportunity to retail investors to participate in this growing market. “Retail investors can participate in the benefits of owning commercial real estate without actually having to buy commercial real estate,” says Ritwik Bhattacharjee, chief information officer, Embassy REIT, a real estate investment trust.

However, does it really make sense to invest in REITs? Let’s understand how these instruments work and look at their performance and risks to figure out the answer.

What Are REITs?

Just like in mutual funds, REITs allow you to buy a fraction of the assets they hold. While the underlying assets in mutual funds are securities, such as bonds, stocks and gold, REITs invest in physical real estate.

At present, there are three listed REITs in India—Embassy REIT, Mindspace REIT and Brookfield REIT—with a combined market capitalisation of over Rs 68,000 crore. The three REITs have raised over Rs 20,000 crore in the capital markets. Altogether, the three REITs own an area of 93 million square feet across commercial office markets, according to data from Embassy REITs.

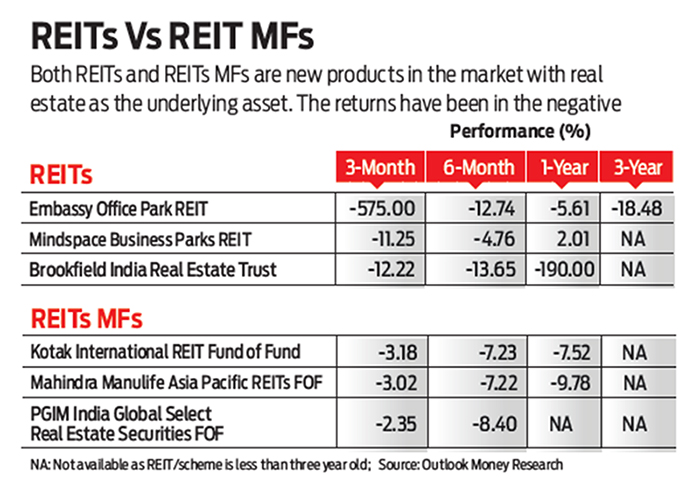

“All the three REITs have been trading at a premium to the listing price. The overall returns are in the range of 13-15 per cent annually, including cash yields and capital appreciation,” says Piyush Gupta, managing director, capital markets and investment services, Colliers India, a real estate services and investment management company. The three REITs in India have been delivering annual cash yields of approximately 5-6 per cent distributed quarterly, he added.

How Do They Pay?

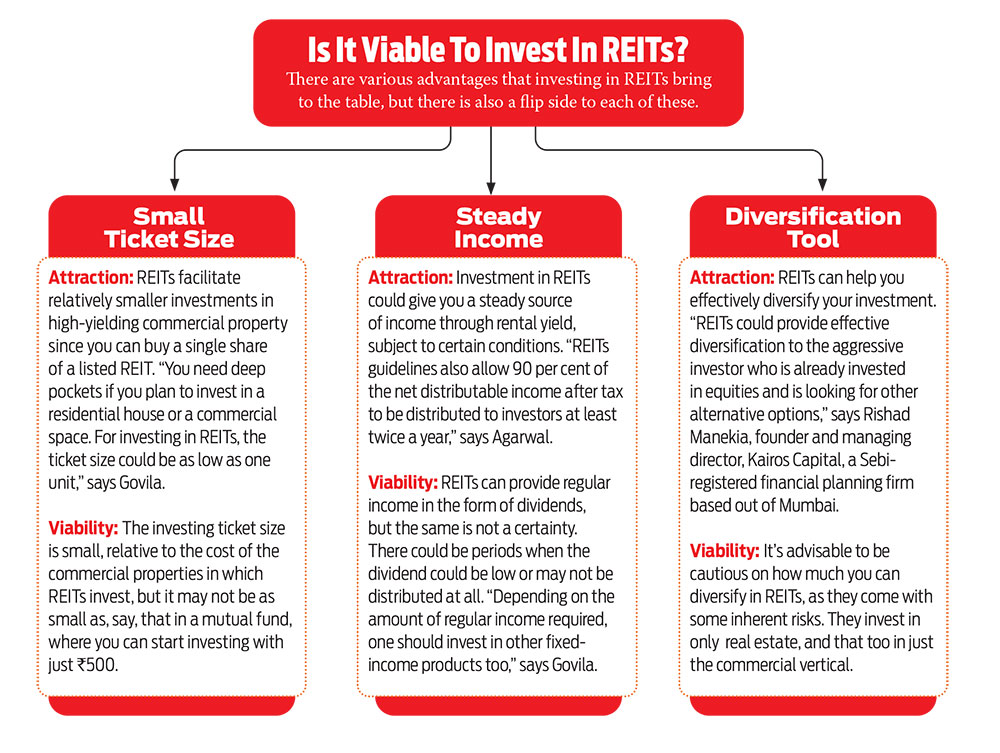

Income from listed REITs is received via the price appreciation on the stock market as well as the dividends they distribute. In India, 80 per cent of the investments made by REITs need to be in commercial properties that can be rented out to generate income, which is then paid out as dividend to the investors.

“The money collected is deployed in income-generating real estate and this income gets distributed among the unit holders. Besides, regular income from rent and lease, and gains from capital appreciation of real estate is also a form of income for the unit holders,” says Shobhit Agarwal, managing director and chief executive officer, Anarock Capital, a real estate services company.

