No one likes reminders, but sometimes, it’s mandatory as well as customary. Every year at this time, all working professionals receive reminders from their accounting departments to submit their tax investment certificates for proper tax evaluation.

As the fiscal year draws to an end, many of you might be considering to invest in tax-saving instruments. If you are planning to invest in a tax-saving mutual fund, also known as equity-linked savings scheme (ELSS), but are not sure which fund to invest in, we have simplified the task for you.

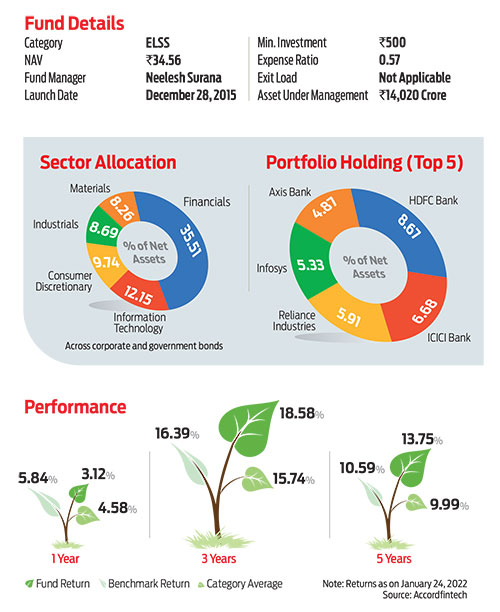

Mirae Asset Tax Saver Fund could be one of your options. The fund has impressed investors with good performance since its inception.

Portfolio

Mirae Asset Tax Saver follows a flexi-cap strategy and invests across sectors and market capitalisation.

The fund takes fair exposure in mid- and small-cap stocks if the fund manager finds the opportunity in that space, though it predominantly remains invested in large-cap stocks.

Being a flexi-cap fund, it gives the fund manager the opportunity to shift gears according to varied market conditions. The consistent performance of the fund clearly shows that fund manager Neelesh Surana, who has been at the helm since inception, has captured market opportunities well.

At present, the portfolio is tilted towards financials, auto, healthcare and consumer products, and is underweight on industrials on account of current valuation. The fund is holding 69 stocks in the portfolio, of which the top 10 account for around 45 per cent of the portfolio.

Performance

It has delivered consistent returns over the years. In terms of calendar year performance, it has outperformed its benchmark and peers in all years with decent margin, barring 2022. On a 7-year basis, it has delivered 20 per cent compounded annual growth rate (CAGR). To give you some perspective about returns, if you had started a systematic investment plan (SIP) of `5,000 at the time of its launch in 2015, its value would be `8.23 lakh now.

Given that Surana is still at the helm and is known for his stock picking ability, the fund may continue to deliver better returns in the future.

OLM Take

Though that may not be possible in this financial year, instead of investing a lump sum in ELSS at the last minute just for tax-saving purpose, it would be wise to start an SIP at the beginning of the FY. This will save you from the last-minute rush as well as help you ride the market volatility.

kundan@outlookindia.com