It’s the time of the year when most parents anxiously wait for the secondary school examination results to come out across the country. The Ghosh family, based in Salt Lake township, on the eastern fringes of Kolkata, is also overwrought as to which way fate will take their 16-year-old son Prajeet Ghosh’s career, as he awaits results of ICSE exams that are due next month.

Prajeet is studying in Don Bosco, Kolkata, and understands that it is a crucial phase in his career. Not only has he to score well in exams, he would also need to decide what subjects to take up in class 11.

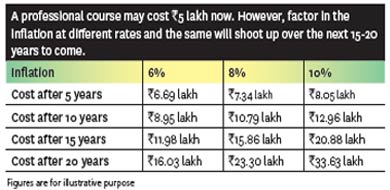

Cost of education

A carefree world At a career counselling session at his school, consisting of interactive classes and a test, it was suggested that Prajeet, whose reasoning power is strong, opt for medicine, computer science and mass communication— in this order. Although Physics is his favourite subject and he is good at it, the counsellors also suggested mass communication as he loves to talk and interact with people. However, Prajeet has other plans. He wants to become an automobile for cars and anything mobile. He spends considerable time following his passion by researching about cars and even subscribes to auto magazines, which has only fuelled his interest further in car designs and safety features.

“My son is a dreamer. He has various ideas and tells me about new things he learns every day,” says Prajeet’s mother Rita. So, if one day he hears about nuclear physics and how destructive the atom bomb is, he tells his mother how this energy can be used for the benefit of mankind. “His teachers tell us that he has the potential, but hard work is also needed,” says Kalyanbrata, his father. Prajeet is also into music. He likes listening to songs and knows how to play the synthesizer, having learnt it from a Kolkata-based branch of Trinity College, London. He also plays the synthesizer in his school band ‘Half Octate’. He is an avid gamer, who loves to frequent gaming parlours and enjoys playing FIFA with his friends.

Kalyanbrata is into outdoor advertising business, which he started about nine years ago with a partner, after working for a few advertising firms. Rita, a teacher, has left her full-time job and now takes part-time teaching sessions at coaching centres. The idea is to spend more time with Prajeet. Like any other parent, Kalyanbrata and Rita want the best for their son and know how important this next juncture is for him; and so will be the next few years, depending on how the next few months turn out to be.

Funding Prajeet’s dreams To make their son’s dreams come true, the Ghoshs have invested in two LIC policies, with Prajeet as a nominee that will mature when he turns 18 and pay out Rs 3 lakh. This sum has been earmarked for Prajeet’s college education and the couple plan to review it the moment the ICSE exams results come out and there is a clear handle on which education stream Prajeet pursues.

Their current income takes care of his education needs, by way of school fee and anything else that he needs. The couple is confident that they will be able to meet his education expenses with existing savings and future income. At the same time, they are also thinking about their own financial goals, especially retirement. In the absence of any clearly defined retirement goal, most of the surplus that Kalyanbrata earns at present is invested back into the business. “I am confident that my share in the business will be adequate to fund our retirement,” he says.

To ensure that medical emergencies are met easily, the couple has taken a floater insurance cover with Rs 2 lakh cover for each of them and a Rs 1 lakh cover for Prajeet. They definitely need to increase this cover, going by the rising healthcare costs in the country.

A cause of concern is that the family does not have any investment in equity or mutual funds. Rita had once put her money in a mutual fund scheme that promised high returns but it did not materialise as expected. “Now, we do not want to take risks and prefer investing in safe instruments,” she says. For their retirement, they will need to put money into equities to build wealth, to be able to manage their sunset years well.

The senior Ghoshs’ dreams rest on their son Prajeet. “The education system is such that a lot depends on how well you score in the board exams. So this time is very crucial for him,” says Kalyanbrata. In an environment where competition is very high, a few marks here and there could make all the difference for him; it is about making the most of the time that is left before he enters 11th standard. For Prajeet, it is just the beginning of an exciting life ahead and we wish him good luck!

Checklist

A defined timeline

No goal is worth the effort if there are no strict timelines to it. Make sure you know the goal you are saving for and when you will need to redeem that money. A child’s education, for example, is a goal that cannot be postponed even for a few months. So set a date.

A specified sum

One can arrive at a tentative amount and map one’s progress as one approaches near the goal. Keep in mind to set the target based on current costs of education and adjust it for inflation for a realistic sum.

Shortlist a plan

There are some child’s education plans that are tailored towards your needs. Choose the one thjat is realistically aligned to your goal and is also within your risk appetite.

Early and regularly

There is no magic wand that will help you summon the money as and when you require. All you need to do is begin early and save regularly. By inculcating this habit, you get the advantage of power of compounding.

Keep a close eye

It is not enough to just finalise a goal and start putting money into it. You need to regularly check its performance and make changes if necessary.

anaghpal@outlookindia.com