Top Picks

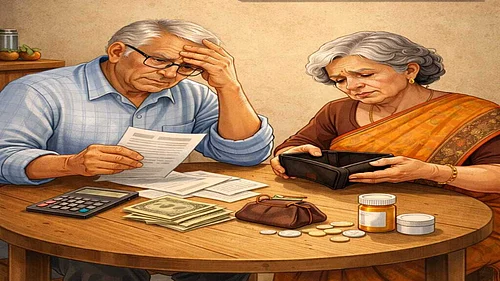

Retirement isn’t a problem you solve in your fifties. The best time to start was your first job. The second-best time is today.

Stock Market Today: Equity markets started lower as trade resumed on Monday after Iran strikes over the weekend

Revolving credit allows borrowers to access funds repeatedly within a preset limit, paying interest only on the amount used. Here are the different types of revolving line of credit and how to choose between them

The EPS-95 pensioners are set to start a 3-day protest demanding a raise in minimum pension from Rs 1,000 to Rs 7,500 per month. According to the National Agitation Committee, the pension is grossly inadequate for pensioners to sustain themselves

The Rajasthan High Court orders an audit of the 31 old age homes running in the state to ensure proper implementation of the Senior Citizens Act provisions and a safe and dignified life for the elderly