By Bhuvanaa Shreeram

EPF To Equity: Options To Generate Regular Cash Flows In Retirement

Investment in a risk-averse financial instrument may offer peace of mind. However, would it be sufficient to beat inflation and generate an adequate corpus for post-retirement life? What you can do

Saving for retirement is one journey. However, turning that savings into smart, sustainable income, one that beats inflation and lasts through life, is a very different challenge. Meet Mr Joshi, a 60-year-old professional who retired from an automobile manufacturing company. Let us walk through his financial journey and explore four practical passive income strategies every retiree should understand today.

Mr Joshi’s Financial Snapshot: At the point of retirement, Joshi has:

Assets:

• Retirals: Rs 1.2 crore (EPF, Gratuity, Leave Encashments)

• Mutual Funds: Rs 50 lakh (70 per cent equity, 30 per cent debt)

• Bluechip Dividend Stocks: Rs 50 lakh

• Fixed Deposits (FDs): Rs 50 lakh

• Real Estate:

1) Own house (self-occupied)

2) One rental property fetching Rs 20,000 per month, with 5 per cent annual rent escalation

Total Liquid Net Worth = Rs 2.7 crore (excluding real estate)

Expenses:

• Rs 75,000 per month for living

• Rs 2 lakh per year for travel

Total = Rs 11 lakh/year initially (expected to grow at 6 per cent inflation)

Emergency Reserve:

• Rs 30 lakh separately kept in liquid funds for emergencies

Investible Corpus for Income Generation: Rs 2.4 crore

Joshi’s Strategy: Rental Income First

Rental Income First:

• While rent is Rs 20,000 per month nominally, Joshi factors in:

1) The potential vacancies

2) maintenance costs

3) property tax and ongoing repairs of the house

So he prudently considers only 9 months of rent per year = Rs 1.8 lakh per year in Year 1, growing at 5 per cent p.a.

Gap To Cover Through Portfolio:

• Year 1 = Rs 11 lakh - Rs 1.8 lakh = Rs 9.2 lakh per year

This gap grows with inflation (6 per cent) annually.

In every strategy, Joshi first uses rental income and only funds the remaining shortfall through his financial portfolio.

The Four Passive Income Options Joshi Considered

Option 1: Growing Annuity Plan (Without Return of Premium—RoP)

Joshi could invest Rs 2.4 crore into an immediately growing annuity plan.

Assumptions:

• Starting annuity yield of around 5.7 per cent per annum

• Annual 3 per cent increase in payouts

• Full taxation of annuity income

Pros: A guaranteed lifetime income and an annual growth that helps fight inflation initially

Cons: Severe liquidity loss as capital is locked in, no capital return to heirs, and a growing gap risk if expenses grow faster than 3 per cent payout escalation

First Year Income:

• Rs 13.7 lakh before tax

• After 20 per cent tax: Approximately Rs 11 lakh (sufficient in early years, but may lag inflation from age 80 and above)

Option 2: Rental + REITs + FD Interest + Dividends (Equal Allocation)

Joshi could diversify among multiple cash flow sources.

Portfolio Structure: Asset allocation expected yield

• Listed Reits Rs 80 lakh, approximately 6 per cent yield

• Fixed deposits of Rs 80 lakh at around 6 per cent interest

• Dividend bluechip stocks Rs 80 lakh, around 2 per cent dividend yield

Annual Incomes (First year estimates):

• Net rental income: Rs 1.8 lakh

• Reits: Rs 4.8 lakh

• FD interest: Rs 4.8 lakh

• Dividends: Rs 1.6 lakh

• Total Pre-Tax Income: approximately Rs 13 lakh

• Post-Tax Net Income: around Rs 11 lakh

Note: While only dividend income is drawn annually from the Rs 80 lakh stock portfolio, the capital remains invested. If we assume an appreciation of around 8 per cent per annum over the long term, this portion continues to grow, contributing significantly to Joshi’s residual wealth at age 95.

Pros: This option offers a diversified income stream with moderate liquidity, and natural inflation linkage in rental and dividend growth

Cons: It demands continuous monitoring. Besides, the interest and rental income are taxable, and Reits are prone to potential volatility

Option 3: Systematic Withdrawal Plan (SWP) Using Bucket Strategy

Joshi could design a "bucket" system:

Bucket Investment Purpose

Short-Term (0–5 years) Liquid and Debt Funds Income Safety

Mid-Term (5–15 years) Hybrid Funds Moderate Growth

Long-Term (Above 15 years) Equity Funds Wealth Growth

Withdrawal Plan:

• Rs 9.2 lakh per year (growing with inflation) drawn from short-term bucket

• Refill buckets every 5 years from long-term gains

Pros: Bucket strategy provides inflation protection, high liquidity, and tax-efficient capital gains withdrawals

Cons: The need for active rebalancing and the risk of market cycles

Option 4: Systematic Withdrawal From Hybrid Mutual Funds

Simple alternative: Invest primarily in hybrid mutual funds and set up a monthly systematic withdrawal plan (SWP).

Assumptions:

• 8 per cent annual return

• Systematic withdrawal of Rs 9.2 lakh per year indexed to inflation

Pros: It is simple, offers reasonable returns, and is easily liquidable

Cons: Lower inflation protection than full equity SWP and exposure to volatility exposure

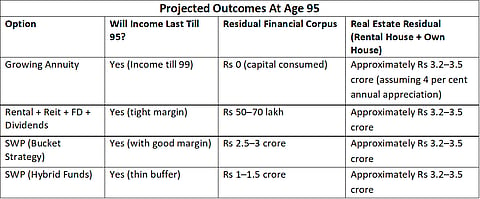

Here are the projected outcomes at Age 95

Projected Outcomes At Age 95

Key Insights:

• Growing Annuity is reliable but illiquid

• Rental + FD + Reits + Dividends offers balanced income but with limited growth

• Bucket SWP balances all dimensions, including inflation protection, liquidity, and wealth preservation

• Hybrid SWP simplifies things for those who want minimal involvement

Joshi’s real estate portfolio remains untouched, growing steadily in value.

Conclusion: What Should Mr Joshi Do?

His choice will depend on what matters most to him:

• If he values guaranteed income and simplicity — an annuity may appeal to him

• If he wants flexibility and control — SWP (bucket or hybrid) gives him both

• If legacy creation matters — equity-led options will leave more behind

Whatever the mix, the true win is designing an income stream that grows with him and supports the life he now wants to live.

Final Thought

Financial freedom is not about how much you have. It is about how long it lasts and how lightly it lets you live.

The author is a certified financial planner and co-founder and head of financial planning, House of Alpha Investment Advisors Private Limited

(Disclaimer: Views expressed are the author’s own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.)