Someone rightly said that the circumstances or characteristics of your life influence your financial concerns and plans. What you want and need depends on how you live and how you would like to live in the future. While everyone is different, there are common circumstances of life that influence personal financial concerns and thus affect everyone’s financial planning. However difficult it may appear, managing family finance is not an impossible task as long as you educate yourself and focus on your individual goal. Factors that affect personal financial concerns are family structure, health, career choices, and age.

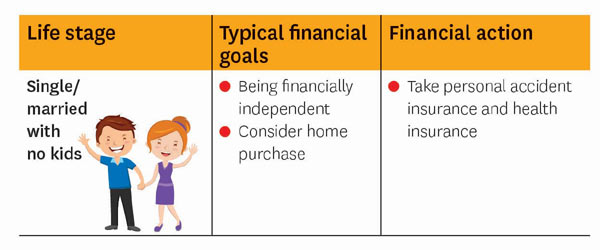

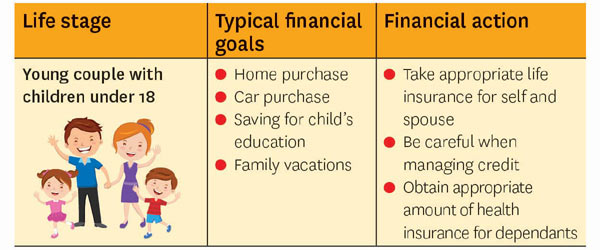

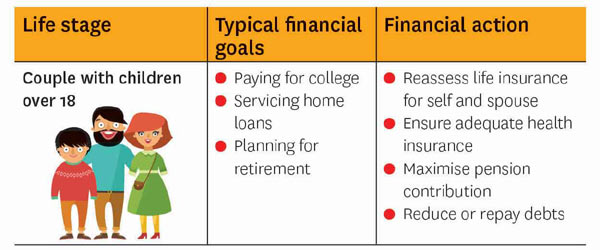

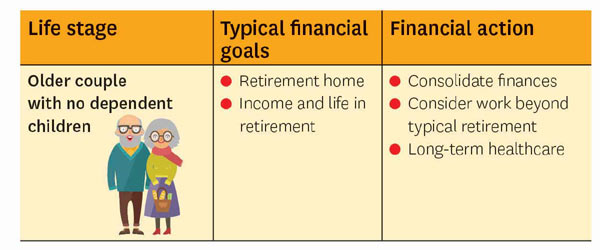

Then you go through different stages in life—single, married, life with dependents, such as children or parents, which determines whether you are planning only for yourself or for others as well (See: Life situations and personal finances). If you have a spouse or dependents, you have a financial responsibility towards someone else, and that includes a responsibility to include them in your financial thinking. You may expect the dependence of a family member to end at some point, as with children or elderly parents, or you may have lifelong responsibilities for some other person.

Each stage of life is different and requires a unique plan of action. See where you fall in and get going

The basics

Having a family finance budget is a good tool to start with, which makes your household budget actionable in a more meaningful way. As you evaluate your personal financial situation, there are several things you can do that will allow you to take control of your financial fitness. The family budget will help you develop a roadmap for financial well-being. It serves as a useful tool and guide which tells you whether you are headed in the proper direction to achieve your financial goals. Says Vikaas Sachdeva, CEO, Edelweiss AMC: “A simple family budget will keep a track of expenses so that you do not overshoot it. The surplus that you are left with after meeting your essential expenses will help you plan for your financial goals.”

It indeed helps to move from spending to saving and managing your cash flows efficiently. The impact of the same is high, especially when you are servicing debts like a home loan and are in the midst of balancing several other expenses like utility bills, school and college costs, groceries and EMIs of your car. In fact, there’s so much to think about that it may be hard to determine where to start in the absence of a budget.

It is equally important that you have an emergency fund in place. Imagine a situation when you are unwell and lose out on income because of sickness? Likewise, an unexpected expense owing to a major repair at home or getting your car fixed can put you off financially. A safe bet is to stash away 3-6 months’ equivalent household expense and use it only for emergencies.

“We are four generations living under the same roof and are in different stages of life to learn from each other on managing our financial goals,” says Faridabad-based Vicky Tickoo. The Tickoo household has 40-year-old Vicky and his wife Sonia (40), their two children— Akshit (11) and Ishita (8), his 66-year-old mother Vimla, father Vijay, 69, and matriarch Rupa who is 86.

