Top Picks

The new life cycle funds are special. They are for long-term goals like buying a house or retirement. The fund slowly changes from more stocks in the early years to safer bonds near the end

Shree Ram Twistex IPO GMP: The basis of allotment is likely to be finalised on February 26, 2026. Here are the latest subscription figures, grey market premium (GMP) trends, and other key details of the Rs 110-crore public issue.

POPULAR

Calculate & Plan your future with ICICI Prudential Life's retirement calculator

Yield to maturity is a key metric used by bond investors. Learn how important it is and what the calculation is to arrive at it

The regulator is understood to be looking at whether commission structures can evolve so that they reward ongoing policy servicing and customer retention rather than concentrating payouts heavily at the initial sale stage

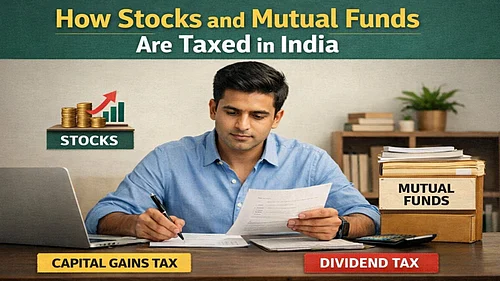

The redemption component, for original individual subscribers holding to maturity, is statutorily excluded from the ambit of “transfer” and therefore escapes capital gains taxation in entirety, even where the appreciation constitutes the overwhelming bulk of the return

Editor’s Note: Reinvention Is A Necessity, Not A Choice

Any plunge you take needs to be well-planned because the middle-class can often not afford to take the risk of leaving a regular income stream

Founders’ Full Circle: From Entry To Exit

While it’s simpler to open a new business or a small venture in India, the shutdown process can be a nightmare. Simplifying the exit process is crucial to give an opportunity to failed founders to learn from their mistakes and try again. We give you a lowdown on how to open a start-up and how to close one should you lose interest or are unable to sustain it.

What Budget 2026 Means For You

The FM made small tweaks to ease the lives of the common people, but income tax slabs, deductions and other tax benefits remain the same. Here’s how the changes will affect investors, taxpayers, consumers and seniors

Budget 2026: Simplifying Tax Law

Coupled with the implementation of the Income-tax Act, 2025, the proposals announced in Union Budget 2026 are expected to simplify tax laws and enhance overall ease of compliance by overcoming practical challenges

How Budget Touches Your Life

As the country’s GDP grows, the size of the Union Budget grows as well. This time, the Budget announced no big-bang measures, like the previous Budget. Instead, Budget 2026 touches you subtly through small measures and a thrust on long term

'Ideal Retirement' Lasts Only A Couple Of Years, Says Riley Moynes

Retirement is not just about cavorting on the beach with a glass of wine, but also about coming to terms with loss and trauma, and re-picking yourself to find a purpose. Riley Moynes, TED speaker, podcaster and author, discusses the challenges retirees face and how they can overcome them, in an interview with Nidhi Sinha, Editor, Outlook Money

SIP Vs SIP + Buying Market Dips: A Reality Check

It’s common to assume that buying during market dips can enhance returns. We ran numbers to see what happens if you invest in a plain SIP and compared it with scenarios when you topped up during market dips. The results will shock you

Nippon India Large Cap Fund: Consistent Across Market Cycles

An analysis of Nippon Indian Large Cap Fund

Why Many Health Insurance Top-Ups Don’t Pay When Claims Pile Up

Base policies are proving to be inadequate because of rising medical costs and premiums. To ensure a large coverage at affordable rates, they need to be combined with a super top-up insurance that takes care of rising family claims

Retirement Is Not About Slowing Down

At 63, Murli Sundrani doesn’t come across as the typical retired gentleman. He treks, goes on world tours, is pursuing multiple courses, and is financially savvy, too

Here’s How To Withdraw Your NPS Funds

A step-by-step guide to withdraw funds from NPS account

Don’t Compare, Look Within

The issue is not that we consume more than our grandparents did, the issue is when we link our identity and self-worth to our lifestyle

SIP Returns Beat Bank FDs’ Over Long Term

SIP Returns Beat Bank FDs’ Over Long Term

Invest 5-10% In Silver Through SIPs For Portfolio Diversification

Invest 5-10% In Silver Through SIPs For Portfolio Diversification

What Is Base Expense Ratio?

The Securities and Exchange Board of India (Sebi) has changed how mutual fund expenses are disclosed by introducing the base expense ratio (BER). Previously, investors kept a track of their mutual fund expenses through the total expense ratio (TER), which combined fund management fees with taxes and statutory charges, such as goods and services tax (GST) and securities transactions tax (STT). This made it difficult for investors to see what fund houses actually charged. In contrast, BER includes only the core expenses of running a mutual fund scheme, and statutory charges are disclosed separately.

SIP For Short-Term Goals Without Compromising Long-Term Dreams

SIPs are most often spoken of in the language of patience. They are associated with retirement, children’s education, and other goals that sit comfortably a decade or two away.

India’s Evolving Equity Markets And The Design Of Flexi Cap Funds

India’s market leadership rotates between large, mid and small caps, and flexi cap funds are built to rotate with it.

Thematic Investing Without The Hype

How to turn trends into portfolios using discipline valuation checks and sensible sizing for investors

Flexicaps Reduce The Cost Of Being Wrong

In uncertain macro periods, they can lean defensive without abandoning equities when conditions improve later

Business Cycle Funds Try To Time Regimes Not Stocks

Business cycle mutual funds aim to navigate volatility by changing exposures as macro conditions evolve

Previous Magazine Issue

From “Powerplay Overs” to the Follow-on Phase, IDFC FIRST Bank outlines a relatable, cricket-inspired roadmap to building a resilient retirement corpus