There has been carnage on the crypto street. The crypto market capitalisation has dipped drastically in the last six months, and all major cryptocurrencies have lost two-third of their values from their peaks.

The crypto market capitalisation touched $3 trillion in November 2021, up from $620 billion in 2017, riding on a wave of popularity among investors, but went in for a sharp correction in the last six months; it is now again below the $1 trillion mark.

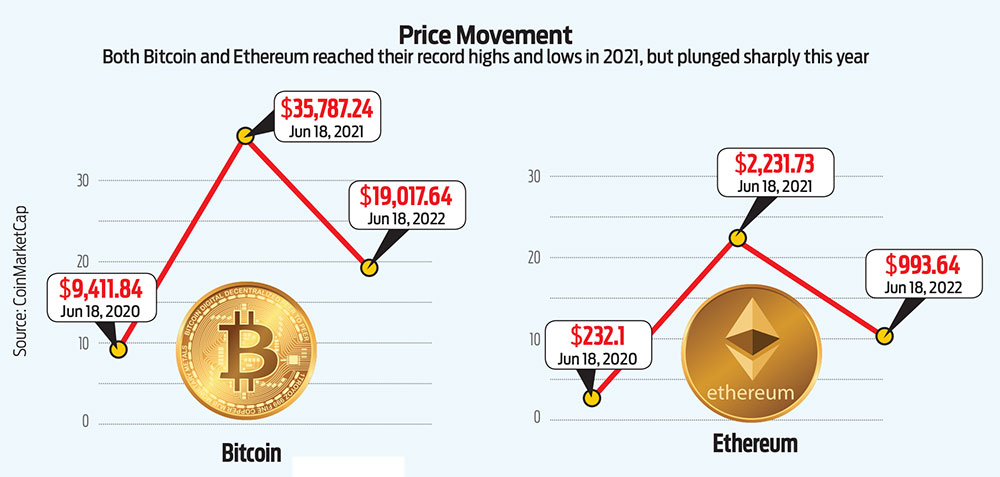

Bitcoin (BTC), the world’s largest and oldest cryptocurrency, is down by over 70 per cent from its peak of $67,566 on August 11, 2021, to $19,017 as on June 18, 2022. Ethereum (ETH), the second-largest cryptocurrency, is moving in tandem with Bitcoin.

The sharp contrast between where these cryptocurrencies were a year ago and where they are now has sent shockwaves among crypto investors who wanted to experience the thrill of investing in a new asset class that promised them quick wealth. Sample this: On June 18, 2021, the price of Bitcoin shot up to $35,787, a jump of 280 per cent from $9,411 on June 18, 2020. These investors lost almost half of their wealth on June 18, 2022.

The naysayers are now arguing that the crypto price gyrations prove that these assets are highly volatile and nothing more than gambling instruments. Recently, Microsoft founder Bill Gates in a TechCrunch conference said that “crypto currencies and NFTs are based on greater fool theory”. In economics, the “great fool theory” suggests that it does not matter what price (high) you pay for an asset given that there is a great fool out there who will buy the assets at an even higher price.

In India, the government’s imposition of steep taxation on crypto gains is being seen as a measure to highlight their unsuitability for financial portfolios focused on individual money goals.

Firm believers in crypto are, however, treating it as a blip, arguing that the global rise in interest rates has affected both the crypto and the stock market. Central banks across the world are raising interest rates at a much faster pace to fight historic levels of inflation and signs of recession appear to be on the horizon especially in the larger economies, they say.

“Price volatility does not mean price instability,” says Ajeet Khurana, a crypto advisor. He says that share buyers also want volatility in the market, but in their favour, and just because share prices are more volatile than bond prices, “it doesn’t mean that the share market is a gambler’s den. Crypto prices are more volatile than share prices, and as long as investors understand what they’re investing in, any comparison to gambling is uncalled for,” he says.

Yet, investing in shares is different from investing in cryptos, which have no underlying assets to support them. When you buy shares, you become a shareholder and a partner to the profit or loss of the company. Shares of a company move according to the business performance, economic outlook, and demand and supply, while the price of cryptos move only on demand and supply.

For those caught in between, i.e., the small individual investors, we analyse the movement and valuation of cryptos in the past three years, bust the myths on comparisons with movements in the equity market and the road ahead for them.

