Data can be interesting and tell a story which many may not otherwise visualise. Going by the most recent RBI report on 14 March 2017, the demons of demonetisation it seems are mostly unfounded. Portraying a distinct change in consumer spending habits, the RBI's report revealed that transactions through the Unified Payments Interface (UPI) has been on the rise and looks like it has benefited from the demonetisation drive. Both in volume and value terms, this payment route has found more takers.

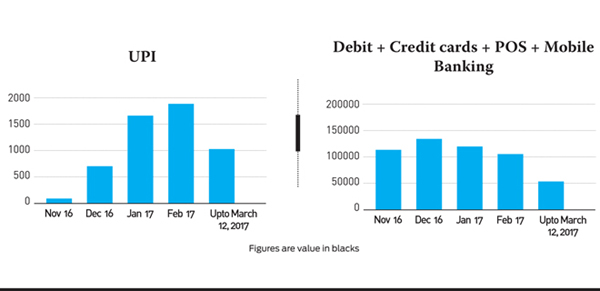

The data, which is updated till 12 March, 2017, indicates a northward movement of UPI transactions. According to the data, the new-age payment has amounted to Rs 1020 crore in value through 24 million lakh transactions in the first 12 days of March compared to 42 lakh transactions amounting to Rs 1900 crore in February.

The ease of payment associated with UPI is triggering consumers to opt for the same it seems. For those joining in late, UPI is a system that enables multiple bank accounts into a single mobile application of any participating bank merging several banking features without the need to feed in credit card details, IFSC code, or net banking/wallet passwords. It allows the transfer of funds between any two banks both online and offline.

UPI payments have seen a surge right after demonetisation. The value of UPI payments rose by 677.78 per cent in December 2016 in comparison with the previous month. The number of transactions shot up to 20 lakh in December in comparison to 3 lakh in November 2016. The trend has followed since with January recording 42 lakh transactions amounting to Rs 1660 crore.

Value in Rs Crore, UPI- Unified Payments Interface, POI- Point of Sale

"We have observed over the years that tax revenue is generally the highest in the month of March which could be one of the reasons why UPI payments have gone up. Consumer behaviors are witnessing changes for sure," said D.K.Srivastava, chief policy advisor, EY.

The National Payments Corporation of India (NPCI), the nodal agency for UPI, had conducted a pilot launch with 21 member banks on 11 April 2016 after which banks started uploading their UPI apps from 25 August 2016. In another interesting development, RBI's data reveals that transactions through debit/credit cards and point of sale machines have witnessed a fall and so have the overall e-transactions in the country. The concern over people falling back on cash, now that the restrictions on withdrawals have been lifted is coming true. "As cash flow increases, e-payments are going to slow down and obtain a more or less stagnant figure," added Srivastava. So, is the increased usage of UPI a short time joy or a long time shift? We will have to wait and watch.