Debamita Saha, a new mother based in Kolkata who is an independent medical practitioner, has resumed work partially now that her daughter is six months old. She has cut her working hours by half compared to when she was working regularly till two months before her daughter was born.

“My child is my top priority now. I would like to spend as much time with her as possible. But I also cannot afford to not work. I have started my private practice and now I know I would really need to stay very disciplined to balance everything,” says Debamita, who did not want to reveal her real name. She feels a double income is required to take care of the added expenses and responsibilities now that her nuclear family has expanded.

Several women like Debamita choose to maintain a work-life balance but many prioritise the child over work by choice or because of circumstances such as lack of familial support or quality childcare facilities.

When it comes to shouldering household responsibilities such as caring for a child, women are expected to take the lead. About 113 million women aged 25-54 with partners and small children were out of the workforce in 2020, globally, according to estimates in a 2022 report by the UN Women and International Labour Organisation. The trend was similar even during the pre-Covid period. In 2019, labour force participation for mothers was 55 per cent (for women aged 25-54 with partners and at least one child under the age of six at home); this figure was lagging women’s overall participation rate of 62.1 per cent. In 2020, about 19 per cent of women were in the labour force across India, down from approximately 30 per cent in 1990, according to data from Statista, a business data platform.

“With multiple responsibilities and limited time, women tend to deprioritise things that they may find more difficult to handle like finances,” says Mrin Agarwal, founder-director, Finsafe, a financial education company.

As we celebrate Mother’s Day on May 8, let’s look at what new mothers —especially those who have taken a break or have taken a less demanding professional role—can do to ensure that the focus on financial life continues. Following this list of dos and don’ts will lead to financial stability.

Maintain The Balance

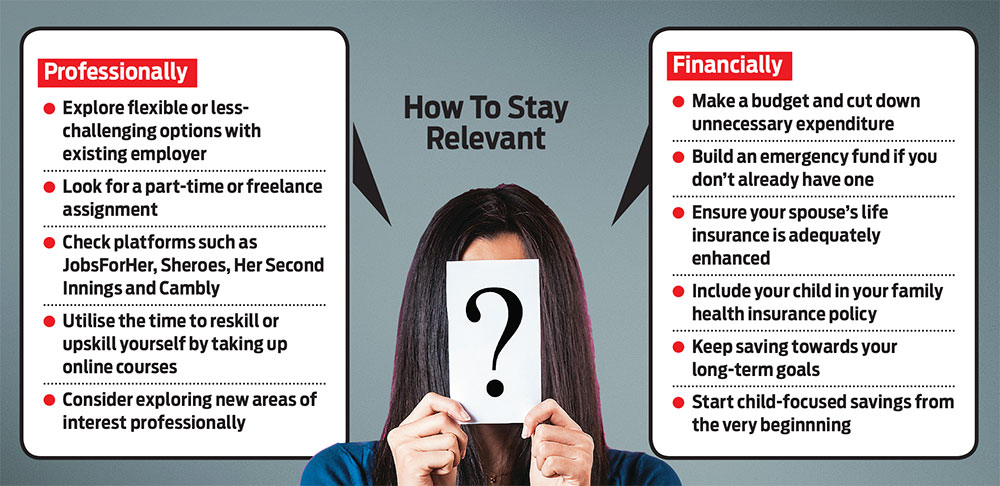

While it is easy to get swayed by the demands of motherhood and charmed into professional inaction, if you want financial independence and would like to be part of the workforce in the future, if not immediately, there are several ways to remain relevant even while taking a break.

To start with, take steps to maintain some (if not full) financial independence. “It is very important for women to manage their finances as they need to continue to have independence. Women taking a break should ensure they have some source of income,” says Agarwal.

In lieu of full-time work, look for part-time or flexible working options. Platforms such as JobsForHer, Sheroes, Her Second Innings and Cambly connect women to such employment opportunities. Check with your current or former employers for part-time options.

It is important to be prepared for a lower salary that a part-time job may entail. Remind yourself that this may be a better option than not having an income at all.

If flexi- or part-time work is not your cup of tea, reskilling or upskilling is another way to stay relevant. “If the break is for a longer period, the need to re-establish yourself may become a mission,” says Arijit Sen, a Sebi-registered investment advisor and co-founder of financial advisory firm Merry Mind.

Certification courses, training programmes, workshops, networking events, etc. can serve the purpose of gaining back relevance in your field of work and make your re-entry simpler. Moreover, the availability of online modules can help in maintaining a balance between personal and professional needs.

Of course, all this is easier said than done. So, it makes sense to seek help and not isolate yourself. “Make sure you have support or flexibility at work too. This will allow you to maintain your career as you completely or partly take care of your child,” says Shweta Jain, founder of Investography, a financial planning firm.

Keeping career links active also help if you plan to return to full-time work. “If you had taken maternity leave, you may be re-joining the same position or taking up a different role as mutually agreed,” says Sen.

The break from work is also an opportunity to dabble into new areas and rediscover your professional interests. “Since the baby has probably changed your life completely, take it as a cue to change what you didn’t like about your work earlier. The positive attitude you develop is the difference between success and failure,” Jain adds.

Towards Financial Stability

Apart from the physical and emotional demands a new mother has to contend with, break from work can result in financial shortfall as income reduces at a time when baby-related expenses increase drastically.

Making a budget is a simple step that can help make informed decisions about whether you need to go back to a job or invest in new skills. “In such a scenario, budgeting plays a crucial role. A new line item gets added to the family’s household and lifestyle expenses. Trying to do too much may pinch you so set a family budget and track cash flow by using financial planning tools and processes,” says Sen. Look closely at your expenses in the last three to six months and then factor in the increased child-related expenses.

Debamita and her husband revisited their existing budget after their daughter was born. Since Debamita was taking a break, the couple consciously cut down their discretionary expenses and made other adjustments.

If you don’t have an emergency fund already, now is the time to get serious about it, especially as your household moves from being double-income to single. It may take you some time to build an emergency fund, but it will bring peace of mind.

Ensure that your family health cover includes your baby and your spouse’s life insurance is enhanced appropriately to cover you and the child. If you have a life insurance in your name, continue it to ensure enhanced protection. Once the basics are sorted out, make sure you invest for future goals. While this needs to be planned along with your spouse, it is important to be a part of the financial discussions. “Women should also read up about personal finance and keep themselves aware. This can help them manage family finances better,” says Agarwal.

If you are planning ahead for your child, you could open a bank account in your child’s name once she completes three months and deposit all the cash gifts that she may have received. You will be surprised how easily you can save and invest in the child’s name this way. “Deposit all gifts in this account over the years and you may end up building a small fortune,” adds Jain.

Amid all this, don’t forget to spend some me-time. To remain mentally and physically fit, Debamita has joined early morning yoga classes that she attends before her child wakes up. Pursue an interest that gives you pleasure.

Being prepared is half the battle won. Looking at all factors—professional, financial and personal—will help you take an informed decision about your finances even as you take care of your child.

meghna@outlookindia.com