A good salary hike with growth prospect is perhaps the most important consideration for most people when changing or choosing a job. But imagine signing up for a fat salary hike and realising later that it didn’t make a lot of difference to your take-home pay.

Mridul Gogoi, 46, a content writer, joined a new organisation in 2009 at a 25 per cent hike on his previous cost to the company (CTC). At the end of the first month, he was sorely disappointed when he received his pay—his take-home had increased only by 8 per cent. That was because unlike his previous employer, his new employer had no provision for allowances and reimbursements on which he could claim tax benefit.

You could avoid a situation similar to Gogoi’s if you look at the salary break-up in advance and understand its components and the mandatory deductions from the human resource department (HR) before signing on the dotted line. You could even negotiate for a break-up that suits you, or decide against the offer if it doesn’t suit you.

The Salary Structure

There is no one-size-fits-all solution when it comes to salary structures. Companies create pay structures commensurate with the employees’ work experience and expectations.

Says Padma Priya Paladugu, finance manager at Bridgentech Consulting, an HR solutions firm: “There is no such thing as a perfect salary structure. It depends on various parameters, such as the candidate’s profile, education, years of experience, industry of expertise, location, and in-demand skill set, among others. The compensation is determined based on each criterion, the industry benchmark and best practices, the employer’s ability to pay and the requirements of the employer.”

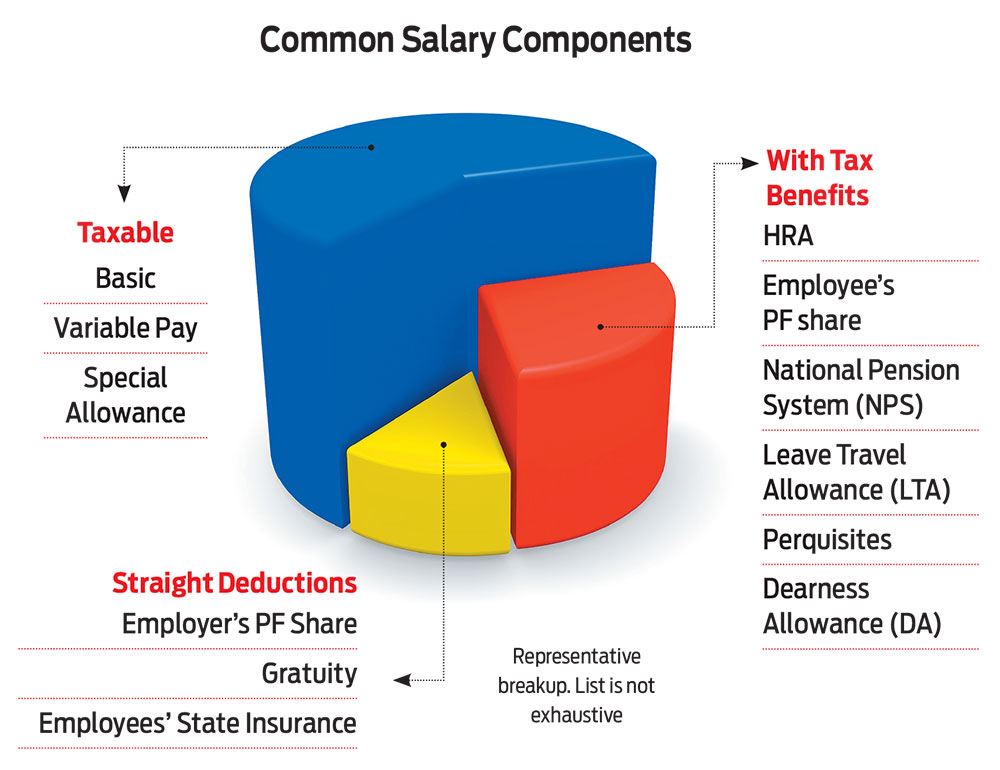

Broadly speaking, a salary structure can be categorised as fixed pay and variable pay. The fixed component could be a mix of basic salary, dearness allowance (DA), house rent allowance (HRA), leave travel allowance (LTA), dynamic flexi benefit allowance (FBA), and contributions to Employees’ Providen Fund (EPF), National Pension System (NPS) and gratuity.

The basic pay, which is the core of the salary, comprises 40-50 per cent of the CTC, while allowances are typically a percentage of the basic pay or the CTC, says Abhishek Upadhyay, finance controller at nurture.farm, a farming technology solutions company.

Other components could include reimbursements for mobile phone expenses, Internet charges, books and periodicals, meal coupons, group mediclaim and personal accident coverage, among others.

The variables could include the individual’s performance-based or company’s performance-based bonuses, employee stock option plans (ESOPs), etc. These components are, typically, available to those in the higher salary brackets or leadership positions. Some start-ups also go for innovative structures. High-performing employees may prefer to have these components in their salaries.

With several IPOs entering the market, salary break-ups have changed to some extent. “Salary structures have changed with ESOPs, which help employees cash out on IPOs or buybacks,” says Sarbojit Mallick, co-founder of Instahyre, an AI-based HR consultancy firm.

The nature of the job can also make a huge difference. Says Nilabh Kapoor, chief operating officer (COO), Workforce Fulfillment & Enterprise Business BetterPlace, a technology-driven digital solutions company for blue-collar workforce management: “A good salary structure would constitute incentives on performance above and beyond the fixed pay. It might vary for a full-time, contractual, and gig job.”

