The 2004-2007 rally in the Indian stock markets took everybody by surprise as the key stock indices witnessed a seven fold increase in their values. Investors created a lot of wealth while those who were not part of the market developed a strong fear of missing out the bus.

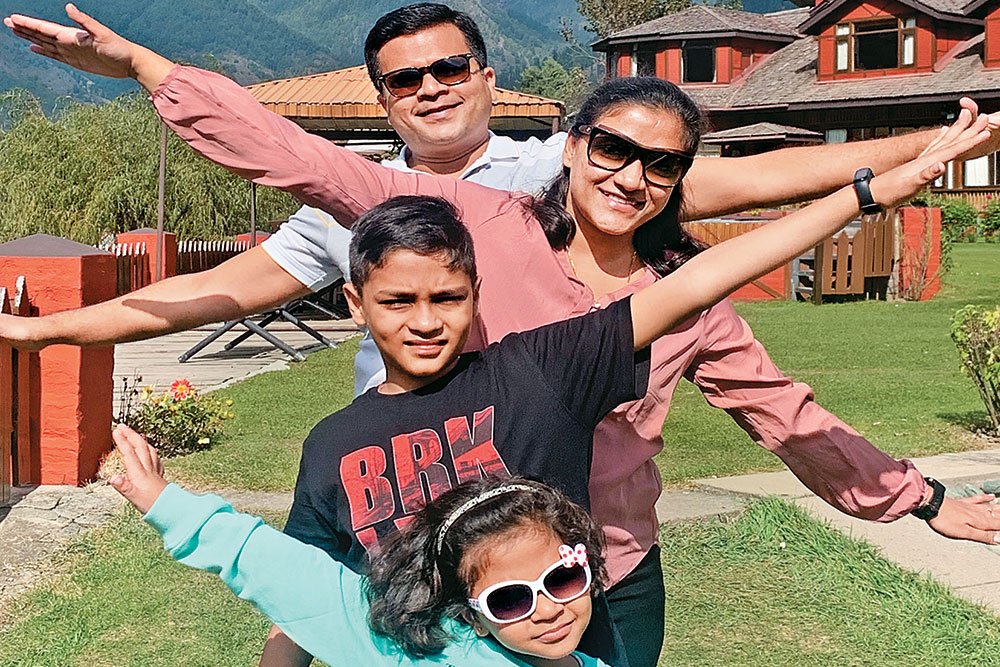

Abhishek Harlalka, who was 27 years then and a father of two small children — daughter Gia (3 years) and son Mannan (1 year); thought that somewhere he was missing out on the benefits of the financial markets’ strength. Since a quick seven fold increase in a matter of 3-4 years made everybody glued to the market; nobody wanted to miss the rally anymore. Abhishek was not an exception as he too wished to create wealth through stock markets. Given the fact that his children were still small, he and his wife Gitika knew that they should not delay investments.

The young Harlalka couple met Bharat Bagla, their mutual fund distributor. The latter gave them a patient hearing and understood what they were going through and what they wanted for their children’s future and their own future. “I realised that Harlalkas were undergoing a solid FOMO amid roaring markets. I took them into confidence and suggested a systematic approach to create wealth in the long-term, which they agreed to,” says Bagla.

Basically, Abhishek and Gitika wanted a corpus of Rs 25 lakh for each of their children for their higher education needs and at the same time wished to have financial security with a corpus of Rs 50 lakh for themselves. “The best part was that Harlalkas were a young couple in their mid-20s and their children were also very small. Thus I knew they have a long investment horizon which gave me confidence that they would do good if they are systematic and consistent,” emphasises Bagla.

To begin with, as the markets were entering the last leg of the rally, Bagla recommended Systematic Investment Plans (SIPs) for wealth generation. Harlalkas started their investment journey with three SIPs worth Rs 10,000 each in a consumption based thematic fund, mid cap fund and a small cap fund on January 1, 2008.

SIP investment under the professional guidance of Bagla was a good decision. However, the timing of the start coincided with one the biggest crashes in the financial markets on the back of global meltdown. The markets kept on seeing continuous value erosion and by the end of the same year in 2008, the Sensex got more than halved to below 10,000 mark. The majority of the investors were in panic mode as their portfolios were in the red. Reaction of Abhishek and Gitika was no different as they saw the market cracking more than 50%. It further fell by another 20%.

