Mention equity investments and chances are most taxpayers will look the other way. No wonder when it comes to income tax, the focus is more towards savings than planning taxes efficiently, which leads to suboptimal usage of the available tax deductions. One of the biggest challenges that every taxpayer faces is to preserve the value of his money; basically ensure that it does not lose its worth, which is possible only if it beats inflation. The only known asset class that beats inflation in the long run is equity and it is for this reason that every taxpayer should make the most of the available tax deduction that can be deployed in suitable equity instruments.

The positioning of the equity linked savings scheme (ELSS) is unique within the universe of instruments in which one can save and invest to bring down the income tax liability. ELSS is also the most unique mutual fund scheme as it is open for investments to only individual taxpayers and HUFs (Hindu Undivided Families). This diversified equity fund is approved by the Central Board of Direct Taxes (CBDT) to qualify as a tax-saving instrument. So, investments in this fund qualify for tax exemption under Section 80C of the Income Tax Act, 1961.

The mutual fund structure ensures that these funds come with the dual advantage of capital appreciation and tax benefits. It also comes only in the growth option, so there are no complications of dividends and reinvestments when it comes to ELSS. What this means is that by investing in ELSS, you effectively hit two birds with one stone— you can claim deductions under Section 80C when investing in these schemes and you also get to experience the potential of equity investments through a mutual fund.

EQUITY EXPOSURE

Compared to other fixed-return options, ELSS is the only option with significant equity orientation as a tax saver. Though the National Pension System (NPS) and even Ulips have equity exposure, it is never as high as what ELSS tends to have. ELSS has a minimum exposure of 65 per cent to equities compared to the maximum exposure of 50 per cent allowed under the NPS and 40 per cent in retirement plans from mutual funds. If you look a bit deeper into the equity allocation of some of the ELSS, it goes as high as 80-85 per cent, or more. Yes, this does expose your investments to higher risk, however, the three-year lock-in when investing in these funds buffers the risk significantly.

Further, each tax planning fund is constructed differently, which means there is choice with varying degree of risk when investing in these schemes.

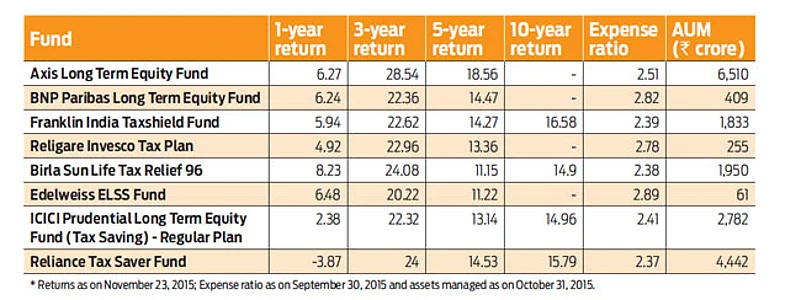

Keeping this in mind, the OLM Elite has a mix of ELSS that suit the risk profiles of different taxpayers. At present, there are 22 ELSS schemes to choose from, which collectively manage assets amounting to Rs.37, 290 crore, which is 12 per cent of the equity component of the told industry assets (as per Association of Mutual Funds of India). What this means for you as a taxpayer is that you can use the different benchmarks, portfolios and investment approaches to select a fund that allows you to meet your twin needs of tax saving and wealth creation.

INSIDE THE ELSS

Like other diversified equity schemes, equity linked saving schemes are also actively managed and have different characteristics, which aid in their performance. To arrive at a wide variety of ELSS that you can consider before investing between now and March 2016, we have hand-picked eight different schemes with varying risk profiles and investment approaches from the ELSS universe. All these schemes are well-diversified equity mutual funds with a proven track record and history, making them a suitable option for every investor looking to save tax and invest in equities.

For instance, Birla Sun Life Tax Relief 96 has more than 350 stocks available in its investment universe, which are selected based on rigorous and in-depth research. However, the fund’s portfolio has about 50 stocks in all, indicating the kind of filtering process that is undertaken to arrive at a portfolio. In contrast, Edelweiss ELSS Fund has about 65 stocks in its portfolio indicating the kind of diversification that different ELSS follow. Naturally, the investment approach adopted by each of the schemes is different, depending on the fund’s stated objective as well as the investment tactic followed by the AMC and the fund manager.

