One of the biggest outcomes of demonetisation was the respect for currency notes among one and all. Many started keeping less cash and depositing currency of all denominations to the bank. Several people wrote to us about banks not accepting soiled and torn notes, which made us explore the truth behind the move. Stapling of currency notes was a reason for currency notes to develop tear, something that The Reserve Bank of India (RBI) started discouraging with a the de-stapling process in 1996 in order to minimise damage to currency notes.

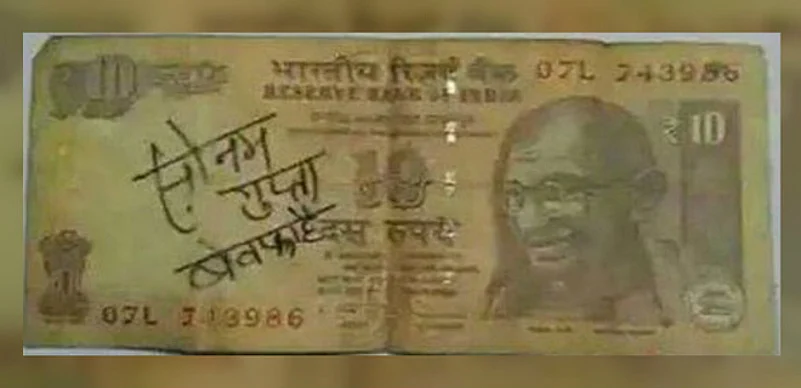

However, it was not until 2002 when the RBI issued the directive against stapling, making it mandatory for banks to discontinue the practice of stapling currency note packets, under Section 35A of the Banking Regulation Act, 1949 with the objective of giving clean and good notes to the public. But, people do staple currency notes and many even write on them. The popularity of Sonam Gupta was palpable last year with her jilted lover writing on a Rs 10 note that she is ‘bewafa’ (unfaithful). The image went viral and started several debates about not just the character of the girl, but also the validity of scribbled currency notes.

Total acceptance: The RBI has time and again clarified that it has in no way stopped the acceptance of soiled or torn currency notes. The exception is only in case of notes with political slogans written on them. However, the RBI has been urging people to not deface currency notes by writing on them or scribbling. Several financial institutions and even traders using high volume currency notes prefer to write with a pencil on the notes to track the number of notes so that they can erase the same once the need is fulfilled.

Fines and penalties: In a 2016 circular by the RBI, it is clearly mentioned that if a bank branch refuses to exchange soiled notes from any member of the public, the bank will have to pay a penalty of Rs 10,000. Like always, there are a few rules that one needs to follow – if you exchange more than 20 notes, or notes worth Rs 5,000 per day that are torn or soiled, the banks may levy a service charge or fee linked to the denomination being exchanged.

Mutilated notes: According to the RBI, currency notes which are in pieces and/or of which the essential portions are missing can also be exchanged. Essential portions in a currency note are name of issuing authority, guarantee, promise clause, signature, Ashoka Pillar emblem/portrait of Mahatma Gandhi, water mark. Refund value of these notes is, however, paid as per RBI (Note Refund) Rules. These can also be exchanged at the counters of any public sector bank branch, any currency chest branch of a private sector bank or any Issue Office of the RBI without filling any form.