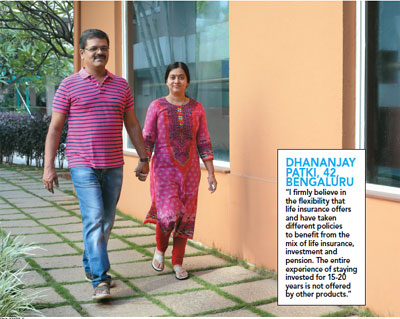

When it comes to investments, 42-year-old, Bengaluru based software engineer Dhananjay Patki is convinced on the multiple benefits of a life insurance policy. “You get life cover, you get tax benefits and you get the advantage of long-term investing,” he says. The penchant for life insurance amongst Indians is well documented and one rarely comes across someone who does not have a policy. Over the past 15 years, the insurance landscape has changed since the opening up of the sector and the setting up of private insurance companies in India. It not only heralded a new wave of insurance companies, but also exposed us to a whole new world of variety of insurance plans.

When it comes to investments, 42-year-old, Bengaluru based software engineer Dhananjay Patki is convinced on the multiple benefits of a life insurance policy. “You get life cover, you get tax benefits and you get the advantage of long-term investing,” he says. The penchant for life insurance amongst Indians is well documented and one rarely comes across someone who does not have a policy. Over the past 15 years, the insurance landscape has changed since the opening up of the sector and the setting up of private insurance companies in India. It not only heralded a new wave of insurance companies, but also exposed us to a whole new world of variety of insurance plans.

“I have a few Ulips, which allow me to save regularly and provide for investment options that otherwise would have been difficult to manage. I also get significant life cover,” adds Patki. He has put his money in Ulips of varying time frames and vouches that these are doing well, enforcing regular investing habits in him. It is not just Ulips, even traditional insurance plans have for long been the favourite among middle-class Indians. “Life insurance is a powerful tool and incomparable to any other financial product. Most importantly, it offers peace of mind and security, which cannot be taken away,” stresses S.K. Roy, chairman, Life Insurance Corporation of India.

BUILDING BLOCKS

The root of every life insurance plan rests on the principal of creating a financial back-up that you can leave for your near and dear ones if something were to happen to you. The importance of term plans, which offer only death cover, cannot be undermined and is a must-have for anyone with financial dependents. Tarun Chugh, MD and CEO, PNB MetLife, says: “The key to ensuring that your family is financially secure is to start early and to understand your financial goals before choosing insurance products.” Once the foundation is laid, there is choice available to add insurance to suit one’s needs and priorities.

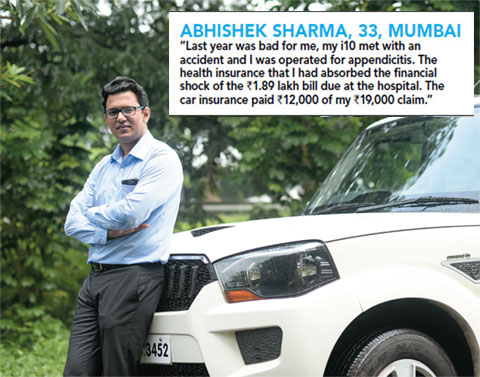

Likewise, the biggest financial blow you can face is owing to your ill-health, which, at times, could render you in a situation much worse than even death. “Last year was bad, I needed surgery for my appendix and the hospital bill of Rs.1.89 lakh would have been difficult to manage but for the group health insurance that I was part of,” recounts 33-year-old Mumbai-based Abhishek Sharma. He had insurance cover for Rs.2 lakh and he was lucky that the hospital bill was within this limit, and he avoided paying the bill from his own pocket. In the absence of insurance, the financial implications of this kind could have added significantly to the trauma he was facing with acute appendicitis.

The ill-luck for this marketing executive did not end with the surgery though; his car was involved in an accident, resulting in need for repairs. “A biker hit my i10 from the rear and it got damaged for no fault of mine,” he rues. The shock did leave him rattled, but he was relieved that the car insurance would help him absorb the financial blow of the accident. The repair cost was estimated at around Rs.19, 000 out of which the insurer paid Rs.12, 000. It took a few days to get the paper-work cleared and a few more at the garage to get his car back.

The ill-luck for this marketing executive did not end with the surgery though; his car was involved in an accident, resulting in need for repairs. “A biker hit my i10 from the rear and it got damaged for no fault of mine,” he rues. The shock did leave him rattled, but he was relieved that the car insurance would help him absorb the financial blow of the accident. The repair cost was estimated at around Rs.19, 000 out of which the insurer paid Rs.12, 000. It took a few days to get the paper-work cleared and a few more at the garage to get his car back.

“My job involves travelling and without the car, it would have been difficult. Thankfully, the entire claims experience and the speed at which the car was repaired has only reinforced my faith in the benefits of insurance,” he recounts. He is not alone, Delhi-based Supriya Das is fraught with anxiety and worry ever since her husband died suddenly earlier this year. “He was 52, with no signs of ill-health, it all happened so abruptly after he complained of chest pain,” she says. Her husband, Dipen Das, worked with a private company as company secretary and collapsed on way to the hospital, leaving his 49-year-old wife and 23-year-old collegegoing daughter in a state of shock.

