Payment fraud is evolving as rapidly as the technology that enables digital transactions.

Victims of fraud have a lot of ways to seek redressal besides filing a complaint with the concerned banks.

Regulators must continuously tighten the liability frameworks, and wherever applicable, encourage proactive fraud reimbursements.

India’s Digital Fraud Surge: What Consumers Need To Know About Rights And Remedies

Legal and regulatory measures are gaining momentum, but there is a time lag between the frauds' transformation and the protective measures reaching the users who are not so tech-savvy.

India’s digital payments story is often depicted as a story of conquering challenges with innovation: billions of UPI transactions, QR codes at every mom-and-pop shop, and fintech applications turning smartphones into wallets. But hidden behind this bright picture is a darker reality: a surge in digital and financial fraud that is slowly eroding family savings and trust. For many in the new middle class, the pressing concern is no longer, “Will my payment go through?” but rather, “Who is on the other side of this link, OTP, or QR code?”

These figures offer a reality check. According to the Reserve Bank of India (RBI), payment fraud involving digital channels increased by over five times to an estimated Rs 14.57 billion in the year ending March 2024, compared to the previous year, even as UPI continued to break volume records. Another study pointed out that during the year 2024, Indian consumers lost an enormous amount of Rs 22,842 crore to the hands of cybercriminals and fraudsters, which was a huge increase from earlier years.

The official sources have cautioned that if the current trend continues, the annual losses may cross Rs 1.2 lakh crore. Interestingly, it has been found that one out of five UPI users is likely to have faced some kind of fraud, yet more than half of the victims reportedly do not file complaints, often due to embarrassment or uncertainty about how to proceed.

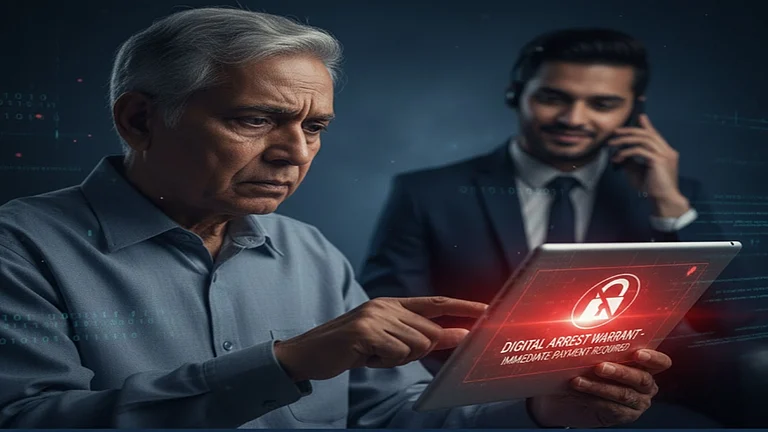

“Payment fraud is evolving as rapidly as the technology that enables digital transactions. Traditional phishing emails have given way to fake customer-care numbers, “KYC update” links, remote-access apps, bogus investment groups, romance scams, and even deepfake audio or video impersonations of trusted individuals. What unites these schemes is social engineering. Fraudsters rarely breach systems; instead, they manipulate people. Victims are often caught off guard, believing they are dealing with a legitimate entity simply because of a familiar brand logo or the tone of the message. In that moment of misplaced trust, they share OTPs, approve collect requests, or install malicious apps that hand over control of their devices,” says Ashwini Kumar, Advocate & Founder of My Legal Expert (MLE).

Legal and regulatory measures are gaining momentum, but there is a time lag between the frauds' transformation and the protective measures reaching the users who are not so tech-savvy. The authorities have earmarked digital fraud as a major risk and are compelling banks and payment institutions to reinforce multi-factor authentication, real-time monitoring, and fraud reporting systems. The police have launched online reporting and specialised coordination centres for cybercrime to follow and cut off the money flow through mule accounts and fraudulent websites, while public awareness campaigns and law enforcement agencies continue to urge consumers not to share sensitive information or click on unknown links or numbers.

“Thankfully, victims of fraud have a lot of ways to seek redress besides filing a complaint with the concerned banks. Complaints may be made to the Banking Ombudsman and supported with a cybercrime report through the designated online portals or local police stations. Customers may also go to consumer commissions for service deficiency in case of high-value or repeated fraud or to civil court for recovery, although these are slower routes. What is more, even partial recovery or bank credit is a common practice when fraud arises from prompt reporting,” informs Kumar.

Fraud prevention is as much a behavioural challenge as it is a technological one. Data suggest that the rapid expansion of digital payments, combined with low levels of financial and cyber literacy, has created an ideal breeding ground for scammers.

A large number of the victims - elderly parents added to family UPI setups, small traders going cashless, and rural households that are new to app-based banking - are unaware. To them, the easy-to-use interface might disguise the danger of risk. Therefore, it becomes very important that every digital financial inclusion initiative is coupled with strong and continuous education about the basics of safe and unsafe practices. This makes it essential that every digital financial inclusion initiative be paired with sustained and practical education on safe digital practices.

“The best approach for 2025 and beyond must be an amalgamation of technology, regulation, and behavioural discipline. Consumers need to adopt a few simple, non-negotiable but highly effective rules: never share OTPs or PINs, verify phone numbers and links through official websites or apps, double-check beneficiary details before transferring funds, secure devices with locks, and report every suspicious transaction immediately, no matter how small it is,” says Kumar.

In the meantime, the regulators must continuously tighten the liability frameworks, and wherever applicable, they should encourage proactive fraud reimbursements. The use of digital payments is here to stay, and so is digital crime. The crucial question is whether consumers feel empowered or helpless.