Investors often face the dilemma of whether to buy stocks or invest in mutual funds. The answer to this lies in hybrid investing. It is based on the fundamental concept of diversification. It combines stocks and debt. Hence, it allows investors to actively participate in specific companies' growth while mitigating financial risk through broader market exposure.

In this blog, we will understand the concept of hybrid investing and look at how hybrid funds are a strategic investment tool for the hybrid investor.

What Are Hybrid Funds?

As investors aim to diversify their portfolios, they often consider holding various schemes that invest in different asset classes. Hybrid funds offer a solution for investors seeking exposure to both debt and equity securities within a single mutual fund. You do not need to worry about whether to invest in stocks or invest in MF.

These funds provide a convenient way for investors to spread their risk while potentially maximising returns. This approach is rooted in three principles: asset allocation, correlation, and diversification.

- Asset allocation means dividing investments among different types of assets

- Correlation refers to how returns of assets move together

- Diversification involves investing in various assets in a portfolio to minimise risks

Assets in the same class usually have similar risk and return factors, leading to a high correlation in returns. On the other hand, assets from different classes tend to have a low correlation in returns. By blending assets with low correlation, investors can reduce portfolio risk.

Types of Hybrid Mutual Funds

Here are the different types of hybrid funds.

1.Multi Asset Allocation Fund

Diversifies by investing in at least three asset classes.

2.Aggressive Hybrid Funds

Mixes a larger equity portion (65-80%) with a smaller debt component (20-35%).

3.Dynamic Asset Allocation or Balanced Advantage Fund

Adjusts between debt and equity based on market analysis.

4.Conservative Hybrid Funds

Focuses on income through debt with a minimal equity share (10-25%).

5.Equity Savings Fund

Aims for a balance of risk and return through equity, derivatives, and debt.

Advantages of hybrid mutual funds

You can achieve the below advantages by investing in these funds.

1.Single Fund Access

Hybrid mutual funds eliminate the need for multiple funds by allowing investors to access multiple asset classes within a single fund.

2.Different Risk Profiles

Hybrid mutual funds offer options for conservative, moderate, and aggressive investors through equity-oriented, debt-oriented, and dynamic asset allocation funds.

3.Active Risk Management

These funds actively manage risk through diversification and asset allocation strategies. They combine non-correlated asset classes like equity and debt.

4.Diversification

Hybrid funds diversify not only across asset classes but also within them. They invest in various subclasses such as large-cap, mid-cap, or small-cap stocks.

5.Automatic Rebalancing

Fund managers handle portfolio rebalancing as needed. This saves investors time and effort in managing asset allocation and tracking markets.

Conclusion

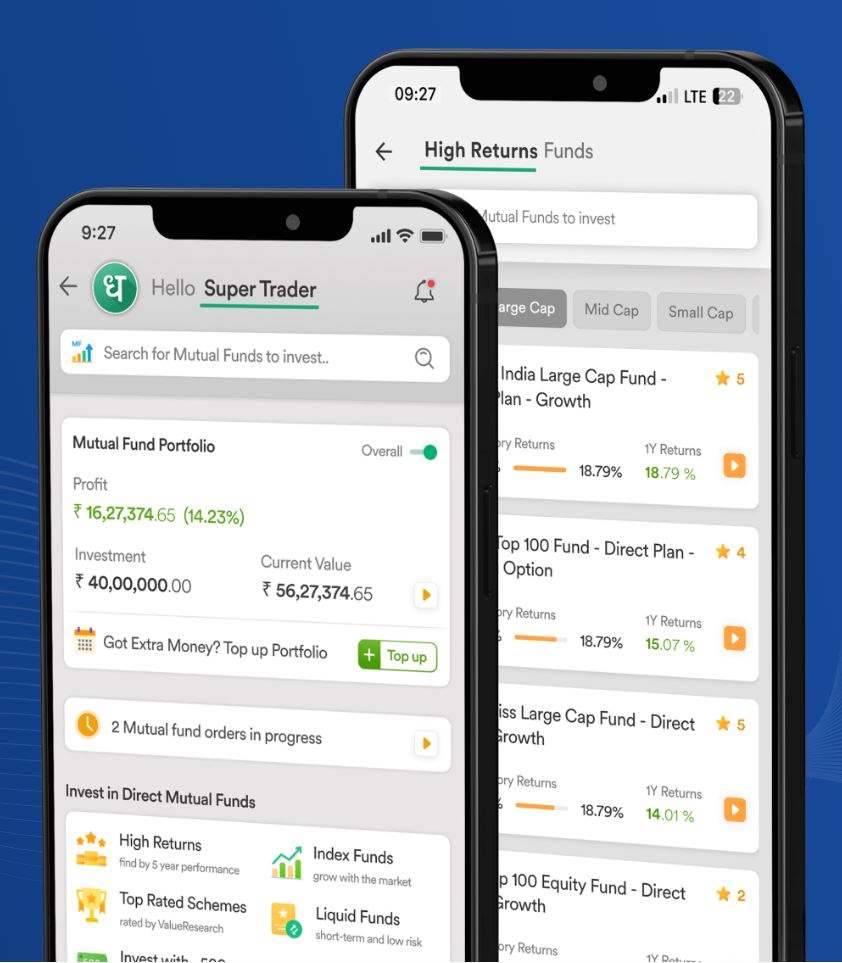

Hybrid investing through hybrid mutual funds not only maximises potential returns but also offers a safeguard against market volatility. There are several types of hybrid mutual funds that you can invest in to avail the benefits of diversification within a single fund. To start investing in mutual funds, consider Dhan.