The concepts of wealth and prosperity are closely intertwined with the festival of Diwali. Several mythological legends explain why the goddess of wealth, Lakshmi, is worshipped on the occasion, but it is also said to mark the post-monsoon harvest celebration, a time to enjoy the fruits of labour and plan for the future.

Author Devdutt Pattanaik says in a blogpost, “It all began as a post-monsoon harvest festival…. A time to balance the books and open new books of accounts. If the harvest was good, debts were repaid and both farmer and moneylenders celebrated their fortune. If harvests were bad, this was a time of intense prayer and rituals in (the) hope of a better future.”

It is considered auspicious to invest in assets, such as real estate and gold, and now, even equities, during Diwali. Muhurat Trading, the symbolic hour-long trading session on the day of the festival, that has been taking place for more than 50 years, is a classic example of this belief. With more and more people investing in the stock market, Diwali investing is now synonymous with equity investing.

However, with the market seeming to gyrate in a never-ending trance, you should have a sound investing strategy in place and not get swayed by the festive mood and gamble away all your savings without a thought. Let’s understand how strong the fundamentals of the Indian market are and what is the way forward to help you make the right choices.

Indian Market On Strong Footing On A High

The mood on Dalal Street is clearly festive. The BSE Sensex once again reclaimed the psychological 60,000 mark on August 17, 2022, after almost five months.

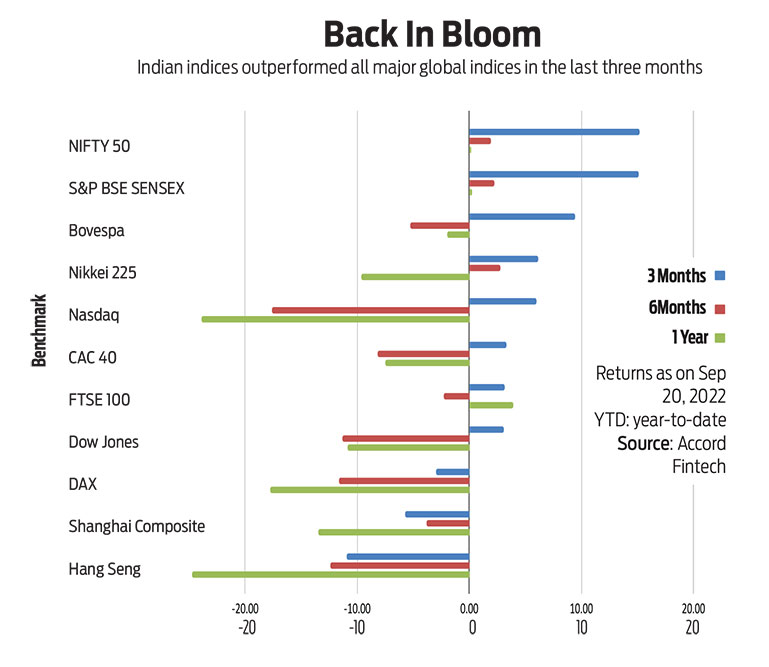

The broader indices, the BSE Sensex and the NSE Nifty, have gone up by around 14 per cent in the last three months, as on September 23, the highest number clocked by major international markets in the period (see Back In Bloom).

Indian equities have also outperformed the MSCI Emerging Market Index by 25 per cent over the last year, as on August 31, 2022. This is despite record outflow of foreign institutional investments worth Rs 3.6 lakh crore. Historically, the Indian market has traded at 15-20 per cent premium to the MSCI Emerging Market Index.

“Our markets have been remarkably resilient on the back of continued strong domestic investor interest and relative strength of the Indian economy amid global volatility,” says Suresh Soni, CEO, Baroda BNP Paribas Mutual Fund.