Says Jinesh Gopani, fund manager, Axis Long Term Equity: “Axis Long Term Equity is a multi-cap fund with an endeavour to have at least 50 per cent in large-caps and the rest in mid- and small-caps.” The fund invests in fundamentally sound companies while being agnostic of its benchmark constituents. In contrast, BNP Paribas Long Term Equity Fund is overweight on private sector banks, telecom and healthcare, and underweight on IT, industrial capex, metals, and energy sector.

“The investment universe of the fund comprises about 220 stocks, which are selected based on the BMV (business, management, valuations) philosophy of investing. The stocks with good business in terms of strong moat, growth and catalyst are selected. Evaluation of management is mainly by way of its aspiration to grow and corporate governance,” says Shreyash Devalkar, fund manager-equities, BNP Paribas AMC.

What this means is that the commonality across ELSS is the tax benefits they offer and not the approach they adopt to investing. It is for this reason that performance of ELSS varies, just the way it does for other diversified equity funds. Explains Mahesh Patil, co-chief investment officer, Birla Sun Life AMC: “BSL Tax Relief 96 is a well-diversified fund with a portfolio made up of around 50 stocks across 18 sectors. The fund strives to maintain its ‘high quality’ by investing in stocks that have superior return ratios and a strong balance sheet.”

According to Vetri Subramaniam, chief investment officer, Religare Invesco Mutual Fund “The investment universe of Religare Invesco Tax Plan consists of unique names in the BSE 200 Index, the CNX MidCap Index, and three sector indices along with select bottom-up stock ideas. The total universe of stocks for the fund as on September 30, 2015, was 293 stocks, which is the same as that of the fund house.”

For retail investors, the lesson when investing in ELSS is to understand that these schemes have high-quality portfolios, which work towards superior risk-adjusted and consistent returns over a medium to longterm horizon, something that is in-line with investor expectations. What’s more, you can invest regularly through SIPs or even by way of lump sum investments, and hence plan over the entire year when to deploy money towards tax savings.

SUITABILITY

Overall, the performance of ELSS funds is less volatile. Says Kartik Soral, equity fund manager, Edelweiss AMC: “ELSS are suitable for investors looking to invest in equities for a minimum period of three years and also looking to claim tax benefits under Section 80C of the Income Tax Act.” The lock-in in ELSS funds enforces a disciplined approach to investing and gives fund managers the freedom to explore better investment opportunities.

“The three-year lock-in period gives us the leeway to invest in good companies without worrying about redemptions and instead concentrate on building a good portfolio. Companies take time to grow and expand their business, which, in turn, would reflect in its finances. So, when investing in these stocks, a lot of patience and discipline is required to see the company perform, increase its profits and thereby add to shareholder returns,” explains George Joseph, fund manager, ICICI Prudential AMC, on why the three year lock-in not only helps the taxpayer but also fund managers to make the most of the investments in these schemes.

There is definitely a lot going for these schemes for every taxpayer to consider investing in them. In fact, if you do not have any investment in mutual

funds, ELSS is one category where you can start investing, to begin with. It has all the necessary ingredients of that you need in your first fund—it is well-diversified, has a three year lock-in to reign in your anxiety, and comes with tax savings on your investments. For this reason alone, one should consider investing in ELSS because, in the long run, equity is the only asset class that has the potential to beat inflation and build wealth. This fact has been proved by numerous studies. With benefits of capital appreciation and tax benefits, these types of funds can be used by you to align your investment plans with your taxes.

For a better retirement

The tax saving option from mutual funds is not restricted to the popular ELSS; there is also a retirement plan offered by a few asset management companies (AMCs). Under these schemes, investors invest for a very long term as early withdrawal by way of redemption is discouraged before one retires, with the standard retirement age taken as 58 years.

Investment in retirement plans qualifies for tax deduction under Section 80C. The schemes have been approved by the CBDT, according to which the scheme can have an investment exposure of 40 per cent in equities and the rest in debt. Although the equity exposure may not seem to be high for long-term investors, for the very long term, even this level of equity allocation over different market cycles should help in creating a sizeable retirement corpus.

These funds work in two parts—first is the accumulation phase when one can invest in these towards building a retirement corpus and also get tax benefits, and the second when the corpus can be utilised as payout in retirement. The payout phase can be in lump sum or work as a regular payout by way of a systematic withdrawal option.

These plans were introduced two decades ago, with UTI Retirement Benefit Pension and Franklin India Pension Fund being the only two funds in vogue till, in early 2015, Reliance AMC introduced a retirement plan, with several other AMCs planning to launch similar schemes. While they have less equity exposure as compared to ELSS funds, these schemes have the built-in discipline to ensure that you save towards your retirement with tax savings and also build a sizeable corpus.