· Indian Bank extends special FD deadline by 90 days to December 31, 2025

· Special fixed deposits include IND SECURE and IND GREEN for 444 and 555 days

· Minimum investment amount is Rs 1,000 for these FDs.

· Indian Bank extends special FD deadline by 90 days to December 31, 2025

· Special fixed deposits include IND SECURE and IND GREEN for 444 and 555 days

· Minimum investment amount is Rs 1,000 for these FDs.

In the wake of the Reserve Bank of India’s (RBI) Monetary Policy Committee meeting on October 1, 2025, the Indian Bank has extended the last date for its special fixed deposits (FDs). The earlier date for its special tenure deposits (444 days, 555 days) was September 30, 2025, which is now extended to December 31, 2025. The FD rates remain the same, but the deadline to invest in these FDs is now extended by 90 days. Here are the details of the existing FD rates of Indian Bank as of October 7, 2025.

This nationalised Bank offers two special FDs. These are IND SECURE and IND GREEN for 444 days and 555 days, respectively. The highest rate offered by the Bank is 6.70 per cent for the general public and 7.20 per cent for senior citizens.

IND Secure FDs

On this 444-day FD, the Bank offers 6.70 per cent to the general public and 7.20 per cent to senior citizens (60 and above). Super seniors (80 and above) can avail of a maximum of 7.45 per cent on this FD, which is also the highest amongst all offered by the Bank. One can open this FD with a minimum of Rs 1,000.

IND Green FD

Indian Bank’s Green FD is for 555 days and offers 7.10 per cent interest to senior citizens and 7.35 per cent to super senior citizens. The rate for the general public is 6.60 per cent. The minimum deposit for this FD is also Rs 1,000. The funds under this FD are invested in energy-efficient and sustainable energy projects.

Other Regular FDs

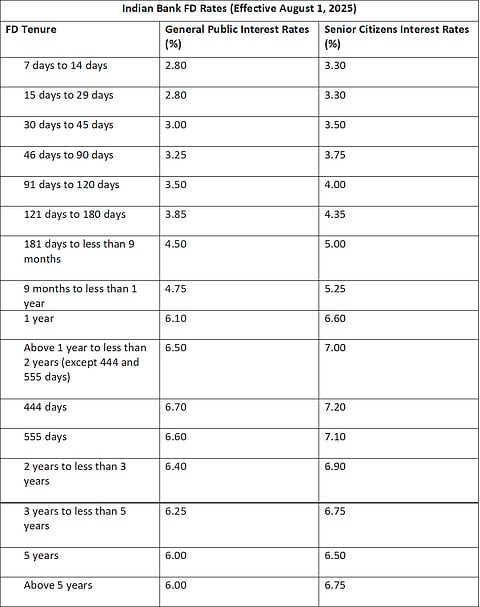

The FD rates were last revised on August 1, 2025, and are the same as on the date of writing. The rates for senior citizens and the general public are:

The bank offers an additional 0.50 per cent to senior citizens over the rates available for the general public, up to five years. For more than five-year tenures, it offers 0.25 additional, making the total additional interest of 0.75 per cent of 75 basis points - bps (50 bps + 25 bps) for seniors.