This fund is not for the faint hearted and seeks investors to have some risk appetite, considering its multi-cap approach to investing. Tata India Tax Savings Scheme, known as Tata Long-term Equity fund until December 2015, is one such fund that has delivered on many of these parameters. The fund’s performance was not good between 2008 and 2010 when it barely managed to beat the benchmark, but since then it has made amends and has fared well.

The fund manager follows a bottom-up approach to stock-picking, and the fund focuses primarily on companies with high growth potential and capital efficiency, while not losing sight of opportunities thrown up by company, industry or market-specific developments. “This focus on quality companies and select tactical bets has helped the fund perform across market cycles,” says Rupesh Patel, Fund Manager, Tata Mutual Fund, who describes the scheme as a market-cap and sector-agnostic, yet diversified, fund that predominantly invests in companies which have compounding characteristics and significant potential to grow over a period of time and have.

“The fund avoids taking large single stock exposures. The objective is to deliver superior risk adjusted returns to the investors over a longer period of time,” he adds. Large-cap stocks account for close to 55 per cent of its portfolio, the balance being allocated towards mid- and small-caps. ICICI Bank, HDFC Bank, ITC, Tata Motors, and YES Bank make up its top five holdings.

Returns Record

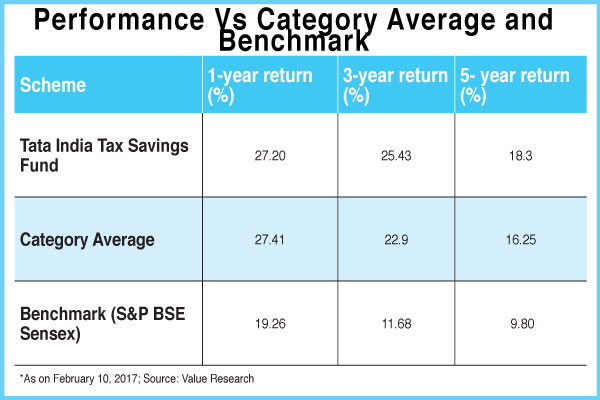

The fund has beaten its benchmark over one-, three- and five-year periods (see table) and has also outperformed its peers in the three- and five-year periods. Its more recent performance, however, has been marginally dull compared to that of its peers, though it has outperformed them intermittently.

On the risk meter, it is rated as a ‘moderately high’ risk scheme. Given its significant exposure to small and mid-cap stocks of around 45% and long-term performance track record, it is best suited for those with a higher risk appetite and long-term investment horizon.