4th Edition - Bigger & Better Than Ever

India’s Biggest Financial &

Retirement Planning Expo India’s Biggest Financial & Retirement Planning Expo

February 20-21, 2026

Jio world CONVENTION Centre, BKC, Mumbai

February 20-21, 2026

Jio world Convention Centre, BKC, Mumbai

February 20-21, 2026

Jio world Convention Centre, BKC, Mumbai

February 20-21, 2026

Jio world Convention Centre, BKC, Mumbai

February 20-21, 2026

Jio world Convention Centre, BKC, Mumbai

February 20-21, 2026

Jio world Convention Centre, BKC, Mumbai

February 20-21, 2026

Jio world Convention Centre, BKC, Mumbai

February 20-21, 2026

Jio world Convention Centre, BKC, Mumbai

February 20-21, 2026

Jio world Convention Centre, BKC, Mumbai

40 After 40 expo begins in ...

About 40 After 40

After three successful editions that brought together 10,000+ professionals, experts, and industry leaders, the IDFC FIRST Bank presents Outlook Money 40 After 40, the Financial and Retirement Planning Expo 4th edition, is back in Mumbai in February 2026. And this time, it will be bigger, bolder, and more impactful than ever because we are also focusing on customisation.

Now a countrywide movement on Retirement Readiness, 40 After 40 is our initiative to spread the message that there’s a need to Retire Right. With longevity increases, you need to plan for a 20-30-year post- retirement phase holistically. Financial fitness, healthy ageing, emotional resilience and having a sense of purpose can help you live meaningfully.

who should attend?

The Beginner

If you want to explore about why you should start planning for retirement and how.

The Mid-Life Planner

If you are already on the road to retirement planning, but need nuanced strategies.

The Family Person

If you want to achieve all your family goals while simultaneously planning your retirement.

The Entrepreneur

If you’ve always dreamed of opening something of your own, but need guidance.

The Young At Heart

If you are retired, but are looking to make your life healthy, independent and meaningful.

The Legacy Builder

If you want to leave a legacy for the next generation, plan it with us.

why should you attend?

Key speakers

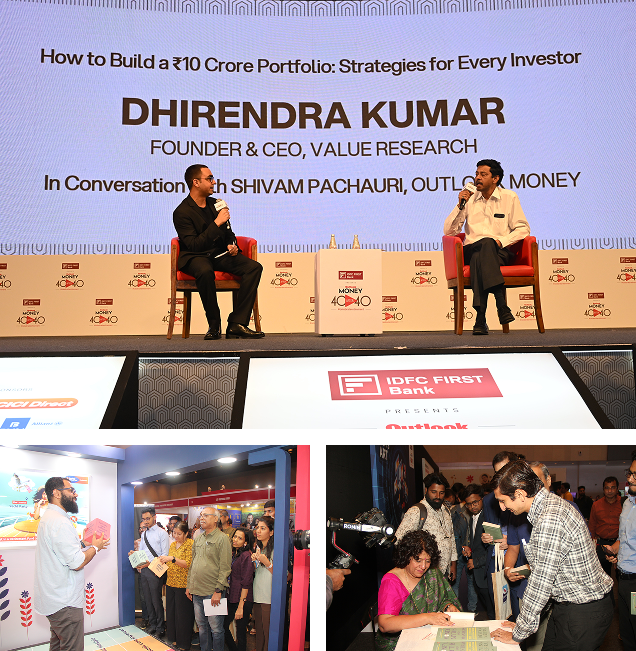

Highlights from past editions

Teaser | 40After40 | Coming Soon

Strategize & Secure Outlook Money’s Online Workshop

Gaur Gopal Das-Motivational Speaker, Life Coach and Author | 2nd edition of 40after40

Learn from Experts- Saurabh Chaturvedi- HDFC Pension| 2nd edition of 40after40

Puneet Sehgal - SBI Mutual Fund| 2nd edition of 40after40

- View More

Market Trends & Investor Psychology

Biases Control Your Investments More Than You Think

Health Insurers Won’t Deny Rightful Claims, Says Tapan Singhel Of Bajaj Allianz

- View More

Testimonials

I realised retirement is not about numbers — it’s about choices. Here, I found mine.

— Ananya, 52

I came with doubts, I left with a plan that gave me confidence.

— Ravi, 46

For the first time, retirement feels less like fear and more like freedom.

— Meera, 59

Choose Your Experience

Select the registration type that suits you best

gallery

Directories

Visit directories to find qualified professionals and best practices

platinum Sponsors

Pension Partner

Mutual Fund Partner

Gold sponsors

Associate Partner

exhibitors

Financial Wellbeing Partner

radio partner

ticketing partner