When it comes to personal finance goals, money always seems to be less than what you need to achieve the goal. At the same time, with a plan, you can work your way to achieving your financial desires. Like most young couples, Hyderabad-based Nagamalleswara Rao and wife Krishna Tejaare have many desires— which they have listed among their future goals, while at the same time they face issues of being short on money to realise them right away.

The couple is also starting a family soon. Rao, 30, works as a product assurance engineer with technology major Cognizant and his 26-year-old wife is a deputy manager at Mishra Dhatu Nigam Limited, a mini-Ratna company. The couple have one set of parents as dependents and currently live in a rented accommodation and plan to move to a house of their own this year for which they are looking at a home loan.

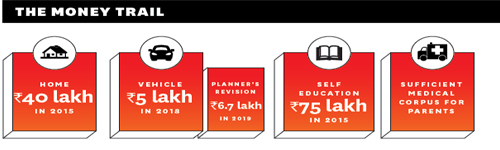

Credit must be given to this young couple for the careful planning they have done to list out their goals. For instance, there is no harm in planning ahead about children’s future financial needs; however, doing so when they are yet to have a child is getting carried away too far. It is for this reason that we have rescaled some of their financial goals. But, care has been taken to accommodate the financial needs once they have children, especially their education.

Lessons to learn

Like most Indians, the Raos are under-insured, have savings in mandatory pension and money in the bank with hardly any investments. But their biggest strength comes from the fact that they have no financial liabilities. However, they have not started planning for their retirement, assuming like many others that it is a long way to go. However, going by Rs35,000 that he needs to run his home today, he will need Rs2 lakh a month in 2044, adjusted to an average inflation of 6 per cent.

They should maintain their Rs90,000 savings account balance towards contingency fund, subject to increase with time. They both need to increase their life insurance cover too; considering their financial goals, they both need Rs2 crore cover each. At the same time, it will be good to take individual health insurance cover for Rs5 lakh each instead of a family floater. As they have dependent parents, they should consider a basic health insurance for Rs2 lakh for parents and add a top up of Rs10 lakh for each of them.

They should also pay 22.75 per cent by way of down payment for their dream house and fund the rest with a 20-year home loan. The down payment can be funded by using their existing EPF and FDs. At the same time, they should go easy with decorating their home and do so in instalments so that they do not strain their finances. Given the state of the economy, jobs are not guaranteed, it is thus important that Rao’s desire to study further by taking an education loan should be a priority, without compromising on their finances, especially when they have an addition to the family coming up.

There are some benefits that this couple enjoys. Since Krishna is employed with a PSU, they automatically are ensured adequate health cover for life provided she pursues her career till retirement. Likewise, the government employment will also take care of contributions towards pension which qualify for tax savings. With some tweaks to their current finances, the couple should be able to achieve all their goals comfortably. Achieving financial goals requires dedication, perseverance, and how this couple manages to do so will decide how they succeed with it.