Not Yet Stranded

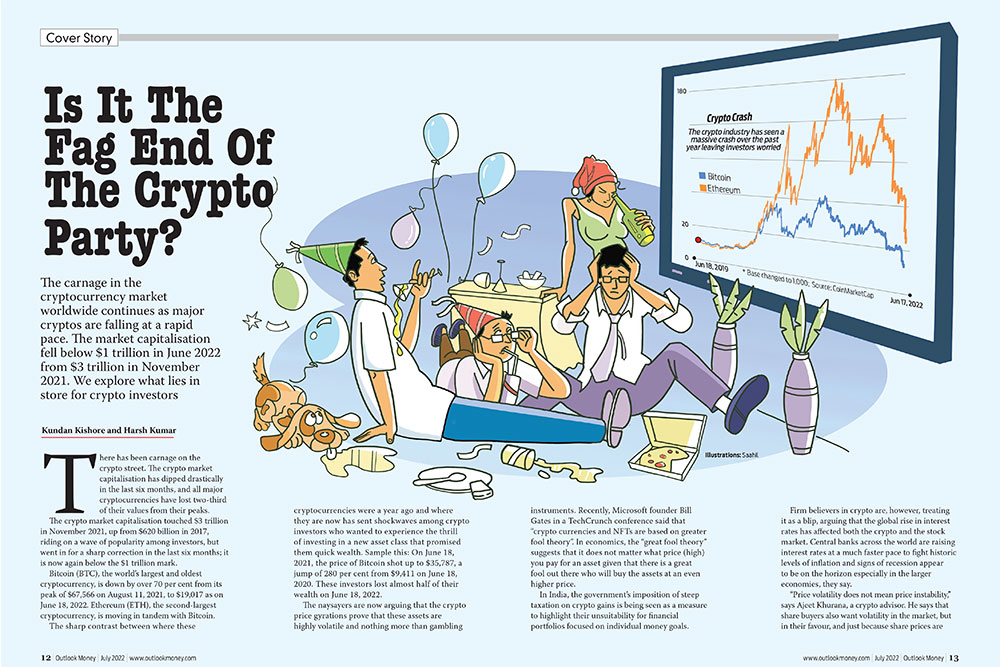

Crypto is a new-age investment product, and as with all things new, it will also take time to evolve and get standardised. Fifty years ago, people kept their money only at the bank. Nobody invested in the share market. But in early 2000s, when I started working, most people of my age began investing in mutual funds through systematic investment plans (SIPs). Crypto became slightly popular in the early 2010s, and the software engineers were the early movers and pioneers. They built the entire ecosystem of blockchain technology and crypto. Later, it caught the fancy of the Gen Z and the millennials. The party is not over yet. It will rise again. Even the share market rides through the bull and the bear phases, and so it will be with crypto. Investors just need to be patient.

That said, as with all other investment products, this also needs a thorough understanding. Once governments enact those regulatory bodies for the crypto industry, things will settle down here too.

Akash Ahuja, Thane

Castaways Indeed

Around 2016, a few of my friends began investing in cryptocurrency. They made money as well. Now, most of them have made an exit. It is the late entrants who will lose the most. I believe the losses mentioned are just a tip of the iceberg (Is It The Fag End Of The Crypto Party?). Some invesors are castaways indeed who have lost huge sums of money and now have no one to approach to or tell people of the losses. Since it is heavily dependent on technology, the law enforcement authorities won’t be able to provide much help either.

Neha Pal, email

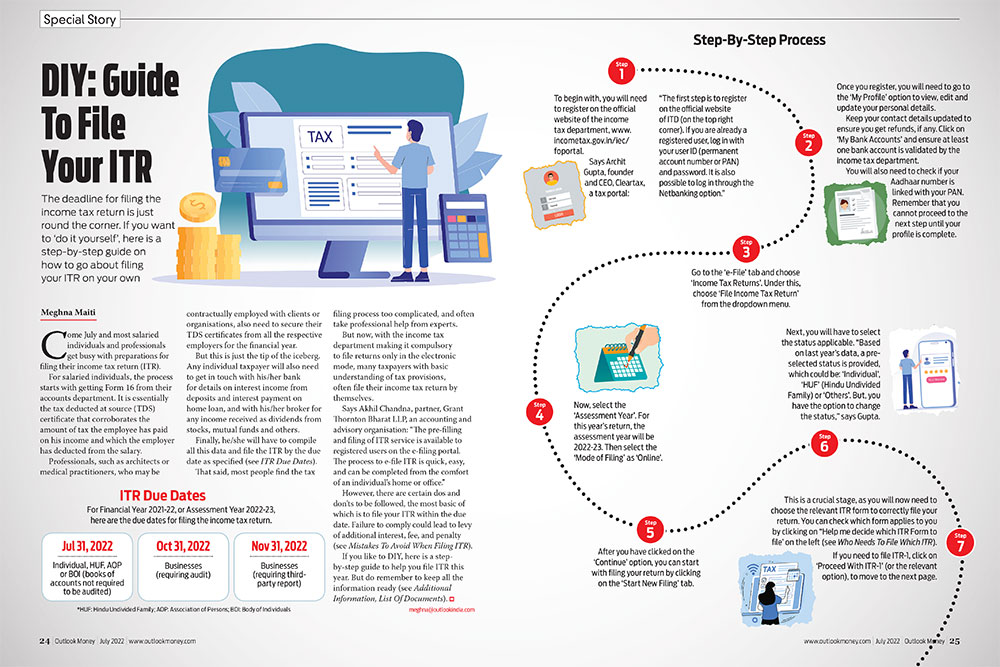

Tax Filing Made Easy

I have been a regular reader of Outlook Money for the past three decades. I wish to convey my appreciation for the quality of the content published here.

The article on tax filing (DIY: Guide To File Your ITR) published in the July 2022 issue is quite informative and will immensely help those who wish to file their income tax returns by themselves.

N.K. Bansal, Ahmedabad

Financial Behaviour

I have always liked articles on behavioural finance, and Larissa Fernand’s pieces in the last few issues need special mention here.

In each of her articles, she has given a different perspective on money. And that was the case this time, too.

Her article, The Emotion of Money, gave a different dimension on our approach towards spending.

This makes much more sense, as spiritually or philosophically, it is our emotions that ultimately make more money flow to you, which most of us are not aware of, in spite of us wanting to have more and more money in our lives.

Saurabh Kesharwani, Sagar, MP

Letters must be addressed to: The Editor, Outlook Money, AB-10, Safdarjung Enclave, New Delhi 110029, or letters@outlookmoney.com. Please mention your full name and residential address.