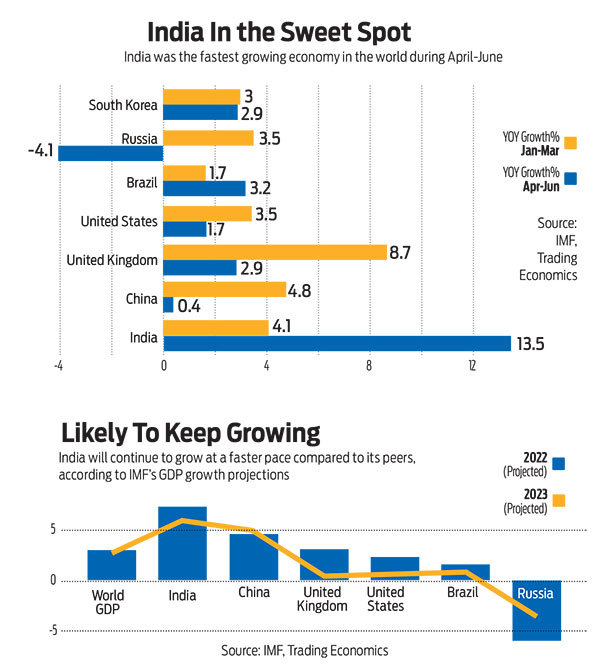

India has emerged as the rising star on not just market returns, but on the growth front as well. It clocked the highest growth of 13.50 per cent in the quarter ending June 2022, as compared to other countries (see India In The Sweet Spot). According to the International Monetary Fund (IMF), India’s projected growth for this fiscal and the next are 7.4 per cent and 6.1 per cent, respectively (see Likely To Keep Growing). In comparison, China’s projected growth is 4.6 per cent and 5 per cent, respectively.

The Return Of FIIs

The festive mood in the Indian market is back after a gap of 10 months, during which the bears had tightened their grip. Between August 2022 and mid-September, foreign institutional investors (FIIs) had pumped in a little over Rs 24,000 crore in the Indian equity market, driving some sectors and stocks to new highs.

“FIIs have turned buyers in India, as India has started to emerge as a growth story that is not burdened by the issues plaguing many other nations in Asia,” says Srikanth Subramanian, chief executive officer, Kotak Cherry, an investment platform.

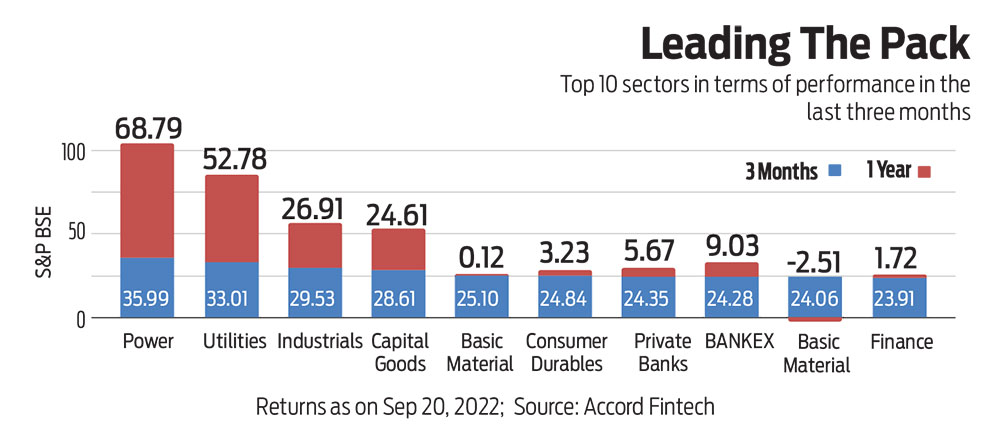

A major portion of the inflows are getting invested in domestic consumption driven sectors—financials, telecom, consumer utilities, capital goods, and automobiles. A report published by Edelweiss Wealth in September 2022 says that in the one-and-a-half months from July 1 to August 15, 2022, the top three segments were financials (Rs 7,696 crore), food and beverages (Rs 6,237 crore) and telecom (Rs 4,989 crore).

