Five states have reverted from NPS to OPS.

RBI warns that OPS would create a future fiscal burden that is projected to exceed NPS by 2030.

States need to monitor finances as per the FRBM requirement for long-term sustainability.

Old Pension Scheme Reversion: States Risk The Accumulation Of Unfunded Pension Liabilities In Future, Says Govt

OPS reversion may reduce pension outgo in the short term, but it will create an unfunded financial burden on the government in the long-term

The state governments have the freedom to offer the Old Pension Scheme (OPS) or the National Pension System (NPS) to their employees. To opt for the National Pension System (NPS), they need to notify this under Section 12(4) of the Pension Fund Regulatory and Development Authority (PFRDA) Act, 2013. Responding to a question regarding the state government’s reverting from NPS to OPS requires the central government’s approval, the Minister of State for Finance, Pankaj Chaudhary, replied that “Such shifts fall exclusively under State policy discretion.”

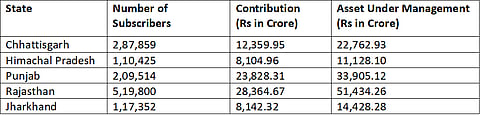

Notably, so far, five states have reverted from NPS to the OPS. These are Rajasthan, Chhattisgarh, Punjab, Himachal Pradesh, and Jharkhand.

Whether the reversion to the OPS would create liabilities on the state governments and create a burden on their budgets, the minister quoted the Reserve Bank of India (RBI) report and the recent Comptroller and Auditor General (CAG) report.

In the written reply, the minister, quoting the CAG, said, “The reports indicate that OPS, being an unfunded defined benefit pension scheme, is likely to lead to an increase in committed fiscal liabilities over the medium to long term that threaten to undermine State-level Fiscal Responsibility and Budget Management (FRBM) targets.”

The FRBM Act, 2003, provides guidelines to set targets for the fiscal deficit and debt of the government. This is to develop fiscal discipline, reduce expenditure, increase taxes, etc., to create a balance between the government's revenue and expenditure.

The reply quoted the RBI report titled “State Finance: A Study of Budgets of 2022-23”, according to which the annual savings in fiscal resources by reverting to the OPS are short-lived. “By postponing the current expenses to the future, States risk the accumulation of unfunded pension liabilities in the coming years.”

Referring to the RBI’s September 2023 Bulletin, the minister highlighted that reverting to OPS could be a short-term strategy. In the short run, the pension outgo may be reduced, but in the long term, it would only add to the “unfunded pension liabilities”. The projections show that the pension burden under the OPS would be more than the NPS contributions by 2030.

Here are the details of the NPS corpus, contributed by the subscribers in the five States that reverted to the OPS, as of December 31, 2025:

Source: Lok Sabha Reply

The States that are reverting to the OPS need to monitor and manage their finances as per the FRBM requirements and strive to remain sustainable in the long run. The reply also underlined that “unfunded OPS is likely to exert severe pressure on their finances, especially with increasing longevity, which may constrain capital expenditure to be incurred by such States and create long-term inter-generational fiscal liabilities.”