TWISTS AND TURNS

The Das family is yet to cope with the trauma, but they are financially secure owing to the life insurance policies Dipen had taken over the years. “I was aware that he was insured, but never dreamt of it actually coming our way like this,” says Supriya. The only breadwinner, Dipen had ensured that there was a financial back-up in the form of insurance policies and other savings in case something happened to him, which have helped the Das family to self-support themselves. One of the policies will take care of their daughter Ishita, who is in her final year MBA, while some of the others will help manage the day-to-day finances.

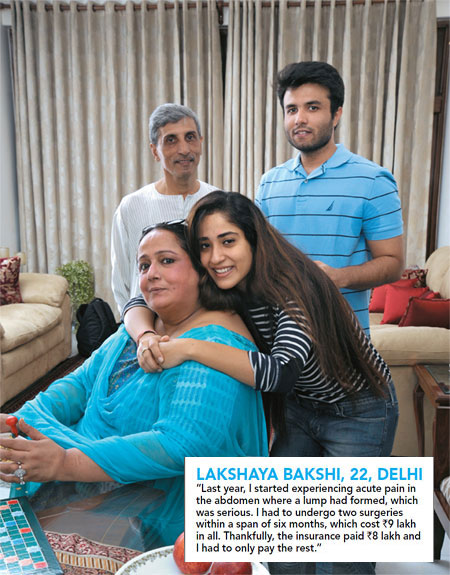

In another part of New Delhi, the Bakshi family, comprising the couple Vivek and Nalini with their children Lakshaya and Chandini, are like any other urban family. The only difference is that this family has experienced filing insurance claims on health grounds, which would have otherwise caused financial stress. “In 2013, I felt pain on the left side of my abdomen, which I did not take very seriously till it was unbearable,” recounts Lakshaya. His family doctor recommended him to a hospital for further tests. The medical examination resulted in this youngster undergoing two surgeries in a span of six months to get rid of a lump, which could have been life threatening if left unchecked.

In another part of New Delhi, the Bakshi family, comprising the couple Vivek and Nalini with their children Lakshaya and Chandini, are like any other urban family. The only difference is that this family has experienced filing insurance claims on health grounds, which would have otherwise caused financial stress. “In 2013, I felt pain on the left side of my abdomen, which I did not take very seriously till it was unbearable,” recounts Lakshaya. His family doctor recommended him to a hospital for further tests. The medical examination resulted in this youngster undergoing two surgeries in a span of six months to get rid of a lump, which could have been life threatening if left unchecked.

The financial implications in the absence of health insurance are mind-boggling—the entire hospitalisation and surgery cost him Rs.9 lakh. “I surely believe in insurance products. It basically prepares you for any future contingencies,” says 58-year-old Vivek. The wise move to take Rs.20 lakh health insurance for all family members worked well for the Bakshis, who have experienced few other insurance claims in the past and are sold on the numerous benefits of having insurance and not leaving things to chance.

CHOICES GALORE

The rising healthcare costs and choices within health insurance plans can be quite confusing for a layman. Says, Sanjay Datta, chief-claims, underwriting and reinsurance, ICICI Lombard: “Essentially, health insurance is a comprehensive policy, which covers a wide range of health-related issues, and there is critical illness, which covers life threatening diseases.” So, what a basic health insurance does is to pay for the medical expenses that a policyholder experience, while critical illness pays a specified lump sum amount to the insured on the occurrence of certain critical illnesses defined in the policy such as cancer, cardiac problems, liver failure, and so on.

The same variation exists in the life insurance space as well, wherein there are simply insurance plans, policies that mix savings and protection, and those that offer protection and investments. In recent years, unit- linked insurance plans or Ulips have made a mark for themselves, more for the wrong reasons than right. These policies combine protection and investment and, when managed well, have the right attributes to be your buddy through your life. The plethora of investment options available suit the different risk profiles of individuals from the safest fixed return-type investments at one end to the completely market-linked ones on the other.

Explains Amitabh Chaudhry, MD and CEO, HDFC Life; “We have eight fund options that cater to customers depending upon their risk appetite. It is important to give this choice as Ulips are the only plans that offer flexibility in the form of fund switch and premium redirection that helps customers to change their investment without having to withdraw from the plan.” Through Ulips, you can move across equity and debt investments or a mix of the two in varying proportions, without having to worry over tax implications when switching across the available funds. That these policies come with a lock-in of five years, the experience could well be a testing ground for understanding how investments fare with changing market conditions.

Explains Amitabh Chaudhry, MD and CEO, HDFC Life; “We have eight fund options that cater to customers depending upon their risk appetite. It is important to give this choice as Ulips are the only plans that offer flexibility in the form of fund switch and premium redirection that helps customers to change their investment without having to withdraw from the plan.” Through Ulips, you can move across equity and debt investments or a mix of the two in varying proportions, without having to worry over tax implications when switching across the available funds. That these policies come with a lock-in of five years, the experience could well be a testing ground for understanding how investments fare with changing market conditions.

It is not just about life and health, other forms of insurance like motor insurance, household insurance, travel insurance and even protection available for all your electronic gadgets like smartphones and tablets exist. These can help you face the financial risks you are exposed to in case any of these act up. You never know when an earthquake can strike and shake the foundation of your house or your iPhone malfunctions. These are all risks, which do not come with prior notice, leaving you exposed to vagaries of life. What you can least do is protect your financial interests in meeting this risks.