Goal setting

It is amazing how the family across generations has managed to not only achieve their financial goals but have also done so comfortably and smartly. It may not be easy at times. But, no pain, no gain. Keep in mind that shortterm changes can have long-term effects. “I have always believed in following the simple rule of spending less than what you earn,” says Vijay Tickoo. This is a lesson, which the younger generation is finding immensely useful.

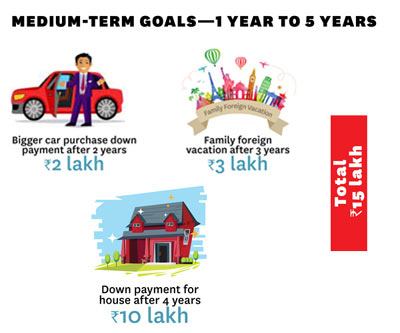

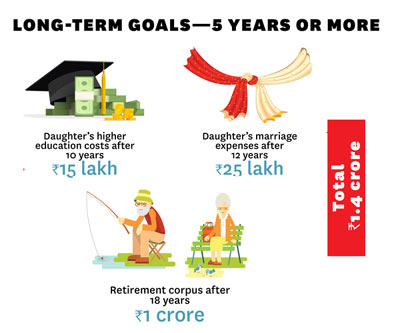

The other fact that will help you is to draw up a list of financial goals that you have and write them. By doing so you ensure that you have a clear timeline and sum assigned to it. “Our annual goal is to set aside Rs 2 lakh towards children’s education and Rs 1 lakh for short family vacations each year,” states Vicky. He has achieved some goals and is in the process of achieving some others; he is pretty clued into what goes into making a plan work. Yet, Vicky is conservative when it comes to the way he invests. “I am more into debt securities like RD and FD, beside the PF contribution and money in PPF,” he recounts.

However, his retired father is a relatively higher risk taker, who dabbles in shares and trades often. “Interest in trading started post retirement primarily to kill time but after a while I figured I was able to get the act right,” Vijay quips. The stark contrast in risk profile between the two is due to their respective perception to risks. While Vicky comes across as a conservative investor who does not want to risk losing any or substantial portion of his principal, his father is a moderate risk taker who ensures his asset value is protected while marginally increasing the value of his portfolio.

In contrast, an aggressive investor is someone who is willing to take calculated risks with the expectation of achieving higher than average returns. You can ascertain your risk profile by undertaking risk analysis tests, which will also help you invest in instruments that are suitable to your temperament. There is another way to assess risk profile—even if you are a low risk taker, circumstances may force you to take higher risk with your investments. The role of a financial advisor comes in handy, who can guide you to park your money into instruments which will achieve the goals within your risk limits.

The reason to let someone help you ascertain your risk profile is necessary, just the way visiting a doctor is to get yourself treated. As your goals and priorities change over time, you may find that you need to modify your approach to investing. It is important to understand the key financial principles—risk and reward, the time value of money, diversification, volatility and other essential concepts—all that are the foundation of a sound investment strategy.

Solutions for all

Like many Indian families, the Tickoos also have a penchant for putting money into real estate. They have recently added a floor to their house to earn rental income from it. At the same time, Vicky has two other homes, which were bought as investments. “One of the flats is in Gurgaon and the other one is in Mohali, for which I have taken possession. I am hoping to spend my retirement in Mohali,” says Vicky.

Do not mistake financial planning to be about only investments; it also entails insurance, taxes and aspects of estate planning, especially if you have people across generations involved. A good start is to get the life insurance needs fixed first to take care of your financial dependents. In the same vein, get your act right by taking adequate health insurance for all family members. The healthrelated risks you are exposed to these days can put you in a state which can impact your future income flows and jeopardise all your future financial goals.

One of the things, which may start late is planning for retirement. Says Sudipto Roy, managing director, Principal Retirement Advisors: “Instead of following the idea of saving after fulfilling all your essential and discretionary expenses, the ideal way is to set aside a certain sum of total income and decide other expenses with the left surplus.” He believes this is the approach needed to save towards retirement and that one must start this at the earliest.

The trick for familial well-being is to lay out financial goals collectively and then work towards it. Time and again it has been proven and demonstrated that those who are disciplined, systematic and regular with their savings and investments, are those who can attain their financial goals. We have the Tickoo’s example to look up to and achieve our financial goals and do so happily and in good time.

This article first appeared in Outlook Magazine, dated May 23, 2016