Single income, no insurance and meagre savings is a recipe for disaster that Mumbai-based Shindes are staring at. Both Tushar  and Shraddha are 30 and have a 9-month-old daughter Aadhya who has increased their responsibilities and made them look into their financial lives. One look into their finances and it becomes difficult to either label them brave or just ignorant. They have no insurance, life or health, and they have little savings. There are a few things to their advantage—they live in their parent’s house and Shraddha is a science teacher in a school, and will rejoin work soon.

and Shraddha are 30 and have a 9-month-old daughter Aadhya who has increased their responsibilities and made them look into their financial lives. One look into their finances and it becomes difficult to either label them brave or just ignorant. They have no insurance, life or health, and they have little savings. There are a few things to their advantage—they live in their parent’s house and Shraddha is a science teacher in a school, and will rejoin work soon.

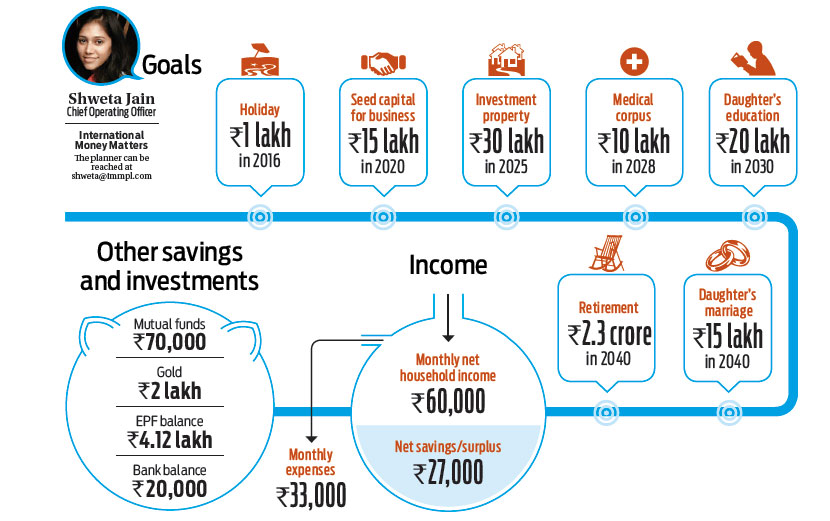

Like any typical Indian couple, they have financial goals that include buying a house, educating their daughter and saving for her marriage, which is a good 25-30 years from now. The fact that they have listed these goals is a saving grace as these will be the stepping stones to getting their financial house in order. Some of their financial goals need revision because they just do not have the money to reach there as of now. For instance, Tushar needs to revise the seed capital for his business from Rs.30 lakh to Rs.15 lakh. Likewise, the couple should think of reducing their aim to set aside Rs.70 lakh as investment in property to Rs.30 lakh.

Sound foundation The importance of health and life insurance cannot be stressed, and you should read this issue’s cover story to understand why they are so crucial. In a similar vein, you should cultivate the habit to save more and invest your money fruitfully. Considering you have mentioned that you want to create a medical corpus for your parents, we are assuming you are aware of its relevance and importance. Strangely, you have kept yourself and your wife out of this. Since you have a small daughter, you should take a health insurance plan for each one of you. A few days of hospitalisation can set you back financially in a significant manner, and the best way to work around this is to have adequate insurance as recommended.

You have two loans, which you are servicing currently, and it is important for you to realise that these are a drain and need to be closed as soon as possible. Having experienced the repayment on loans, you should ask yourself if you really need to buy the second house. After all, you are living with your parents at the moment and are in no hurry to move out, which means this is a goal that can be deferred for some more years. Similarly, you need to rethink on starting a venture of your own, which entails a risk factor, especially when you are the primary breadwinner.

Having got your finances analysed and planned, you now have a roadmap with which you can set about fine-tuning your financial life to make the most of what you have. In the midst of all these financial issues, do not forget to spend time with your daughter to enjoy the pleasures of being with a growing child!

A plan to act on

A plan to act on

Contingency corpus

■ Maintain minimum three months’ expenses as contingency fund

■ Continue maintaining Rs.20,000 as the bank balance towards the contingency fund and set aside the mutual fund investment for the same

■ It is recommended to save the entire surplus of next one month towards building emergency corpus

Insurance

■ It is recommended that Tushar take a term life insurance cover of Rs.1 crore

■ He should also purchase independent health cover of Rs.5 lakh each and critical illness cover of Rs.10 lakh each for himself and Shraddha, and a Rs.3 lakh cover for Aadhya

■ Tushar should purchase a personal accident cover of `50 lakh for self

Vacation

■ Start systematic monthly investment of Rs.8,500 starting September 2015 for 12 months in a liquid fund

Seed capital for business

■ EPF could be withdrawn and utilised for investing in business

■ It is recommended to start systematic monthly investment of Rs.10,500, starting September 2015, till 2020

Expense corpus in 2025

■ It is recommended to start systematic monthly investment of Rs.3,000 once Shraddha resumes her work from the first quarter of 2016 and continue investing till 2020

■ As no income in the first year of doing business has been considered, it becomes extremely important to create this corpus to meet regular expenses during the year

Investment in real estate

■ It is recommended to cover 50 per cent of the cost through self-funding and remaining through a home loan

■ Start systematic monthly investment of Rs.7,300 once Shraddha resumes her work. Step up the investment amount by 30 per cent every year till the goal year

Medical corpus for parents

■ Start systematic monthly investment of Rs.2,200 from first quarter of 2016. Step up the investment by 30 per cent every year till the goal year

Aadhya’s education

■ Start systematic monthly investment of Rs.5,200 from the first quarter of 2016. Step up the investment by 25 per cent every year till 2030

■ For Aadhya’s marriage, start systematic monthly investment of Rs.32,000 from 2030 till 2040

Retirement

■ Based on the current cashflow, Tushar’s retirement age needs to be postponed from 46 to 55

■ Tushar wishes to have retirement expenses of Rs.8.5 lakh per month starting 2040, which translates to Rs.2 lakh in today’s value. But, considering the current cashflow, he will be able to meet retirement expenses of Rs.85,000 per month, which translates to Rs.20,000 per month today (their current household expenses)

■ In order to meet inflation-linked expenses till Shraddha’s life expectancy, assumed to be 81 years, a corpus of Rs.2.4 crore will be needed. Rental income from investment property could be used for the same

■ The deficit can be met by starting systematic monthly investment of Rs.13,770 from 2021 till retirement. This needs to be stepped up by 10 per cent annually. These investments should be made into diversified long-term equities through mutual funds.