The financial year ended with a rather cruel joke on scores of savers who hold their money dearly into small savings instruments. Many people thought of the news announcement as pure statistics detailing how the cut was just 10 basis points or 0.1 per cent. Some went to explain that 100 basis points is equal to one per cent. In case of the most talked of financial instruments – PPF, the cut meant on a full Rs 1.5 lakh savings in a financial year, the loss in earnings on the deposit was a mere Rs 150 in a year.

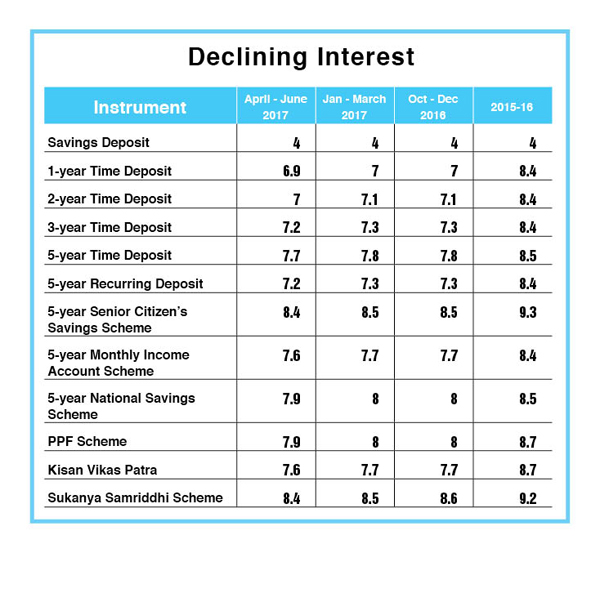

Just two years ago, 2015-16, the guaranteed interest in case of the PPF was 8.7 per cent, which is now 7.9 per cent. In case of a long-term savings instrument like the PPF, in which one plan and then puts in the money – the falling rates could be traumatic. It is easy to laugh off the Rs 150 loss in a year, which balloons into several thousands of rupees over the 15-year tenure of this instrument. It is the same argument that those professing equity investments should consider with a twist.

For years, proponents of mutual funds who despise Ulips, which are insurance cum investment products, would shout from rooftops over how even a 100 basis point going towards investment charges in case of Ulips is wealth erosion compared to investments in mutual funds. The argument is not about which is better – it is about how you handle a situation where the predictable outcome loses the predictability. Savers save because they feel reassured of what they are going to get at the end of the tenure of the instrument of their choice. So, in case of a 5-year FD, they know how much their deposit will gain in value and that is what attracts them to the deposit.

Shun small savings?

If you are a saver and tax saver, you will continue to have your money in small savings till they mature. If you have got into any of these instruments in the past 2-4 years, you should consider staying through their tenure. However, if you have been into them for just the past couple of years, it would not be a bad idea to cut your losses and exit. But, is there a similar safe option? The answer is no. Yet, it makes sense to shift out.

The reason – returns on fixed instrument small savings too have become volatile. Moreover, when compared to the inflation rates, what you actually earn from these savings is actually near zero of negative in some cases. What is your option? If you are ultra conservative, liquid funds are a good bet. If you are not the one to feel comfortable about actively managed mutual funds, you could consider the passive funds like ETFs (exchange traded funds). These mirror popular indices such as the BSE Sensex or the Nifty50 and so on.

Investments in these instruments are not guaranteed. But, they move in tandem with the index they track. And, unlike actively managed funds in which there is no guarantee of future returns based on past returns, in case of ETFs past performance is very close an indicator of future returns. The CPSE ETF is a popular ETF that has caught the fancy of several investors. These are like mutual funds which invest in 10 Maharatna and Navaratna companies, with defined allocation towards each stock that is in the list.

They have done fairly well over the past few years since their launch and they invest in PSUs, which have a fairly well defined performance track record. As these are all government of India enterprises, there is little to worry over promoters running away with the money like say Unitech or Kingfisher. Yes, the returns from such investments may not be stupendous, compared to the actively managed funds. But, then these are meant to mirror the performance of the index and not outperform it by leaps.

Perhaps, the time is right to move out of the fixed return small savings instruments completely or keep cribbing over falling rates each successive year or quarter depending on how the returns rate is linked to the instrument.