Punjab National Bank (PNB) has abolished the monthly average balance (MAB) requirement for all its savings bank account holders effective July 1, 2025. Now, the bank will not levy any penalty on customers for not maintaining the MAB, also known as the minimum average balance in their savings accounts.

PNB Waives Penalty For Non-Maintenance Of Minimum Balance: What Are SBI, HDFC, And Other Banks Charging?

Punjab National Bank (PNB) has removed the minimum monthly average balance charges for its savings accounts, offering freedom to customers to use money for different needs without worrying about MAB charges. How do other banks compare?

Removal of maintenance charges will enable PNB customers to transact freely from their accounts without having to worry about maintaining the minimum average balance. The step will benefit all customers, especially senior citizens, women, students, and low-income families, allowing them to access banking services without the stress of having to maintain a minimum balance or face penalties for non-compliance.

What Is MAB?

MAB is the minimum monthly average balance a customer is required to maintain in their bank account. In failing to do so, banks charge a penalty. Typically, banks add the closing balance of each day in a month and divide it by the number of days in that month to find the monthly average balance for that month. If this average is lower than the stipulated amount, customers are charged a penalty, which varies from bank to bank.

PNB MAB Non-Maintenance Charges

Previously, PNB charged fees ranging from Rs 50-400 for not maintaining the MAB. These charges vary depending on the type of account and the location of the bank branch (rural, semi-urban, urban, or metro cities). In rural areas, PNB’s MAB requirement was Rs 1,000, whereas it was Rs 2,000 in semi-urban areas, Rs 5,000 in urban areas, and Rs 10,000 in metro cities.

However, this move is not new for banks. Banks keep adjusting their deposit and lending rates to align with the repo rate. At the same time, they can make changes in their internal rules, such as a fee for a particular service, minimum balance requirement, MAB charges, and various other service charges to stay in good standing. Removal of MAB is one of such measures through which banks encourage their customers to open accounts with them and engage in different types of financial transactions.

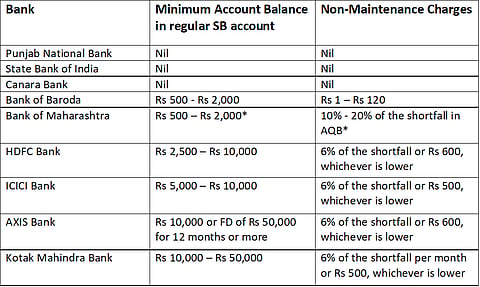

Here is a list of nine public- and private-sector banks, their MAB requirement, and the penalty for non-maintaining the minimum balance:

Source: Bank Websites | *The Bank of Maharashtra levies penalty on average quarterly balance (AQB)

Canara Bank removed MAB charges recently, on May 31, 2025. It removed the charges for all its savings bank accounts, including domestic savings bank accounts, non-resident Indian (NRI) savings accounts, as well as salary accounts. The non-maintenance charges for its savings accounts became ineffective from June 1, 2025. The waiver of the non-maintenance charges made all its savings bank accounts no-penalty accounts in the context of MAB.

Now, PNB’s removal of minimum balance charges is likely to provide low-income households more freedom to utilise their money instead of keeping it idle in an SB account that offers a rate of interest of 2.50 per cent per annum.