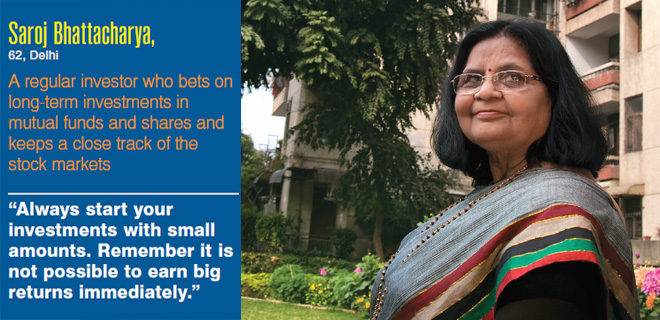

At 62, Delhi-based Saroj Bhattacharya can put a lot of youngsters to shame—she is a serious investor. A mechanical engineer by qualification, she worked for about 25 years in some of the biggest Indian steel companies before calling it quits. "I left that job about a decade ago, when my kids were appearing for their board exams," she says. With investing being her passion, she was able to use her time fruitfully by putting her money to work.

It also allowed her to achieve her financial goals. "I have been able to buy my own house and provide good education to my children, both of whom are established now," says Bhattacharya. Incidentally, she is also the secretary of the building complex where she stays and is in charge of its finances.

Bhattacharya is an example of a growing tribe of women who are into managing their own money. Undoubtedly, there has been a significant shift in this in the last decade or so as far as women and money management is concerned. Women are now increasingly taking charge of their finances.

At 62, Delhi-based Saroj Bhattacharya can put a lot of youngsters to shame—she is a serious investor. A mechanical engineer by qualification,

she worked for about 25 years in some of the biggest Indian steel companies before calling it quits. "I left that job about a decade ago, when my kids were appearing for their board exams," she says. With investing being her passion, she was able to use her time fruitfully by putting her money to work. It also allowed her to achieve her financial goals. "I have been able to buy my own house and

provide good education to my children, both of whom are established now," says Bhattacharya. Incidentally, she is also the secretary of the building complex where she stays and is in charge of its finances. Bhattacharya is an example of a growing tribe of women who are into managing their own money. Undoubtedly, there has been a significant shift in this in the last decade or so as far as women and money management is concerned. Women are now increasingly taking charge of their finances.

Changing trends

Take the case of Mumbai-based Nikita Derasaria, 25, who is working as a research associate in the valuation department of an Indian research firm and in her first job. "I look to save 30-40 per cent of my salary every month into different avenues such as savings account, mutual funds and equity markets. This helps me maintain liquidity as well as diversify my total risk exposure," she says. One of the main reasons for more women taking charge of their finances is the fact that more women are pursuing a career and earning money. With more women entering the workforce, they are automatically looking to be in control of their money. The shift is not only in the case of older women, even fresh executives in their first job are aware that they need to be involved in managing their money for maximum gains.

This view is echoed by Tejal Gandhi, CEO and founder of Mumbai-based Money Matters, "Today, lots of women are opting to stay single or are divorced, which by default makes them have to seek control of their finances. Even, homemakers want to know their rights and, hence, would like to know what the different investment options are."

Doing it her way

Even in instances where husband and wife both have well-paying jobs, women are taking equal responsibility in family finances, whether it be expenses, vacations or paying EMIs. Kolkata-based Priyanka Dhar, 30, and her husband were planning to buy a hatchback and saving from their salary for its down payment. They finally decided on a Volkswagen Polo and went in for a 5-year loan.

It is a gift from Priyanka to her husband; she will pay the EMIs and other car-related expenses. "The monthly EMI will start from this month and a good chunk of my salary will go in it. Hence, I have decided to curtail my other regular expenses, like shopping and dining out, to the minimal," she says.

