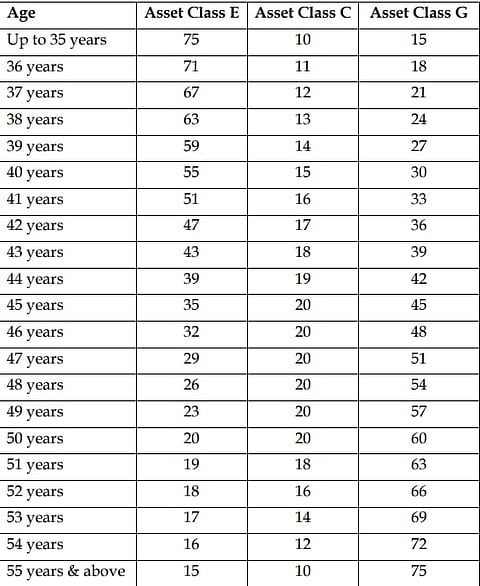

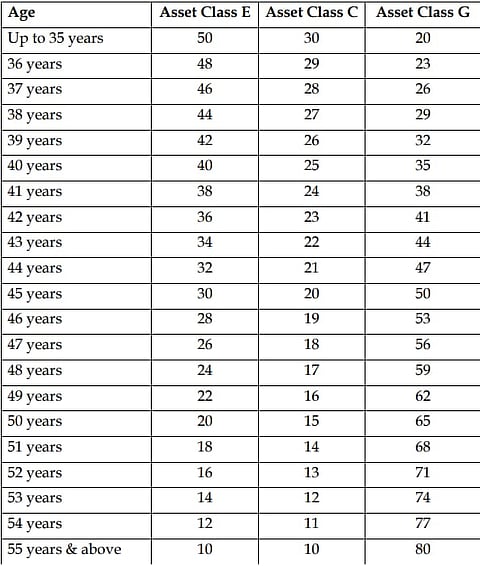

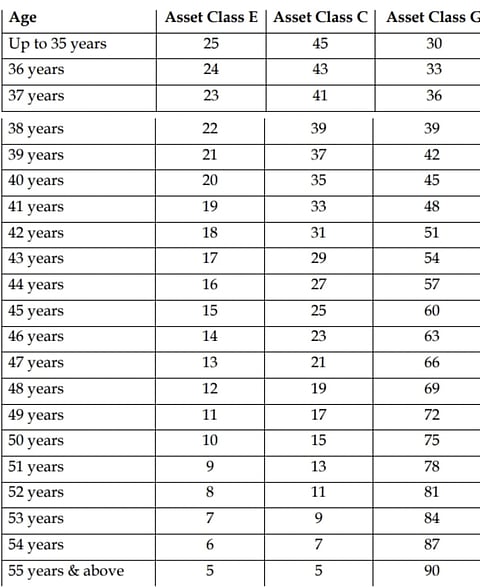

At a time when financial security in retirement is increasingly becoming a concern, NPS's innovative Life Cycle Funds are designed to accommodate subscribers from all age groups with a structured investment plan that balances risks and growth with advancing age. NPS offers three types of Life Cycle Funds: Aggressive (LC75), Moderate (LC50), and Conservative (LC25), each with different investment strategies and risk considerations.

NPS Life Cycle Fund: An Investment Avenue For Every Age

The National Pension System Life Cycle Funds offer investment strategies tailored to the investor's risk appetite and age profile.

Life-Cycle Fund Allocation Overview

The choice of Pension Fund Manager, or PFM, is thus important. The service providers include Birla Sunlife, HDFC, and SBI Pension Fund. A combination of prudent management expertise and optimal asset allocation enables NPS subscribers to build a healthy corpus in retirement.

Major Pension Fund Managers

• Birla Sunlife Pension Management Limited

• HDFC Pension Management Company Limited

• ICICI Prudential Pension Funds Management Company Limited

• Kotak Mahindra Pension Fund Limited

• LIC Pension Fund Limited

• Reliance Capital Pension Fund Limited

• SBI Pension Funds Private Limited

• UTI Retirement Solutions Limited

These funds allow auto-adjustments, allowing investors to course-correct if they face any issue after making an investing decision. This feature will enable subscribers with little or no knowledge to manage their portfolios. The gradual reduction in equity exposure also minimises the risk, and the investment strategies are kept in line with changing financial situations.

These advantages make the NPS Life Cycle Fund an attractive choice for financial security in old age. Since they are managed to change with life cycles, factoring in the risk appetite, these funds provide a stepping stone to a financially secure retirement.