There is no better time to relook at a portfolio than the middle of the financial year. When we relaunched OLM 50, a basket of mutual funds we pick after applying several filters, in May 2022, we promised to do a half-yearly review, and here we are.

Our OLM 50 half-yearly review comes at a time when global uncertainties loom large, and there is widespread fear that markets may tank going forward. At such times—when some stocks get a bit wobbly, while others surge ahead of the market—the task of mutual fund managers becomes quite challenging. They need to dig deeper into the market psyche and company fundamentals to choose the winners that can outperform the benchmark.

The objective of this review is to suggest a better alternative. Instead of pitching for funds that have done well in the short term, we have always believed in the importance of consistent long-term performance and the ability to protect downside in bad market conditions.

New Member

We ran our numbers again and have replaced one of the funds from our earlier selection. Before we go ahead and give you the details, here’s a word of caution: If your fund does not feature in OLM 50 anymore, it does not necessarily mean you should exit it and replace it with another scheme from the list.

Exit: This time, the list has seen the departure of a liquid fund, Nippon Liquid. The departure of this fund is not because of its underperformance or any other reason, but because we wanted to add another fund in the equity category. Existing investors should continue to hold it. Our liquid fund category now has three funds left, and usually a combination of two-three funds is enough to park your emergency money in liquid funds.

Entry: The fund that has been added to the OLM 50 list is ICICI Prudential Value Discovery. It is one of the best funds in the value fund category, and it has also proved its mettle across various market cycles. Pick up Outlook Money’s next issue to read a detailed analysis of the scheme.

How Did OLM 50 Perform?

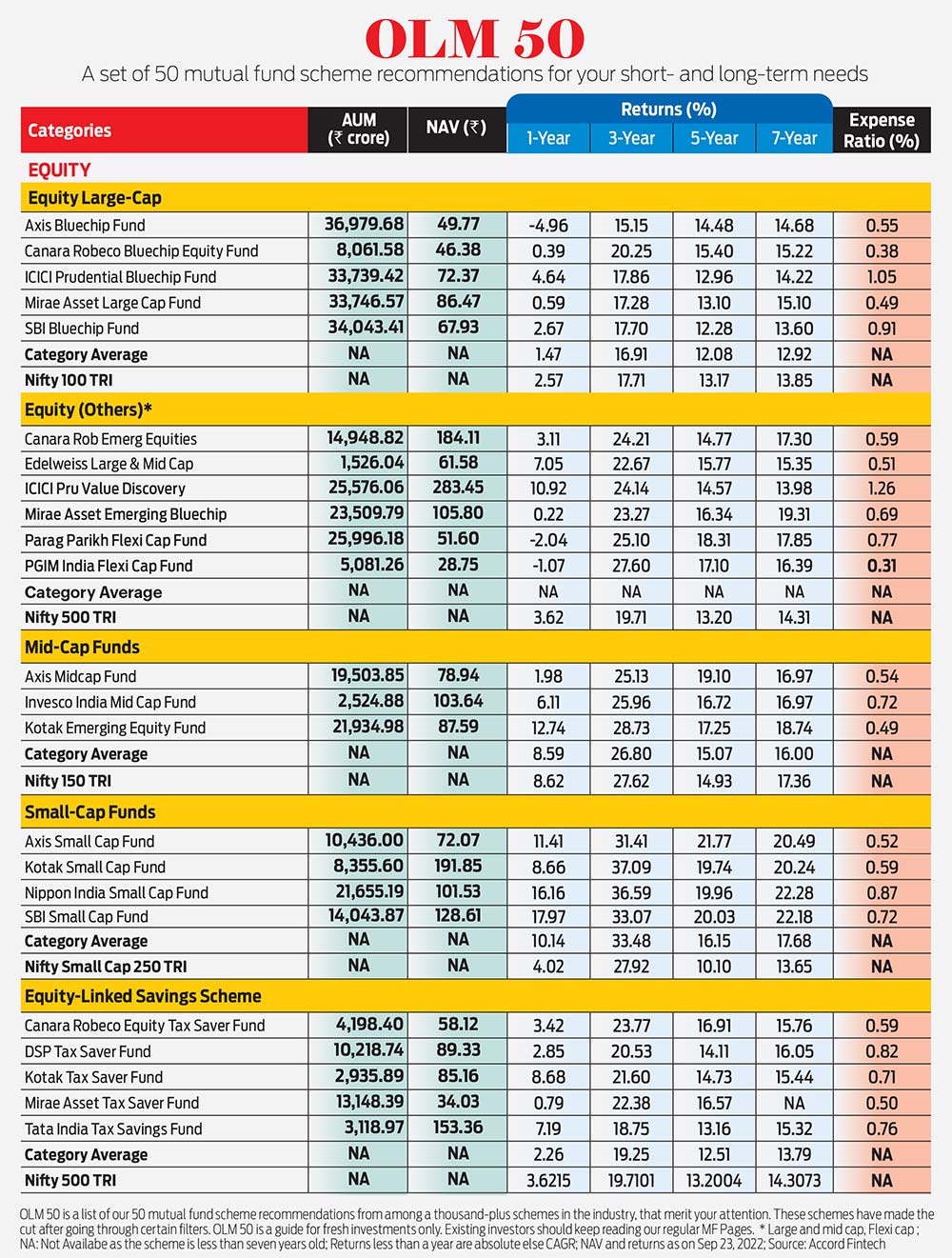

Equity Funds: At present, the Indian equity markets are on a roll despite global uncertainties. When we relaunched OLM 50 in May 2022, the market was on a downward spiral on the back of global turmoil and the US Federal Reserve’s rate hike. However, from mid-June onwards, the Indian equity market started recovering. Broadly-tracked indices, such as the NSE Nifty TRI and the BSE Sensex TRI, are up by 13.75 per cent and 12.12 per cent, respectively, in the three months ending September 24, 2022.