“To be candid, I was really nervous looking at the corrections. I wondered whether the decision of starting SIP was a wrong one. Should I continue or stop?”, reminisces Abhishek about the recessionary years of 2008-2009. However, what really worked in favour of Abhishek was though he started at markets’ peak, his investments were systematic on a monthly basis in a staggered manner. Thus he was saved from the impact of lump sum investments at the peak. SIP ensured his cost of investments were averaged out across the market fall.

Bagla readily understood the state of mind of Abhishek and proactively helped restore his confidence and reminded him about the long-term goals he started his investments for. “During market corrections, it is my utmost duty to hand hold my clients and keep them on the wealth creation track,” explains Bagla. He immediately connected with Abhishek and explained about the market cycles and why he should not stop his investments for long-term benefits. The latter showed confidence in Bagla and stayed put with his investments.

As the market stabilised within a year and bounced back by 2010, Bagla and Abhishek reviewed the portfolio. They found that despite corrections, systematic investments helped Abhishek see a 18% CAGR growth at the end of 2010. His accumulated investments of Rs 10.8 lakh in the last three years had grown to about Rs 18 lakhs. Seeing this growth, Abhishek’s confidence in SIP and his trust on Bagla strengthened further. He could clearly see the long-term benefits which would not have been possible if he had terminated his investments mid way.

It was here that Bagla recommended Abhishek to add another SIP of Rs 10,000 which the latter did happily. It turned out to be quite a prudent investment decision as markets remained in consolidation phase for another three years. An increased monthly investment aided Abhishek in accumulating more units at relatively lesser costs.

Having learnt the lesson of discipline and not losing patience during the 2008 crisis, a matured Abhishek did not dither thereafter, irrespective of the several market crises, be it due to demonetisation, GST, pandemic or even the current ongoing geopolitical tensions. Bagla’s consistent and timely advice and continuous financial education with focus on goals and patience keeping exercise helped Abhishek remain on the growth trajectory.

As a result, as things stand today when Abhishek and Gitika’s daughter is 18 years and son is 16 years, the Harlalkas’ total investments of Rs 68.4 lakh has turned into a large corpus of Rs 3 crore with an average CAGR of 18%. This wealth is much larger than what the Harlalkas couple had wished for in 2008. Moreover, Abhishek is only 42 now; he still has a minimum 13-15 years of more investment period. If investments are continued unabated, not only will he attain financial freedom soon but all his financial goals will be conveniently met.

A happy Abhishek, says, “I am highly thankful to Mr. Bagla for his correct and timely advice which helped me be independent from all financial worries. Without him, possibly I would have not been able to achieve financial freedom.”

According to Bagla, “Abhishek’s trust in me and following my advice really helped us work effectively and efficiently. Without his understanding, continuity and discipline, wealth creation could not have been possible. That’s why I always say patience is the key for wealth creation.”

Illustration Table for Case Study — Abhishek Harlalka & Bharat Bagla

- Harlalkas, parents of two small kids - daughter (3) and son (1), had FOMO during 2007 market rally

- They wanted a corpus of Rs 25 lakh for education needs of each of their children while needed a security fund of Rs 50 lakhs for themselves

- They started SIP worth Rs 30000 at the start of 2008 just before the global crisis

- Will sharp market corrections, they turned nervous and thought to stop SIPs

- Bharat Bagla, their mutual fund distributor, held their hands strongly and kept them on the wealth creation trajectory

- Post three years, Harlalkas could see a 18% CAGR on their overall investments

- They gained confidence in SIP and in Bagla and added another SIP of Rs 10000

- They remained patient and did not panic during the upcoming crisis.

- As on date, their overall investment has reached nearly Rs 3 crore which is much higher than what they initially wished for.

- Harlalkas are happy investors now, they thank Bagla for the right direction

- Not only are they now well equipped to take care of their children’s higher education but have a strong sense of financial freedom.

- They learnt that Patience is the key for long-term wealth creation and every investor should trust their financial advisors.

Disclaimer

The financial journey of Mandeep Sharma and his wife Sheetal Sharma Girish is based on the “personal view and experience” of Jugal Marwaha, Managing Director of Marwaha Financial Services Pvt. Ltd., and should not be construed as professional investment advice. No one should make an investment decision without first consulting with their financial advisor and conducting research and due diligence.

The views are personal and are not part of the Outlook Money editorial Feature.

Bharat Bagla, Mutual Fund Distributor