The Fall, The Rise And The Fall

The Reserve Bank of India’s ban on rupee-crypto transactions in April 2018 dampened the high spirits that had engulfed the crypto market before that.

The year 2019 saw the crypto industry battle its own regulatory challenges on innovations even as participation and experimentation increased. “The inception of Libra by Facebook drew a large crowd, but it was soon entrapped with regulatory hurdles; the proposal of Bitcoin ETF was rejected by the US Securities and Exchange Commission (SEC); SEC also ordered Telegram to halt its TON project,” says Rajagopal Menon, vice-president at WazirX, a crypto exchange. TON was a Blockchain project which Telegram had built for its 180 million users. It aimed to be a decentralised app store platform, but fell foul with the SEC.

That phase came to an end in India early in March 2020, when a Supreme Court judgment lifted the RBI ban on rupee-crypto transactions. Investing in cryptos directly in India was once again possible. In the interim, “the predominant way for Indian investors to invest in crypto assets was only through peer-to-peer (P2P) offerings from exchanges. There was no direct way to deposit money into any Indian exchange,” says Vikram Subburaj, CEO, Giottus, a crypto platform. But soon after, the Covid-19 pandemic spooked both the stock and crypto markets in March 2020.

The Covid-induced shocks on the crypto market didn’t last long. The crypto market caught the fancy of investors, who loved to track the ups and downs on their screens they were glued to at the time as they remained indoors.

“Though the investor sentiment was dampened in March due to Covid raging across the world, Bitcoin was quick to recover. At the tail end of the year, the asset class was not only a choice for retail investors, but institutions also started to pool their resources in Bitcoin which led to the steep rise,” says Menon. For instance, in the US, institutional investors like JP Morgan Chase and BlackRock invested heavily in Bitcoins for quick gains.

The Crypto Party…: That was only the beginning of the big crypto party that investors found themselves into. The year 2021 turned out to be a year of many firsts—Bitcoin breached the $30,000 mark and later in the year touched $65,000, the first crypto exchange was listed on Nasdaq, Bitcoin became a legal tender in El Salvador, and the first US Bitcoin ETF (BITO) began trading on October 19, 2021.

In terms of market cap, even altcoins started receiving a lot of prominence. In India, MATIC, a native token of Polygon created by three Indians, became one of the top-20 tokens in terms of market cap in the world. Says Subburaj: “This was aided by global influencers, such as Elon Musk, and institutional investors, such as MicroStrategy and Tesla, entering the crypto ecosystem. Low interest rates across markets also helped.”

This was also the time when celebrity ads became the norm in the Indian crypto industry. “After May 2021, cryptos saw rising interest fuelled by celebrity endorsement. Several blockchain start-ups and and non-fungible token (NFT) investors came up. Bitcoin was up by 400 per cent and Ethereum by 200 per cent. Meme coins like Dogecoin and Shiba Inu also registered huge gains,” says Pardeep Narwal, founder, New Edge Soft Sol, a crypto mining company.

Naturally, investors caught the bug. Mona Singh, a 32-year-old IT professional, started investing in cryptocurrencies in 2021. “Due to Covid, I started working from home and had ample time. One of my friends who was already investing in crypto since 2017 advised me to do the same. Just for the sake of trying it out, I invested a small amount. Later, in 2021, it turned into a boon, and I made a huge profit,” says Singh.

…Comes To An End? The financial uncertainty in cryptos has taken root globally. With crypto markets shedding gains and volumes, confidence has eroded. Besides, the threat of inflation and rising interest rates has made bond yields attractive, and the uncertainty of cryptos unpalatable.

Most people who entered the crypto market in 2021 have lost 50 per cent of their investments. Trade volumes across exchanges are down by 60 per cent. A recent study by Gemini, a private investment firm, shows that India was leading in the number of first-time crypto investors in 2021. Nearly 54 per cent of all traders in India were buying cryptocurrencies for the first time in their life.

Noida-based IT professional Shivam Tiwari, who has been investing in cryptos since 2017, has been left shaken by the crash. “It made me realise that cryptos, which once commanded a high valuation, could fall steeply very fast,” says Shivam. He lost around 40 per cent of his total holdings in the current fall; Mona lost 55 per cent.

Menon says the “unavailability of banking partners has caused a dip in volumes across Indian exchanges, which is detrimental to the industry.”

