Momentum Investing

Momentum Investing refers to riding an existing market trend and is built on the basic premise stocks that have outperformed recently on the basis of their price movement, may continue to outperform, and similarly, stocks that have underperformed, are likely to underperform.

This strategy aims to buy securities that are rising and sell them when they look to have peaked, providing investors an opportunity to capitalize on the continuation of existing trends in the market and gain from the price movement of stocks.

Nifty200 Momentum 30 Index

The Nifty200 Momentum 30 Index follows a rule-based strategy to buy securities when their price is rising and sell when they appear to have peaked – Investors can benefit from the relatively high return potential of this differentiated strategy over the long term without having to time the market themselves.

Key Point to Remember

The Nifty200 Momentum 30 Index follows a well-defined strategy to decide the entry and exit points for the securities and has consistently demonstrated strong performance over the years.

Since the Nifty200 Momentum 30 Index portfolio is rebalanced on a semi-annual basis, the churn rate is relatively higher than the broader indices – Nifty 100 and Nifty 200.

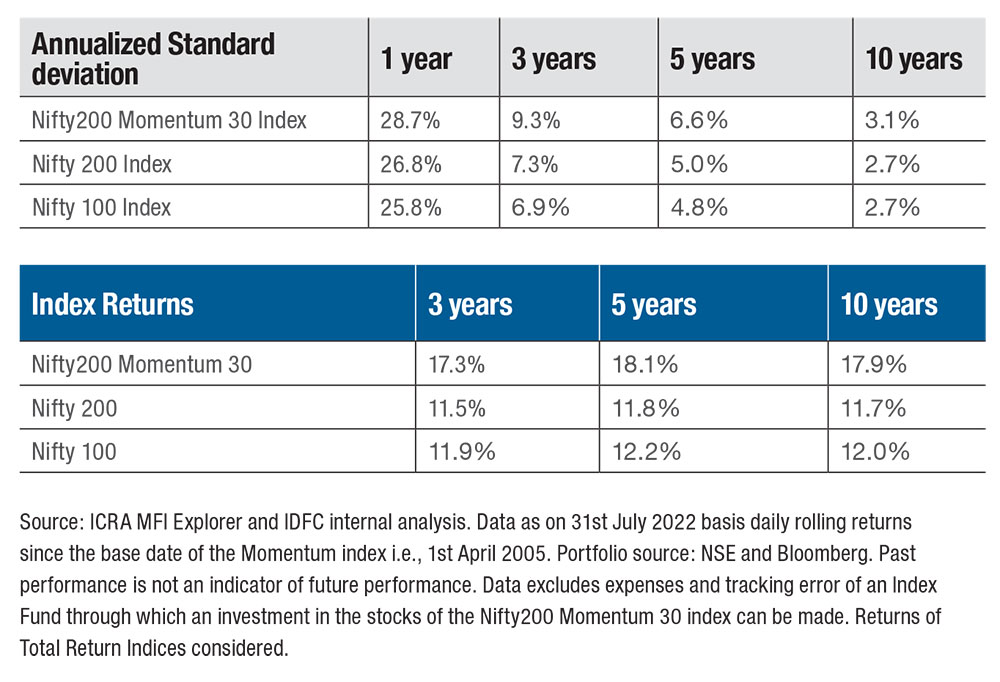

The following tabular representation depicts that the standard deviation (a measure of volatility) of the Nifty200 Momentum 30 Index is relatively higher than the broader indices. However, it can be observed that despite relatively higher risk, the Nifty200 Momentum 30 Index has outperformed across investment periods and could compensate for the risk taken.

***

About The Autor

Mr. Gaurab Parija is the Head – Sales and Marketing at IDFC Asset Management Company Limited. He has over 25 years of experience in sales, marketing, business development, and driving strategic initiatives.

Mr. Parija is responsible for driving accelerated business growth working with seasoned sales and marketing teams across India, focusing on building strong partnerships and enhancing value to clients. He brings in over two decades of mutual fund experience in Retail Sales and Distribution and is amongst the most seasoned sales and marketing professionals in our industry. His deep relationships and passion to add value to clients make him stand out in the industry.

He has been associated with IDFC AMC since March 2017. Prior to joining IDFC AMC, he was associated with Franklin Templeton Services (I) Pvt Limited as a Director, responsible for New Initiatives and Business Development, CEMEA/India (March 2014 to March 2017). Prior to that he was associated with Franklin Templeton Asset Management (I) Pvt Ltd as National Sales Director (April 2009 to Feb 2014), Head – Retail Advisory Services (Jan 2008 to March 2009), and Head – Alternate Distribution (June 2006 to Dec 2007).

Mr. Parija holds a Post Graduate Diploma in Business Management (PGDBM) from IIM – Bangalore.

Disclaimer:

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

An investor awareness initiative by IDFC Mutual Fund.

To complete KYC process, investors are required to submit CKYC form along with a recent photograph, self-attested copy of PAN Card and valid address proof to any designated KYC Point of Service. For more information on KYC along with procedure to change address / bank details / phone numbers, etc please visit IDFC Mutual Fund website i.e. www.idfcmf.com Investors can file their complaints with the mutual fund through their designated investor service contact points. Alternatively, investors can write to us at investormf@idfc.com or Call us on 1800 266 6688/ 1800 300 666 88. Investors may also register their complaint on SEBI SCORES portal. Investors are cautioned to deal only with the Mutual Funds registered with SEBI, details of which can be verified on the SEBI website under “Intermediaries/Market Infrastructure Institutions”. For more information visit, http://bit.ly/IDFC_IAP.