Just the way a swiss army knife has its multiple benefits, the same can be said of your tax savings, if done cleverly. For instance, instead of addressing tax savings at the end of the year make it a habit to do so at the beginning of each financial year. This way, you will have the time to think over how to deploy funds in instruments that work for you. Likewise, if you broadly split your tax savings into asset classes like equity and debt, they can match your risk profile and the most ideal asset allocation suited to you. This way, your tax saving option is tuned to work for you, forever.

If you are living in a rented accommodation, you can claim house rent allowance (HRA) by submitting the rental receipts or a copy of rental agreement with your employer. Note, if the annual rent exceeds Rs.2 lakh, then you are required to provide your landlord’s PAN as well. Avoid the mistake of getting carried away by paying rent to your spouse or to anyone for the house which you own. However, if you are living in your parent’s house, you can pay rent to the parent on whose name the house ownership is. Try and limit the rent that you pay to less than Rs.2 lakh, to make it tax efficient for your parent as well.

If you are living in a rented accommodation, you can claim house rent allowance (HRA) by submitting the rental receipts or a copy of rental agreement with your employer. Note, if the annual rent exceeds Rs.2 lakh, then you are required to provide your landlord’s PAN as well. Avoid the mistake of getting carried away by paying rent to your spouse or to anyone for the house which you own. However, if you are living in your parent’s house, you can pay rent to the parent on whose name the house ownership is. Try and limit the rent that you pay to less than Rs.2 lakh, to make it tax efficient for your parent as well.

“I have saved tax by putting money in PPF, NSC, and bank fixed deposits,” says Delhi based Dr Himani Bhasin. She also confesses that she did not realise that these could be planned well in advance or to suit a plan that will work in her favour. Although her current tax savings are in fixed-return financial instruments only, and they, at best, just about manage to meet inflation. This means the taxpayers’ purchasing power is met in years when inflation is below the fixed interest rate, but it loses even that in years when the inflation rate is more than the fixed return on these instruments.

Yet, these fixed-tenure tax savings can be a great tool to use for those approaching retirement or those already retired. For instance, the maturity of the NSC or the tax saving FD can be used to create an income stream in years when it matures. So, if you are looking to use the entire Rs.1.5 lakh into a fixed-return tax saver, you could put Rs.12, 500 each month in a financial year into a five year lock-in product in such a manner that on completion of five years, the maturity proceeds will act as an income stream, including the accrued interest.

JOINT FAMILY MOVE

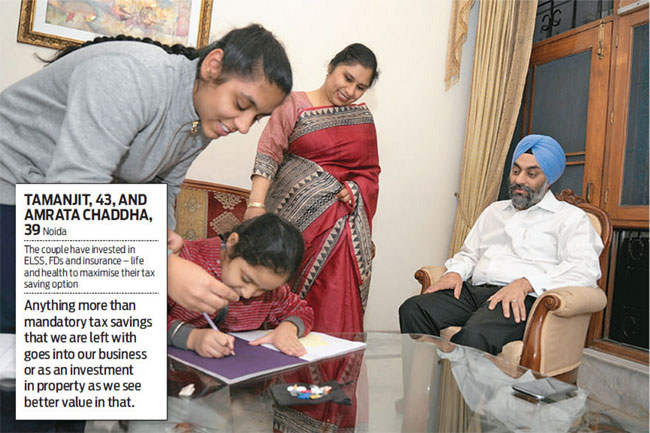

The Chaddhas of Noida, 43-year-old Tamanjit and his 39-year-old wife Amrata, run their own business and usually plough whatever profit they make back into the business, and also some of their own savings. “We do our usual tax savings by way of investments and savings in FDs, PPF and mutual funds, but most of the money after the mandatory tax savings goes back into the business,” explains Tamanjit. There is an opportunity that the Chaddhas are not using at the moment by way of creating an HUF (Hindu Undivided Family). This is a very effective and legal way to save tax as the Chaddhas, like many other Indian families, are undivided and the incomes earned by such families are considered joint incomes as compared to individual incomes and are taxed in the hands of the whole family. The family as an HUF can have a separate PAN and claim tax deductions the same way as individuals do.