Add to that, uncertainties with respect to taxation and regulation have further affected investor morale. The introduction of a flat 30 per cent tax on crypto gains, without the ability to offset losses, along with a 1 per cent TDS (tax deducted at source) mandate has made many new investors reconsider their investments.

Though some experts expect the government to bring in a regulation soon, others feel India is waiting for global cues and, as of now, will just bring in a central bank digital currency (CBDC). But it will be more like digital wallets, according to various media reports. Minister of Finance Nirmala Sitharaman had announced in this year’s budget that RBI will introduce a digital currency this fiscal.

Are Cryptos Treading The Equity Path?

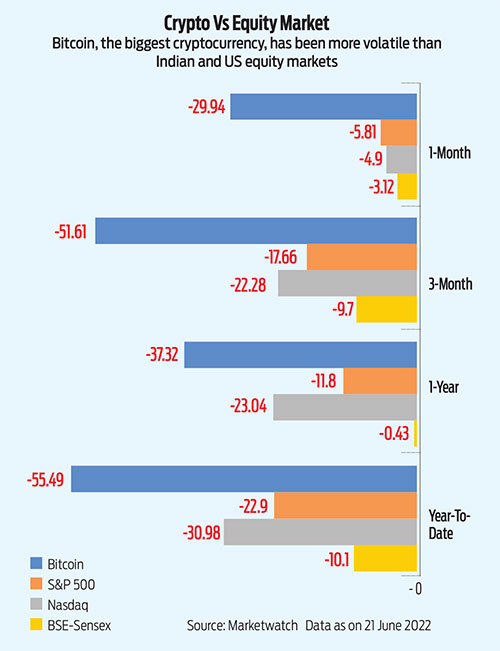

One could argue that cryptos are falling because other mainstream financial assets, especially equity markets, are also falling. To an extent, that is true.

Both equity and crypto have been in a tailspin on fears of lingering inflation. Recent numbers from the US Bureau of Labour and Statistics peg inflation at a four-decade high of 8.6 per cent. More interest rate hikes would be needed to tame inflation, thus bringing in more uncertainty.

Equity markets across the world are reacting to the situation. However, the fall in cryptos is much steeper (See Crypto vs Stock Markets).

So, does crypto follow the equity pattern in terms of price movement? According to an International Monetary Fund (IMF) research, Cryptic Connections: Spillovers between Crypto and Equity Markets, released this January, “the correlation of crypto assets with traditional holdings like stocks has increased significantly, which limits their perceived risk diversification benefits and raises the risk of contagion across financial markets.”

The report says the interconnection between crypto and equity markets has increased over 2017-21. For example, compared to pre-pandemic years, the correlation between Bitcoin price volatility and S&P 500 index volatility has increased more than four-fold. This means the trend of rise and fall of cryptocurrencies is followed by the markets as it is gaining popularity among investors. This is evident from the market rally in 2020 and 2021 when both equity and cryptos were trading at all-time highs.

The report further says that crypto assets may no longer be considered as fringe and could potentially pose financial stability risks due to their extreme price volatility. Thus, regulators need to closely monitor the action in the crypto markets and the exposure of financial institutions to these assets, and design appropriate policies to mitigate systemic risks emanating from price spillovers.

The Road Ahead

Many Gen Z and millennials took the joyride of the crypto rally in 2021, which ended with a jolt. They are now stuck as many exchanges do not allow withdrawal of rupees or transfer of cryptos.

Experts believe this ‘crypto winter’ will last longer and bite investors bitter. Many investors could also switch back to mainstream instruments, such as equities and mutual funds given the strict regulation and taxation, and uncertain returns.

“After the Terra debacle wiped off $840 million from the market, investors have become more cautious about crypto investments. More people are inclined to understand the fundamentals of crypto rather than trade on speculation. The market is gradually moving towards maturity,” says Anuj Yadav, co-founder and CTO, Kassio, a crypto management firm. He added that the crypto industry is now becoming mainstream.

“Now that the Federal Reserve has indicated its interest rate plan for the next few quarters, the market will remain range bound for the next year. Given that it is a crypto market, even a range-bound market’s peak can be twice its bottom. In the interim, volatility will continue,” adds Khurana.

Crypto seems like a rollercoaster ride. So, take it only if you can stomach the ups and downs and don’t get shaken by the jolts.

kundan@outlookindia.com