“They are more focused on domestic consumption driven sectors, and they are not investing in globally connected sectors like metal, IT, Pharma,” says Ajay Bagga, a market veteran.

He, however, sees FII inflows from different lenses. He believes FIIs are not investing in globally-connected sectors because all is not well on the global front. “The so-called smart money is focusing on India’s domestic growth and domestic consumption. So, overall, we are not out of the woods. We don’t know how this interest rate cycle will turn out,” adds Bagga.

Is The FII Flow Sustainable? Major central banks around the world are tightening interest rates as they try to control runaway inflation in their respective countries. On September 22, 2022, the US Federal Reserve hiked interest rates by 75 basis points (bps). One bps is a hundredth of a percentage point. Just two weeks ago, on September 8, the European Central Bank (ECB), too, announced a hike of 75 bps.

The Federal Open Market Committee (FOMC) surprised the market by projecting further sizeable hikes in the coming months. The Fed’s updated economic projections show slower GDP growth and higher inflation. On the back of these, it is anticipated that a steeper rate hike cycle will continue. “We change our profile for the federal funds’ rate, now anticipating another 75 bps in November (50 bps previously), 50 bps in December (25 bps previously), and a final 25 bps hike in February 2023. This would take the federal funds target range to 4.50-4.75 per cent in February, 50 bps higher than our previous forecast for a peak of 4-4.25 per cent. The risks for policy rates may still be skewed to the upside, given sticky, elevated inflation,” HSBC Global wrote in its research report released after the Fed rate announcement.

At home, the Reserve Bank of India (RBI) has also been increasing rates aggressively for the past few months, on the back of high inflation. After falling for three consecutive months, retail inflation rose to 7 per cent in August 2022. The information regarding foreign exchange reserves, which have decreased by 14 per cent from their peak, will also keep the market on the edge. It is to be now seen how RBI will tackle inflation and contain the fall of the rupee in the coming months.

“Given the moderation in commodity prices, including oil, we believe inflation is close to its peak. Indian rupee has also held up well. As such, this could provide some elbow room to RBI to go slow on rate hikes,” says Soni.

The big question though is whether the FII flow continue in the rising interest rate scenario. “It’s very difficult to predict whether FII inflow will come or not, but one thing is clear that the worst of the outflow is behind us,” says Pankaj Pandey, head-research, ICICI Securities. “We are one of the bigger economies which will keep growing at 6-7 per cent. With recession fears in most other parts of the world, obviously FIIs won’t cut allocation to an emerging economy like India. Incremental money may not come in, because of valuation issues, but outflows may not happen,” he adds.

Strong DII Support

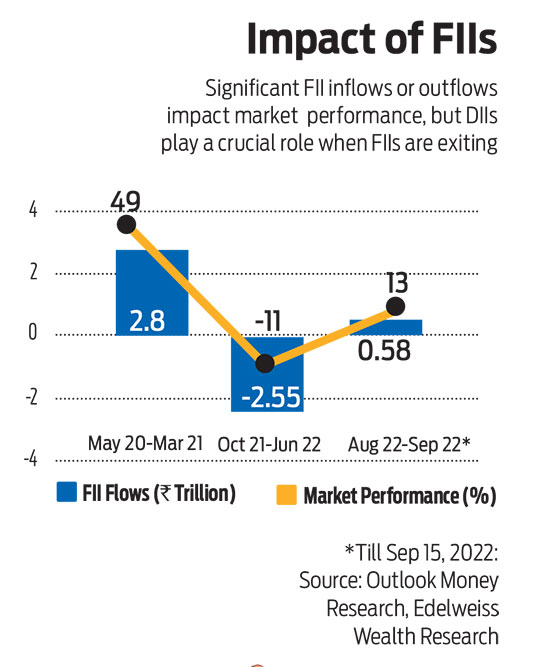

Though significant FII inflows and outflows impact market performance, the effect has gone down drastically over time, thanks to inflows from domestic institutional investors (DII) and retail money. The Rs 39 lakh crore Indian mutual fund industry alone contributes a monthly systematic investment plan (SIP) book of a little over Rs 10,000 crore, apart from lump sum investment. The rising number of demat accounts (100 million-plus) also brings money in the market.