The Chaddhas of Noida, 43-year-old Tamanjit and his 39-year-old wife Amrata, run their own business and usually plough whatever profit they make back into the business, and also some of their own savings. “We do our usual tax savings by way of investments and savings in FDs, PPF and mutual funds, but most of the money after the mandatory tax savings goes back into the business,” explains Tamanjit. There is an opportunity that the Chaddhas are not using at the moment by way of creating an HUF (Hindu Undivided Family). This is a very effective and legal way to save tax as the Chaddhas, like many other Indian families, are undivided and the incomes earned by such families are considered joint incomes as compared to individual incomes and are taxed in the hands of the whole family. The family as an HUF can have a separate PAN and claim tax deductions the same way as individuals do.

A point to remember is that an HUF can earn income from all sources except salary. It can invest the initial corpus as well as gifts received subsequently to start a business and earn profits or capital gains. Ancestral property held by HUF can be let out to earn rental income. In fact, the HUF arrangement especially suits taxpayers who have income from ancestral property and expect to inherit financial assets. Such taxpayers will be able to divert the inheritance to the HUF, thus preventing taxation on such income in their hands at their maximum marginal rate.

POWER OF COMPOUNDING

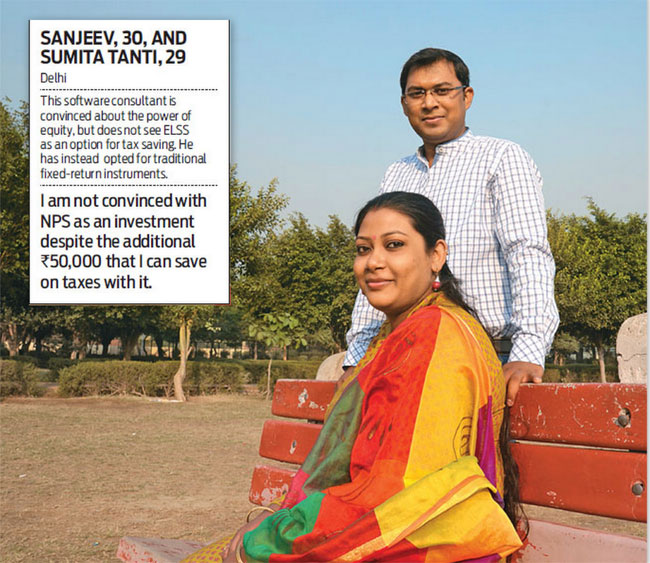

Delhi-based 30-year-old Sanjeev Tanti falls in the highest tax bracket and invests in equities, but is yet to put his money in ELSS. “I am not convinced about these tax saving options and prefer the time-tested PPF and NSCs,” he says. Tanti has probably not heard what famous physicist Albert Einstein had said, “the most powerful force in the universe is compound interest”. You can benefit from the same with a few intelligent tweaks to reduce your tax liability and, at the same time, benefit from the power of compounding. One way to gainfully use this short three-year lock-in period is by planning it in a manner that it creates an income stream in later years, while also acting as a tax-saving instrument simultaneously.

Another way is to invest the entire Rs.1.5 lakh tax savings under Section 80C into an ELSS plan for three consecutive years and be set for magic. In the fourth year, you have the right to redeem the first year’s ELSS investment, which will be tax-free. This redeemed sum can be re-invested as fresh investments on which tax deductions can be claimed. This way, without committing fresh capital, you will have a long-term tax saving cycle, which will also free you of any fresh capital. This way, you set a perennial tax-saving mechanism in an ELSS scheme that not just saves you taxes, but also frees you from making any fresh investments after the initial three years.

We often ignore the obvious and look for ways to save taxes in the most mundane and obvious ways. Nothing wrong with it; however, with some deft handling of finances, you can realise that even tax savings, when used effectively, can make a real big difference to your finances.