With the financial year drawing to a close, everybody is getting busy meeting the deadlines for submitting their tax declaration to their employer. If you are planning to invest in a tax-saving mutual fund, you could consider an equity-linked savings scheme (ELSS). That said, choosing the right one is important as ELSS come with a lock-in period of three years.

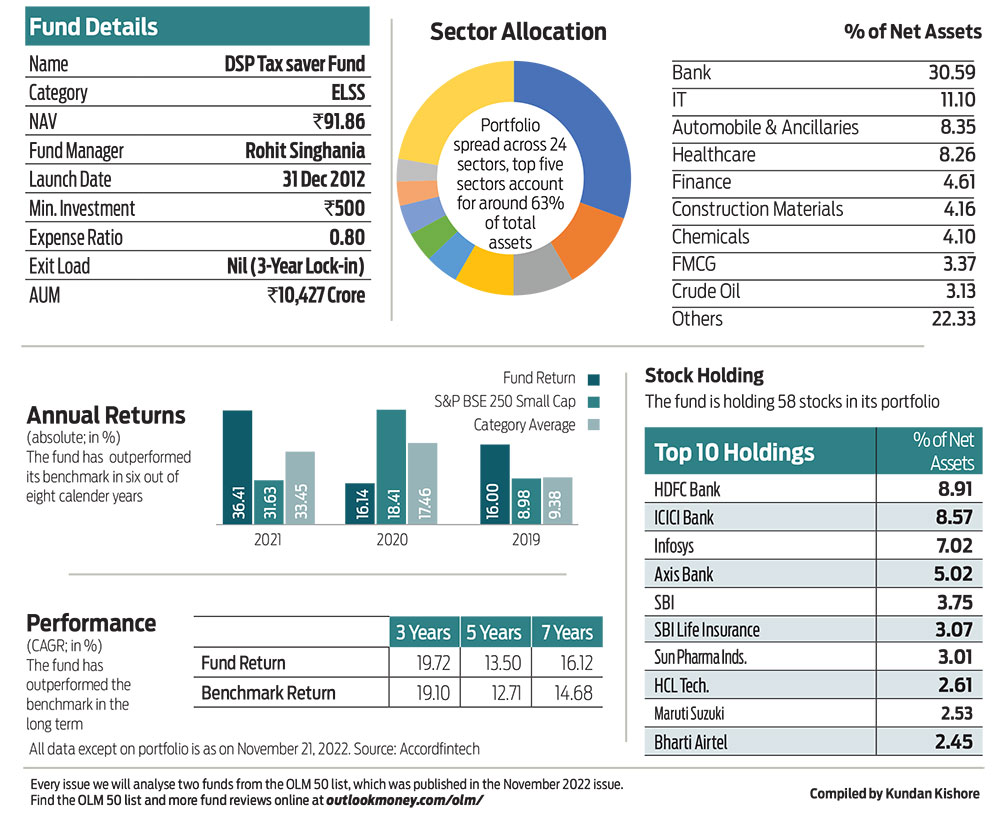

DSP Tax Saver is one of those ELSS funds that you could consider for your tax-saving and investment purpose.

Portfolio

It is well diversified with average 55-60 stocks across sectors and market caps, with the top five accounting for around 33 per cent of the portfolio. Currently, it has the highest exposure in the banking sector, around 30 per cent, as this sector is likely to do well in the future.

Performance

The fund invests across all sectors and market capitalisation. It takes a fair exposure in mid- and small-cap stocks if the fund manager finds the right opportunity to invest.

Being a flexi-cap fund, higher exposure in mid- and small-caps has led to the fund delivering superior returns in a bull run. This flexibility also allows it to switch to large-caps in a bearish market scenario, thus balancing out its returns.