Indian employees by default tend to contribute towards their retirement savings by way of contributions to the Employees’ Provident Fund (EPF). A recent Willis Towers Watson study sought responses from 118 companies to seek their views on the government’s initiative to lead India towards a better pensioned society. The results were pretty clear—80 per cent of the respondents felt that retirement benefits need to be more tax friendly.

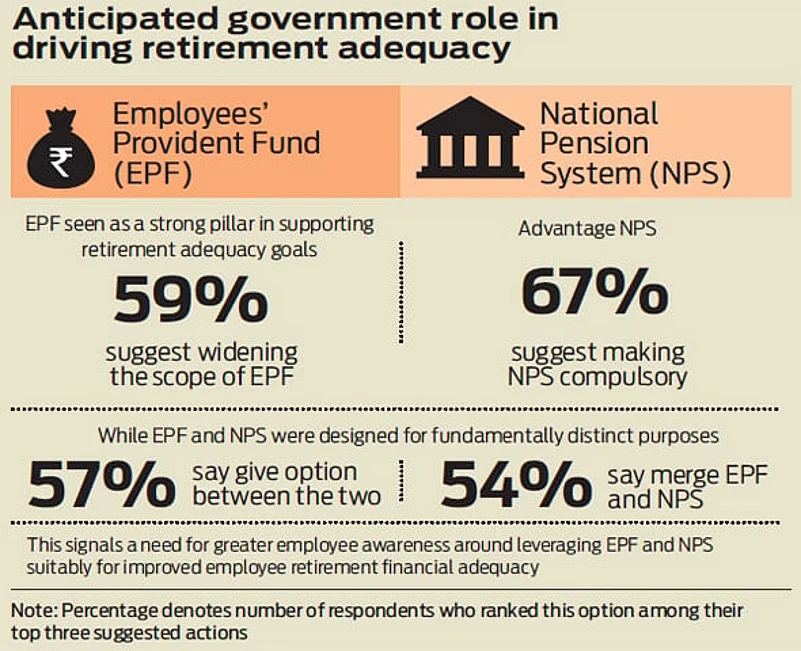

According to the study, the EPF is seen as a strong pillar in supporting retirement adequacy goals with 59 per cent suggesting widening its scope. At the same time, the National Pension System (NPS) continues to draw the attention of Indian employers with 67 per cent suggesting making it compulsory. Both these systems are offered for different reasons, with several employers now offering their employees the option to choose between the two.

Most employees do not understand how these two work and join the one which the employer suggests. For those joining the workforce, retirement planning is still a long way to go, but it is pertinent that they understand that it pays to put their money in equities. Considering the tax benefits on contribution towards these two schemes and the long lock-ins, employees should go in for a higher equity allocation to build their retirement corpus.

While there is a tax anomaly at the time of withdrawing from the system between the two options, it is in the best interest of employees that the government evens out the tax lacuna, which will be in sync with its initiative to lead India towards a better pensioned society.