"More women earning also means they are taking a lot of additional financial decisions like buying a house or a car and other lifestyle decisions such as joining a spa, having a personal trainer for exercises, dietician, beauty consultant and club memberships, all of which comes at a price," says Gandhi.

And, with the disparity in tax rates between men and women no more existent, women find it more compelling and necessary to handle their money on their own. With increasing awareness among working women on the need to invest wisely, most are not just managing their money but doing so with aplomb.

Another significant change that has come about, says Sapna Narang, managing partner of Gurgaon-based Capital League, is that even mainstream media now features a lot of discussion on women and money. A lot is being written and talked about in offline and online women forums and in personal finance magazines like Outlook Money. These conversations push women in a direction where the message is clear—that women should make more efforts to control and manage their money.

Says Bhattacharya, "I always keep track on what is happening in the stock market through newspapers, business channels and magazines." When it comes to savings and investments, the basic rules of the game remain the same for both men and women.

We take a look at the some of the investing mantras to help you take charge, now.

Start early: Often one tends to spend all their income in the early years of their working life, thinking that they will start investing at a later stage. It is important to save a portion of your salary, even if it is a very small amount, and harness the power of compounding. "Luckily for me, I started my career with a bank. So, the habit of savings involved transfering surplus money to a fixed deposit. After 5-6 years, I could see how small amounts had compounded to a big amount by just letting it lie there. So, starting early has helped me in a big way," says Gandhi.

Cover your bases: The first step to saving and investing is to ensure that you are covered for your risks. Having a contingency fund to cover at least 3 months of your expenses is a must, so is adequate health cover. For the working woman with dependants, a pure term insurance is crucial. Deepa Jayaraman, general manager, Hill+Knowlton and a single mother, has bought life and health cover for herself and child insurance for her son.

bWomen love to shop but one needs to control excessive impulsive spending. To keep your expenses under check, make a budget and follow the ‘save first, spend later’ rule. Derasaria makes it a point to plan her monthly expenses at the start of every month. She allocates a portion of her salary into regular monthly expenses and investments. "Having set aside a pool for my monthly expenses and sticking to it means that I can invest the remaining cash," she says.

Make your money work: Do not let money lie idle in savings accounts that earn a very low rate of interest. You need to make your money sweat harder by channelising it into avenues that give you a higher return.

Take more risks: Women, being concerned more about the safety of their money, tend to park it in safe instruments like fixed deposits. FDs promise guaranteed returns but, while doing so, they fail to beat the inflation that eats into the returns. The way to tame the inflation monster is to invest in instruments, which can give you higher returns, though they come with a higher level of risk. For beginners, investing in mutual funds is the way to go, while later one might invest directly into equities. "Having had long illnesses in the family made me realise the power of long-term equity, which we inherited by way of shares from my grandfather, as health insurance does not cover all medical costs," says Gandhi.

Horses for the courses: It helps to be aware of your goals, as it means that you can choose your investments and time horizon accordingly. While short-term goals can be met through putting your money in FDs and debt funds, you should look to make equity investments either through the mutual fund or the direct route for long-term goals. The period of investment that Derasaria looks for is governed by her financial goals, there are short-term goals-an academic course she wants to take up or a trip that she has planned. The core investments in her portfolio are held for long term, for up to five years.

Do your own research: Many women tend to blindly depend on male members of the family, like their father or brother, for their saving and investment decisions. One needs to draw from experience of others, but it is wise to do your own research and make your own decisions. "Over time, I have started taking my own decisions when it comes to dealing with money. However, I always take advice from my family and close friends on my financial decisions, as it helps me draw from their personal experiences and learn something new every time," says Derasaria.

Just for her: What does this mean for the financial services industry? It means the financial sector should treat their communication in a way that women can associate better with it. Many banks and companies are offering more women-oriented products, giving the working women more choices. Hence, you see women-only savings accounts with offers like zero-balance minor accounts and jewellery insurance, credit cards with special discounts on salon and spa services and also rewards on shopping.