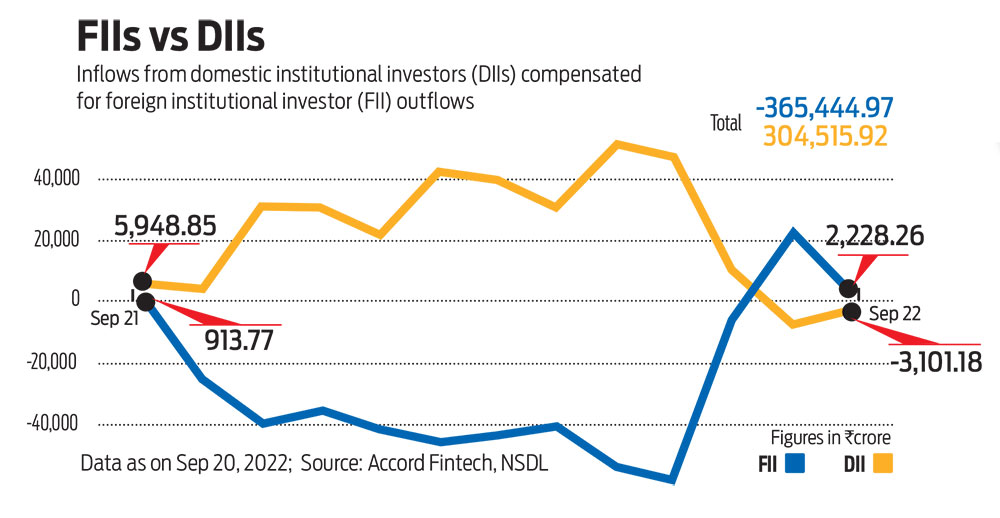

Data shows that FII inflows lift the market, but outflows do not impact the market negatively in a significant manner (see Impact of FIIs). According to an Edelweiss Wealth report, when the market saw FII inflows to the tune of Rs 2.8 lakh crore between May 2020 and March 2021, Nifty was up 49 per cent, but when the market saw FII outflows to the tune of Rs 2.55 lakh crore between October 2021 and June 2022, the market declined only 11 per cent, as DIIs became buyers to the tune of almost Rs 2.98 lakh crore. Further, in the last one year, FII outflow of Rs 3.65 lakh crore was counter-balanced by DII inflows to the tune of Rs 3.04 lakh crore, according to data from National Securities Depository Limited (NSDL).

The Way Forward

Global Concerns

Global concerns, such as high inflation in developed economies and continued US Fed action to raise rates may pose downside risks and contribute to some volatility in the equity markets in the coming months.

Fear Of Recession: The fear of recession is lingering over developed countries. Both the UK and the US have seen a sharp decline in GDP growth in the last quarter. The fall has been steep for the UK, with GDP growth slowing from 8.70 per cent to 2.90 per cent. The way things are moving in the developed economies, there is a fair chance they will slip into recession. But this may not happen overnight.

“Historically, 60 per cent of the times, when the US Fed hikes the rates, it leads to recession, and the recession comes 30 months after the rate hike, as seen in the last 50 years,” says Bagga. If we start counting from March 2022, when the US Fed first hiked the interest rate by 25 bps, this may happen in September 2024. By that calculation, the markets are better off in the next 24 months, though Bagga adds that sometimes it has come in 11-14 months as well.

“In the current scenario, growth could be impacted globally, as the US Fed and the ECB will continue tightening, if inflation in those regions do not start registering a sharp drop from the current levels,” says Anup Bahaskar, head, equity, IDFC Mutual Fund.

