Mention guaranteed returns, and most of us will line up to grab the offer, irrespective of what the product is or promises as returns. The deep rooted fondness for guaranteed products among Indians has been time and again milked by financial service providers. Just a month ago, in our December 2014 issue, we had done a feature on the curse of higher guaranteed returns from company fixed deposits. The guarantees offered on insurance policies are no different—they promise a high return but there is no easy way to ascertain the same. In insurance parlance, these are traditional plans, which are not unit-linked. Though they are more opaque on what they actually do with the money you pay as premium, yet they draw attention because they offer ‘guaranteed’ returns. Due to this guaranteed feature, they are also non-participatory these policies do not pay any bonus unlike endowment and money back plans, where bonuses are common.

Decoding guarantee

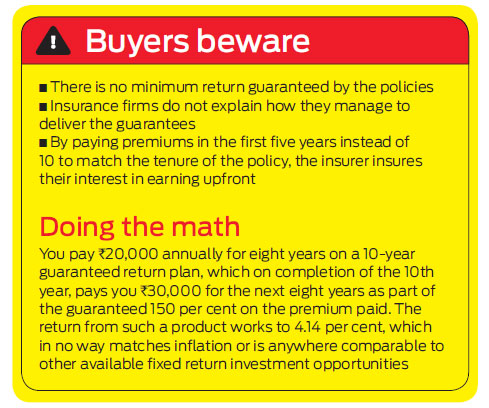

Typically, the policy guarantees paying a percentage of the premium each year after maturity for a predefined period. So, a policy could pay 150 per cent of the premium every year after the policy matures, for the next eight years. Thus, on a policy with a 10-year tenure, where you pay Rs. 20,000 annually for eight years, the maturity benefit is a series of guaranteed payouts of Rs. 30,000 from the 10th to the 17th year. Basically, in guaranteed plans, there is a guaranteed annual payout on survival. In a typical endowment or moneyback plan, if the policyholder survives after maturity, the payout is the sum assured. The guarantee nomenclature varies from insurer to insurer, and so do the benefits. What is common is the fact that the premiums are paid for a tenure that is less than the tenure of the policy. This means, on a 10-year policy, the premiums have to be paid for the first 5-7 years only. The guaranteed returns could either be had in monthly or yearly payouts, after the policy matures, for a certain defined time, or, in any other such combinations. Basically, the guaranteed payouts work only if the policyholder survives and, in case of the policyholder’s death, the payout is only the sum assured. One thing that insurers have managed is to keep the workings of such plans complex for easy comparison or understanding. Hardly any of the guaranteed plans that we analyzed had enough similarities to be comparable. Guarantees were either on premium or the sum assured. Likewise, the proceeds varied, too, depending on the tenure of the policy or the premium. What is comparable though is the death benefit, which is more or less the same across all such plans. It is higher of the sum assured on maturity, or, 11 times the premium, or, 105 per cent of the premiums paid.

Is it for you?

If you are looking for an insurance policy, this is definitely not for you. If you are looking for a savings product, this is not the best of options. However, if you are looking for some form of an income flow at a later time, such policies could work for you. But these are no way comparable to returns that annuities earn, or, for that matter, the returns from a fixed return instrument. But they do serve the need of those who are not part of any kind of conventional pension scheme, but want to create an income stream with an element of guarantee thrown in. But all of this comes with huge downsides. Being a traditional plan, these are rigid. The tenure, once fixed, is fixed and so is the premium paying term. By extension, the payout on maturity is also fixed. Surrendering such policies can be a very expensive proposition. In the absence of partial withdrawal, there is little that you can rejoice about if you bought this. When it comes to insurance, there are plans that either cover lives, or, offer a combination of savings and investments. If you are not looking for a risk-only cover insurance plan that is a term plan, there are plenty of other options. Go in for a guaranteed plan only if you are the sorts who believe in forced savings, which may work out to be a better way to receive income flows in later years than have none.