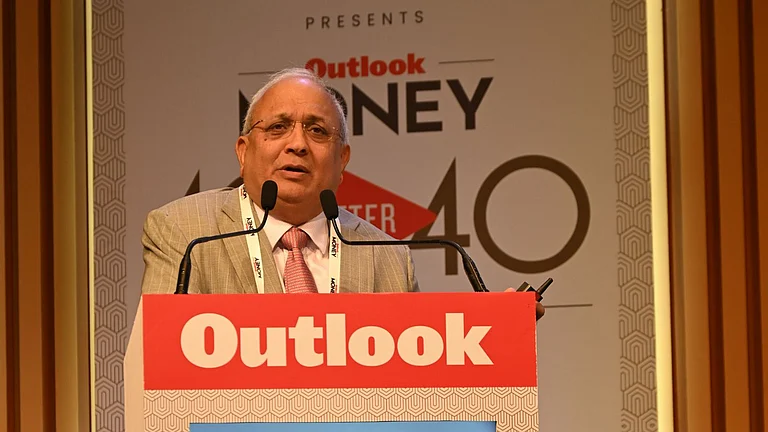

Dhirendra Kumar, founder and CEO of Value Research shared his investing strategy and why investors should not resist ‘temptations’. Kumar also talked about the various benefits of taking risks and how they help an investor in the long-run. Kumar also shared some tips to mitigate risk.

Outlook Money 40After40: Value Research CEO Dhirendra Kumar Shares Investment Mantra - Don’t Resist Your Temptation

Dhirendra Kumar, founder and CEO of Value Research shared his investing strategy and why investors should not resist ‘temptations’. Kumar also talked about the various benefits of taking risks and how they help an investor in the long-run. Kumar also shared some tips to mitigate risk

“I don’t think I have the courage to give you advice. But I would suggest few things. Don’t resist your temptation, try out things,” Kumar said.

Kumar talked about the various ‘temptations’ that investors may face such as investing in crypto, putting money in new mutual fund schemes. He added that investors should not resist such temptations as long as they invest regularly, diversify their portfolio and have a long-term approach to investing.

“The temptation is, crypto can be very exciting. Eating out tomorrow could be very exciting with your friends. Mutual funds sold as a story, a thematic fund, a defence fund or consumer fund can look exciting and it’s not all that bad simply because if you invest in a mutual fund and are investing regularly, diversifying and are able to stick around for a couple of years, even a lousy fund manager can’t really hurt you because by virtue of that diversification and your long-term orientation, you end up being a winner anyway,” Kumar said.

Kumar also cautioned investors against getting ‘excited’ about markets and wanting ‘magic’ to happen. He added that historically investors have lost money whenever they get excited about the market.

“My worry will be that most people expect magic to happen. Magic is not going to happen anyway. I have learned in the last 30 years, that every time investors get excited about the market, it is an inopportune time to get excited. It turns out to be wrong in hindsight. But it gets extremely difficult to resist that. Whether it was 1992, 2001 and things like that,” Kumar added.

Kumar said that investors should try to learn from their own mistakes. He added that investors should lose their own money and should do it early on in their investment journey when the amount of money they lose is less.

“And there is another thing about money issues and investment that you don’t learn from other people’s mistakes. You have to lose your own money. So, it is important that you lose early because you lose less. Because if you resist that temptation, you will not learn it and then you will lose big time when you will have something more significant to lose,” Kumar said.

Kumar said it’s not mandatory for investors to know how the market works before they begin investing. However he added knowing how the market works and then beginning your investment journey has no downside. He added that when people think of investing like a game they are likely to quit the market completely when they lose.

“You don’t have to become an automobile engineer when you learn driving, but it is good to know that when you press the accelerator, what happens. You don’t need to really understand how it really works, but what could be the downside. With that in mind, I would say that understanding how things work would heIp! Most of the people who come get attracted to the market; they think of equity as a ticker. They don’t think that, when you are buying the stock of a company, there’s an underlying company where 100,000 people get up in the morning at 9’o clock to get to work. When people think that this is a game they win sometimes but when they lose, they run away forever,” Kumar said.

Kumar emphasised that while not curbing temptations can have significant benefits for investors, diversifying portfolios and optimising asset allocation are key to mitigating risks.

“There are two, three things to keep in mind. One is to diversify your portfolio, it is the holy grail, you can't avoid that. Second is asset allocation, but don’t worry about asset allocation for the first five years. Reason is that asset allocation is like building a shock absorber. It is building a safety net and you have nothing to lose in the initial five years,” Kumar said.