Will Recession Affect India? When the US sneezes, India catches a cold, goes a famous saying. India is linked to what happens in the world, especially in the US. In 2008, during the subprime crisis, people initially felt India would benefit, but history proves otherwise. The Indian markets fell 63 per cent, while the US markets fell 55 per cent from their peak in 2008; it took five and a half years, till 2013, for the Indian market to reach the January 2008 peak. There is a murmur on the D-street again that India has decoupled from its global peers.

“India is part of the global economy and while it has managed its position better versus the rest, it will still not be able to stay isolated if there is a global crisis,” says Subramanian. As for decoupling, India is always pegged against other BRICS nations. Though India has been able to manage its finances and currency better than the rest, there’s a long way to go before we can truly be decoupled from other emerging markets, he adds.

But not everyone believes so. “We are not driven by global growth too much, unlike China, Europe and others. So, the volatility in growth is far less,” says Pandey.

Domestic Resilience

Barring a few global headwinds, the macroeconomic environment is convincing enough for investors to bring in fresh money to the table. “India has also been able to demonstrate strong support from domestic investors that has been supported by huge investments towards equities,” says Subramanian. He also believes that RBI has been able to manage the relative strength of the rupee.

Experts are of the opinion that our economic performance will remain robust. “Our high-frequency indicators like goods and services tax (GST) collections and bank credit growth are showing strong momentum. After two years of the pandemic, we expect festive demand to be strong,” says Soni.

Increased retail participation in the Indian equity markets directly or indirectly through the mutual funds route, and long-term investment flows from investors like the Employees’ Provident Fund Organisation (EPFO) provides sustained domestic support for the markets. Additionally, FIIs that were sellers till June 2022 have turned net buyers. However, there are multiple factors like interest rates in the US and other global markets, and impact of tension in Europe, which can impact crude oil prices, that can negatively impact India.

Soni adds that continued strong DII inflows, the belief that inflation has peaked, and the resilient consumption demand is keeping sentiments positive for the Indian equity markets.

The government’s ambitious capital expenditure plans as well as strong domestic consumption demand is expected to support India’s growth. While the growth outlook has improved, the balance sheet of the government is in a better shape. “Structurally, we expect that in the medium term, India’s economic growth story could continue to play, out and this would be reflected in the equity market performance,” says Soni.

In the near term, we will see strong consumer demand as well as a revival in industrial capex. Also, bank credit is growing at over 15 per cent year-on-year (y-o-y), the fastest in recent times, indicating an overall improving economy, he adds.

Domestic Drags

Markets could also get affected by some economic indicators, including high oil prices on the domestic front.

First, the Indian economy and markets alike have been battling high inflation, particularly fuelled by food items and energy. If inflation does not come down to comfortable levels, and that too quickly, it will only compound the problems.

Second, in the near term, the markets would be looking at second quarter earnings starting next month for some medium-term direction. The impact of high interest rates, however, may show up in the companies’ margins. Another round of rate hikes, which is a strong possibility, will only hurt them further.

Market volatility is expected to continue until interest rates stabilise. Says Ruchit Mehta, head of research, SBI Mutual Fund, “Expect the markets to remain volatile till there is clarity on the rate hike cycle.” He says inflation will remain the primary concern for markets, as it will dictate actions that global central banks take. The transition from easy monetary conditions to tightening liquidity won’t be easy. India will not be completely immune to large global shocks, but may still be better off.

Opportunities For Investors

In the recent past, the Indian equity market has displayed strength amid weakness across all major global markets. The recent spurt in Indian equities places India’s valuations at an even higher premium to global indices. This could result in some profit booking. “In the past, when Indian equities have traded at such a premium, relative to global indices, FIIs have been sellers. However, this time, FIIs have turned buyers of Indian equities. Thus, the ‘traditional’ bugbear of premium valuations impacting Indian equities has not resulted in FIIs selling,” says Bhaskar.