Almost all the equity funds in OLM 50 outperformed the broadly-tracked Sensex and Nifty during this period. However, the difference in outperformance was narrower in large-cap diversified equity funds. The average return from OLM 50’s large-cap category was 13.98 per cent as compared to the 13.75 per cent from the Sensex.

SBI Bluechip stole the show in the large-cap category with 16.01 per cent return, while in the mid-cap space, Kotak Emerging Equity came out flying with 20.02 per cent. Small-cap-oriented fund, Nippon India Small Cap managed to deliver as high as 23 per cent.

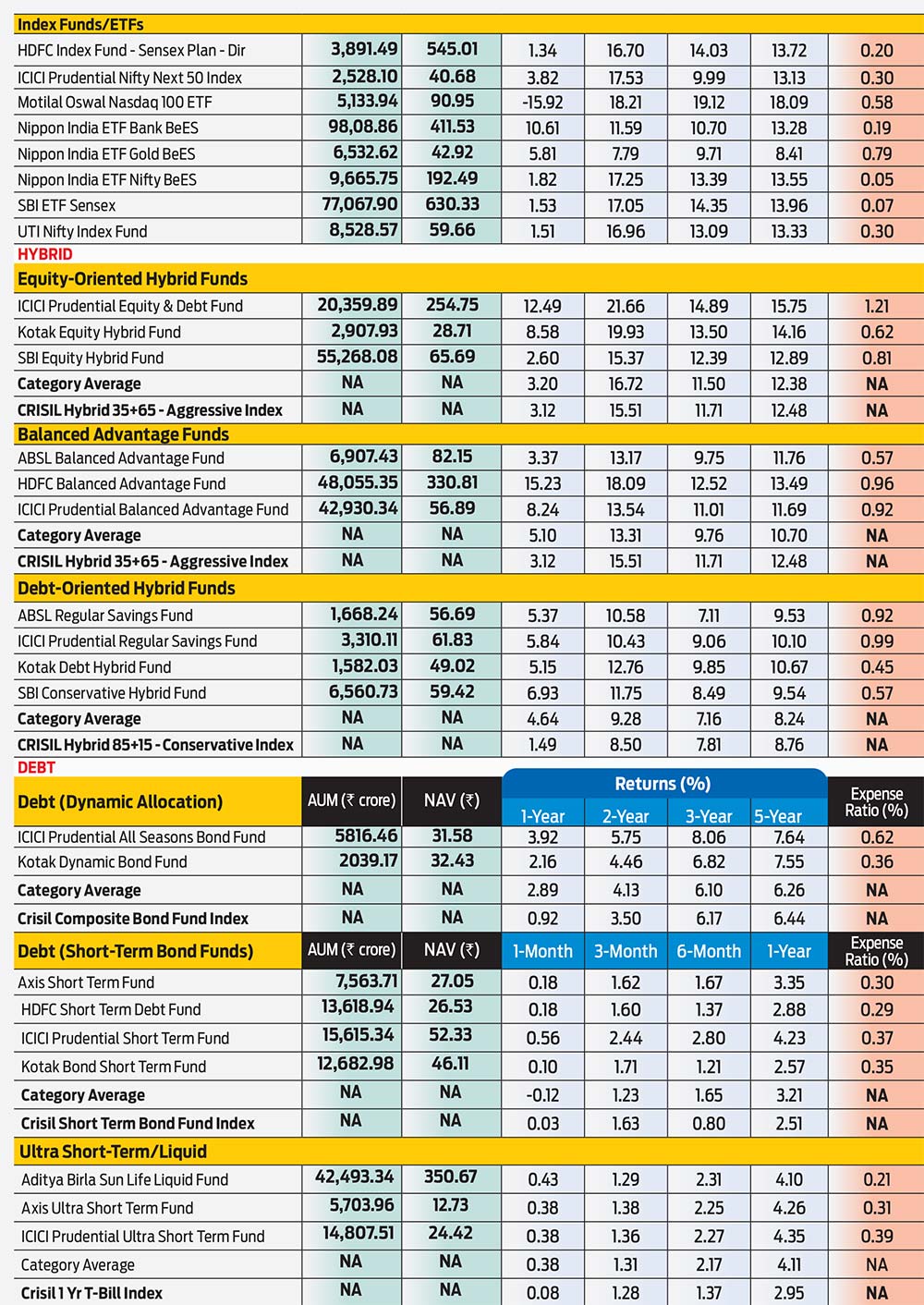

Debt Funds: On the debt front, the market will closely watch the Reserve Bank of India’s (RBI’s) policy action in the future. Since May 2022, RBI has raised repo rates by 140 basis points to 5.4 per cent, not including the rate announcement in September.

“Going forward, elevated energy prices, resilient consumer price index (CPI) and wholesale price index (WPI), accelerated tightening by central banks are likely to put upward pressure on yields. Further, supply of state development loans (SDL), which has been muted till now, is likely to pick up in the coming quarters,” HDFC MF wrote in its recent debt market outlook.

The buzz that the Indian government securities (G-Sec) will be included in the global bond indices is likely to keep a lid on yields.

Since we are still in a rising interest rate situation, it’s better to stick with short-term debt funds.

Guide To Using OLM 50

If your fund is not in OLM 50, it doesn’t mean you should exit it. The same is true if you invested in a fund that was part of OLM 50 earlier, but is not in the list now. There could be multiple reasons why we have knocked out a fund: fund management change, consistently declining performance, presence of better alternatives, and so on. When there is an alarming reason, we will let you know specifically.

Though OLM 50 has many schemes, it’s best to pick seven to eight, and diversify across fund houses.

kundan@outlookindia.com