As the financial year is about to wrap up, all of us are busy with our routine tasks of tax-filing process. Going through rounds of understanding, researching and following tips on tax-saving and investment tools with likes of public provident fund, equity-linked saving schemes or ULIPs are commonplace activities.

Sounds familiar, right?

However, when it comes to paying taxes, what most employees miss out on is their ‘advantage point’ i.e. tax-saving benefits. Offered by companies to help employees save tax and take home a higher salary, these benefits come bundled in the form of reimbursements. The key is to know how these benefits work and how you can use them to your advantage.

To begin with, let’s understand that these benefits aren’t the same as investment tools defined under Section 80C of the Income Tax Act. These go beyond your provident fund, tax-saving mutual fund investments and so on. With employee tax-saving benefits, you can claim returns and save taxes against some of your official expenses.

It sounds almost too good to be true, isn’t it? Here’s a thought -- if you are paying for things like mobile phone bills or spending on the internet or travelling for a meeting, you can claim a tax deduction against all your work-related expenses. Let’s understand.

Myths about tax deductions

The Income Tax Act provides a total of 51 allowances and perquisites, many of which have built-in tax-saving capabilities. Of these, the most popular ones offered by companies include -- phone, fuel and Leave Travel Allowance (LTA). According to a study conducted by Zeta on Employee Tax Benefits, 73% companies offered communication reimbursements to their employees, 52% chose to offer fuel allowance and 48% chose LTA.

As good as this sounds, here comes the tricky part. Most employees shy away from the idea of reimbursements. And, the two common reasons for these are: lack of awareness and the notion of getting a higher in-hand salary.

According to Zeta’s study on Employee Tax Benefits (commissioned to Nielsen India), one in every four employees doesn’t understand tax benefits. About more than 50% of employees prefer giving up on reimbursements in trying to take home a higher salary. What most people miss here is that reimbursements or tax-savings benefits are in fact designed for employees -- this is your advantage point.

Tax-saving benefits for all

As per the Income Tax guidelines, you can save taxes on expenses like driving for official work, making an official call or even using the internet to boost your productivity at work. These expenses, if incurred for official work purposes, are exempted from tax.

Communication reimbursement, which tops the list, is fully tax-exempted. It includes bills for your telephone, prepaid or postpaid mobile, broadband and data card connections. Your employer usually sets the amount of reimbursement depending on the company policy.

Expenses incurred while driving to work is yet another segment often ignored. The Income Tax guideline has you covered if you are travelling on an official tour or a work meeting. Under these set of guidelines, you can claim a 100% tax exemption in fuel reimbursements on a company-owned vehicle.

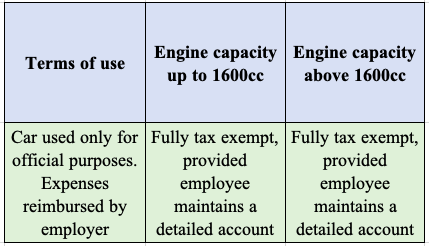

That’s not all. Under the motor car allowance or any other conveyance owned by an employee, taxability is governed as:

In addition to this, your employer can also reimburse both the driver’s salary and car maintenance expenses. But, to get your claims you need to submit proofs, receipts or logs.

So, the next time you file your taxes, investigate your deductions, make that legitimate claim and champion your tax savings.

The author is the Marketing Head at Zeta India