Market opportunities exist in every economic condition. Even in the current scenario, there are sectors that may work for you in the long term. Says Bhaskar, “We believe, sectors should be viewed from three lenses—those where margins could be uplifted due to a structural factor or valuations where current valuations are lower than pre-Covid levels and where certainty of earnings visibility is very high.”

He says auto and banking are best placed to report a healthy spurt in margins, and valuations for many companies within the sector are trading at levels lower than pre-Covid. “Capital goods and real estate developers are sectors where a robust order book gives comfort of strong earnings visibility, though valuations are at an esoteric level. Among other sectors, cement, and engineering, procurement and construction (EPC) contractors, could benefit from softening input prices and reasonably strong demand pull,” he adds.

Experts also advise investors to stick with domestic-oriented sectors such as financials, consumer discretionary, industrials and healthcare. “We believe that domestic consumption could continue to remain strong and could be one of the key drivers for the economy as well as the market,” says Soni. He adds that banks are well-placed now, having cleaned their non-performing assets (NPAs), and are set to capitalise on revival in credit growth. Moreover, the rising interest rate environment should benefit the lenders, as loans get repriced faster than deposits.

Mehta is optimistic on industrials, capital goods, and aspects of consumer discretionary sector, such as automobiles, travel, and tourism. “We see scope for a revival in India’s private sector capex cycle, and continued government focus on infrastructure to be beneficial for the industrial and capital goods sector. Also, with the economy fully re-opened, we see consumers spending more on discretionary items,” he says.

Bagga advises a bit of caution when choosing stocks. “One should be in large-cap and quality companies. In the next one year, we will get clarity on where the global economy is going.”

In the medium term of three-to-five years, however, mid- and small-caps may do better than large-caps, says Pandey. He advises investing in a staggered manner rather than putting in a lump sum on the occasion of Diwali.

Just as the festival cannot be enjoyed without taking precaution, as the risks of burning or excess pollution is inherent, equity investing needs to be approached with a dose of caution. Light the right lamps to make your portfolio sparkle this Diwali.

***

Bodhisatwa Ghosh, 33, Entrepreneur

Kolkata-based entrepreneur Bodhisatwa Ghosh makes it a point to participate in Muhurat Trading session that happens on the occasion of Diwali, and also invests in gold during Dhanteras.

“It is a short period of time, but for me, it has got a sentimental value and I believe that it brings good luck,” he says. He normally buys 500 gm of gold in 24 karat gold bars every year.

However, investing during Diwali is part of his long-term investment journey. Though he is into short-term trading, too, he takes long-term investment seriously. “My idea of investments is to create a passive income. So, I prefer good quality, high-dividend paying stocks which will give me a dividend, irrespective of the marker performance.”

Ghosh sticks to some rules while investing. First, he always invests the money he has, and never trades on margin. Also, he never gets carried away by broker recommendations, and avoids herd mentality.

Whether it is the stock market or other investments, his motto is simple: invest only in what you understand.

—Meghna Maiti

***

Rajesh Kumar Singhania, 55, CFO, Manaksia Steels Manisha Singhania, 50, entrepreneur

The Singhanias invest on the auspicious occasion of Diwali only if the market conditions are favourable.

“Investments should be made at the right points of time after careful consideration and analysis of the market conditions. Thus, it may or may not be the ideal strategy to invest during the Diwali season,” says Rajesh.

Apart from market conditions, investments should be always made keeping in mind the specific goals to be achieved, while meeting up the liquidity requirements, the couple believes. “We aim to maximise return on investments and maintain liquidity as and when required,” he says.

Therefore, there is nothing different this year when it comes to an investment strategy. If the market conditions are favourable, then during the auspicious occasion of Diwali, we consider investing in commodities (gold, silver) and stocks,” he adds.

The Kolkata-based couple believes in the investment philosophy of diversification and not putting all their eggs in one basket. This ensures a certain secured percentage of return as well as mitigates risk, they feel.

Their investments are diversified across property, stocks, mutual funds, fixed deposits, and provident fund.

—Meghna Maiti

kundan@outlookindia.com