What Works For Lower Income?

The package for lower-income slabs is heavily tilted towards government norms for minimum wages, and facilities such as Employees’ State Insurance (ESI). Also, gig workers can have incentives based on performance because “the work is based on short-term jobs demand and the performance quality has higher visibility”. For example, the salary could depend on the number of deliveries or sales an individual has achieved. “On average, the frontline employees today earn an additional variable pay of about 30-40 per cent on top of their fixed salary,” says Kapoor. Moreover, location and distance covered could be vital criteria for determining salary.

Sumit Sabharwal, CEO, TeamLease HRTech, a human resource firm, says that an ideal salary structure “balances components mandated by the government and those in the hands of employer to deliver the maximum benefits to the employee”.

Taxation may not be a big consideration at lower salary levels as income up to Rs 2.5 lakh is not taxable under the Income-tax Act, 1961, for individuals below 60 years of age. Moreover, taking into account the standard deduction of Rs 50,000 and tax rebate of Rs 12,500, an annual salary of up to Rs 5 lakh is not liable to tax.

“The new income tax regime may be more beneficial for lower income slabs, as it has lower rates, especially if one is unable to avail of tax deductions under various sections,” says Kavita Rani, a chartered accountant and one of the partners of Gupta Jalan and Associates, a Delhi-based chartered accountancy firm. Exemptions and deductions can be availed of under the old tax regime, but not the new tax regime.

What Works For Higher Income?

As income rises, benefits, such as PF and medical insurance, also increase. Sabharwal adds, “As we move higher on the ladder, the focus starts shifting toward tax savings, so the benefits and salary are adjusted accordingly. As a result, we see higher contributions to mediclaims, car lease policies, Sodexo cards, loans, and NPS, among others.”

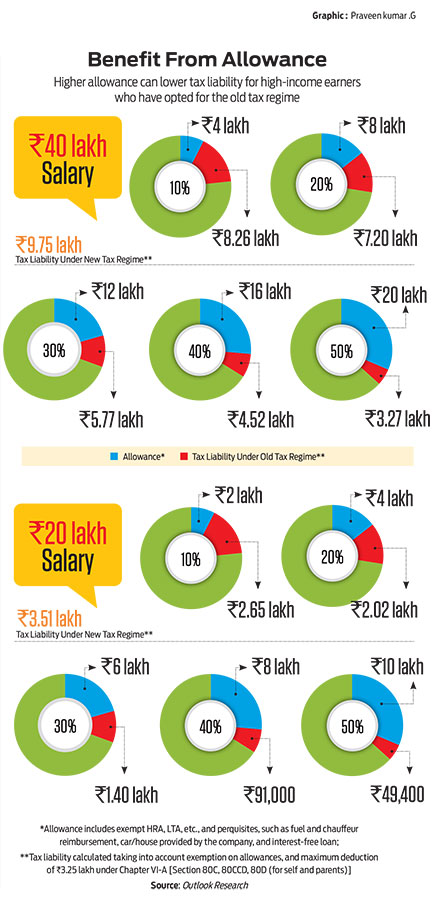

Nevertheless, those in higher salary brackets could also benefit from the old regime, as allowances and reimbursements provided for in the plan are exempt from tax. For instance, an employee can avail of tax exemptions up to 40-50 per cent of the HRA component of the basic salary under Section 10 (13A) of the I-T Act, 1961, under the old tax regime, and lower tax liability substantially (see Benefit From Allowance).

Similarly, under Section 17(2), perquisites can be provided to employees as part of the flexi benefit component. For instance, where an employee owns a motor car and uses it exclusively for official purposes. Likewise, they can avail LTA and other tax-free reimbursements.

Says Ravinder Goyal, co-founder of recruitment firm Erekrut: “The best way to save tax for a salary above Rs 15 lakh is to opt for the old tax regime. Tax-saving investments should be considered, as they not only save taxes, but also help in accumulating a corpus, which can be used to cover various life events later.”

Choose Suitable Tax Regime

This depends on the deductions and exemptions availed of.

Says Paladugu: “Tax liability will be lower if they don’t have exemptions/deductions to avail of and opt for the new tax regime. These considerations should be taken care of on a case-to-case and structure-to-structure basis.”

If you are confused about which tax regime is more beneficial for you, check with an expert.

Says Sabharwal, “Intuitive AI-based products can help employees choose the most appropriate regime.” Employees can even switch between the two regimes after a year.

Your salary structure can vary depending on many factors, such as tax benefits and seniority in the organisation. However, if you know and understand the various components of thew salary, you won’t be shocked by your in-hand salary. If you do not, you may end up miscalculating the benefit and feel cheated when you receive your pay in the end.

***

When Should You Negotiate?

When you opt for the old tax regime: Allowances may give you exemptions that would reduce your taxable income. The new tax regime doesn’t allow deductions and exemptions.

When you are a high-performing employee: You may opt for variable pay when you are confident of adding value to the company and expect to be rewarded for that, or your performance has greater visibility.

When your company’s prospects are good: Having ESOPs in your package may benefit you if the company or start-up performs well. You could also consider variable pay related to the company’s performance.

sanjeeb@outlookindia.com