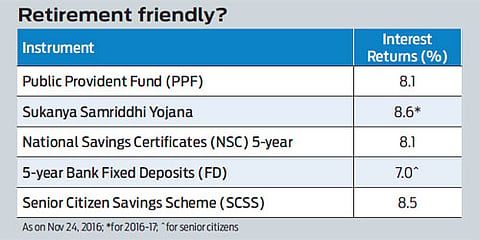

The surplus cash deposits have struck its first target--small savers and depositors. The State Bank of India has cut its deposit rates for different tenures by 1.25-1.9 per cent, effectively reducing the 5-year deposit to less than 7 per cent. The impact of the cut of 0.10 per cent in popular small savings instruments--PPF, Sukanya Samridhi Scheme and the Senior Citizens schemes--have brought their interest levels to about 8 per cent and lower in some cases like the Kisan Vikas Patra (KVP), which is 7.7 per cent at the moment.

A death knell for Small Savings

Demonetisation or not, there is very little to cheer for small savers

Not only are the options dwindling for small savings, the guarantees they provide when compared to the prevailing inflation rates, which is just a shade under 6 per cent, leaves very little to feel happy about. The pain is compounded in case of those who end up paying tax on the interest earned through some of these options. Imagine at 7 per cent interest on a bank fixed deposit, at 20 per cent tax bracket, the effective rate is 5.6 per cent, which, at best, may match inflation, eroding any real purchasing power that one expected after earning the interest.

Demonetisation or not, there is very little to cheer for small savers who will now have to necessarily look for tax efficient options to park their savings or start investing. For those who fear the risk of investing in equities, the writing on the wall is clear--the biggest risk they will be taking is in trying to not invest in equities, which has the potential to meet and beat inflation.