What Are The Risks?

The foremost risk in REITs is, of course, the market risk, since these are traded through the stock exchanges.

“Just like other stocks, the costs are subjected to demand and supply. Then there could be legal disputes as well, such as unclear title of the property, ongoing litigation, and so on. One major drawback with REITs is that the net asset value (NAV) of a REIT unit depends on the value of the underlying real estate. Any slump in real estate prices could also impact the value of its unit and translate into losses for an individual,” says Agarwal.

While REITs have become a reality in India, one needs to be vigilant. A slump in the real estate sector could make exit a totally loss-making proposition.

Says Agarwal: “There could be a major issue for Indian REITs if the supply of investment-grade office spaces does not keep pace with the demand. If it doesn’t, we will see an asset bubble in the short-to mid-term.”

REITs also face vacancy risks. Since the income is mainly generated from rented property, in bad market conditions, lack of takers may affect the dividends. Also, liquidity is always an issue with real estate. “Just like stocks, investors can exit by selling it on the exchange, but the real estate fund, which is invested in REIT stocks is somewhat less liquid as compared to funds invested in other financial securities, such as stocks or bonds,” Agarwal says.

What Should You Do?

Real estate experts are positive about the future of REITs. Says Agarwal: “With institutional investors vying to park funds in Grade A office stock across top property markets, the rents for these listed properties are likely to grow.” This would mean better dividend income in the future.

Also, given the relative low-entry point for retail investors, REITs make it easier for many individuals to add commercial real estate to their overall investment portfolio. Says Col. Sanjeev Govila (Retd.), a Sebi-registered investment advisor and CEO, Hum Fauji Initiatives: “Investing in physical real estate and REITs is very different, especially when it comes to the investment amount.”

However, consider the risks and use REITs as a diversification tool. While doing so, also look at your overall exposure in the real estate sector, whether it is in residential properties or other related instruments such as mutual funds.

Adds Govila: “You may invest some proportion of the total corpus in REITs to diversify the portfolio if your financial circumstances permit so. But broadly speaking, one should not have more than 10-30 per cent in real estate or real estate-oriented investment avenues, including REITs.”

REITs are a relatively new asset class in the Indian markets. Remember not to compare returns from REITs with stock market returns. If you are buying REITs from the secondary market, do so at a discounted price. This will help boost your dividend yield. Make a decision depending on your investment objective, assset allocation, availability of funds, and other facctors.

***

REIT MFs Will Help You Invest Beyond India

As fear from the pandemic subsides, commercial properties are likely to witness a rise in demand

Kundan Kishore

You can invest in REITs through mutual funds too. In fact, the Indian mutual fund industry offers three REITs-based schemes.

All three are fund of funds (FOFs)that invest in the units of other funds. They allow you to invest in commercial properties across global markets as well as gain from both price appreciation and dividend income. Two of them invest in the Asia-Pacific region, while one is a global fund.

Kotak International REIT FOF

This is India’s first REIT-based mutual fund scheme. It was launched in December 2020 during the Covid-19 pandemic, when most office spaces were vacant. Despite the negative environment, this fund managed to garner about Rs 100 crore during launch.

The fund is predominantly invested in Singapore, Australia and Hong Kong with exposure of 48.8, 33.7, and 9 per cent, respectively. It also invests in units of SMAM ASIA REIT Sub Trust Fund and other similar overseas REIT funds. It has delivered 7.52 per cent in the last one year, as on December 5, 2022 and -3.29 per cent since its inception.

PGIM India Global Select Real Estate Securities FOF

Launched in November 2021, this fund invests 95-100 per cent of its corpus in its parent fund, PGIM Global Select Real Estate Securities Fund, which invests in REITs and equity-related securities of real estate companies located throughout the world. The parent fund has invested across 12 countries with major allocations in North America and Japan. These two regions account for 75 per cent of the portfolio. It manages assets worth Rs 100.95 crore. It has given 13.83 per cent return since inception.

Mahindra Manulife Asia Pacific REITs FOF

Launched in September 2021, it invests in units of its parent fund, Manulife Global Fund–Asia Pacific REIT Fund. This overseas fund primarily invests in REITs in the Asia-Pacific ex-Japan region. The fund has an asset size of Rs 29 crore and has delivered -11.71 per cent since inception.

Should You Invest?

Globally, real estate underwent a huge shift during the pandemic. Now, as the pandemic fear has eased, and economies across the world are getting back on track, properties such as hotels, assisted living facilities and restaurants are expected to benefit from the pent-up demand for commercial real estate. All these factors will work in favour of growth opportunities for real estate and and, thus, these funds, too.

That said, none of these three funds have impressed investors since their launch. It is still to be seen how they perform in the future.

In terms of taxation, they do not give any respite to investors as they are FOF, and fall under the category of debt fund taxation, where long-term capital gains (LTCG) tax rate will apply after three years, and investors will have to pay 20 per cent on the gains, with indexation.

If you have adequately invested in the Indian equity market and India-focused REITs, and want to diversify your real estate investing beyond India, you may like to add a small slice in your overall portfolio.

meghna@outlookindia.com