HDFC Bank reduced MCLR effective November 7, 2025

Canara Bank revised MCLR rates effective November 12, 2025

Borrowers can benefit from cheaper EMIs and shorter repayment periods

HDFC Bank And Canara Bank Cut MCLR In November: Loans Just Got Cheaper

HDFC Bank and Canara Bank reduced their marginal cost of lending-based rate (MCLR) this month, leading their loan rate to get cheaper

The reduced Marginal Cost of Funds-Based Lending Rate (MCLR) means lower interest rates on bank loans. Recently, HDFC Bank and Canara Bank reduced their MCLR rates, which means cheaper loans for borrowers. This year has been beneficial for borrowers due to the declining lending rate. The primary reason is a 100-basis-point repo rate increase by the Reserve Bank of India (RBI) this year. Another contributing factor is the low inflation rate, which remains below the targeted inflation rate, among other factors. Simply put, when the repo rate (the rate at which the RBI lends to banks) is reduced, banks’ borrowing costs become cheaper, which translates into lower lending rates for borrowers.

Here are the details of the change in MCLR of HDFC Bank and Canara Bank.

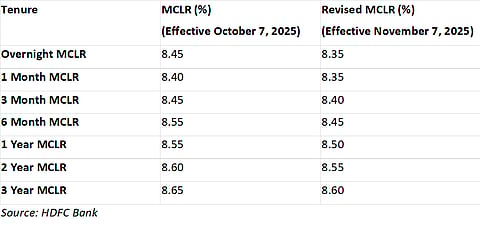

HDFC Bank

HDFC Bank reduced its MCLR by 5 to 10 basis points for all tenures, effective November 7, 2025. The maximum cut has been in the overnight and six-months tenure (10 basis points), and for the other tenures, the bank reduced MCLR by 5 points. Here is the detail.

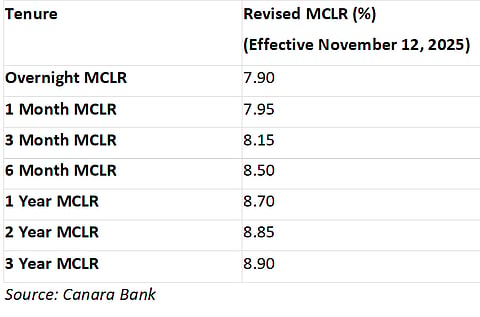

Canara Bank

This public sector bank has revised and reduced its MCLR rates on November 12, 2025. Now, it ranges from 7.90 per cent to 8.90 per cent. Here are the details:

These new rates will be applicable for new loans, advances, first disbursement sanctioned, and other credit facilities renewed or reset. Besides, if borrowers want to switch their loans that are linked to other benchmark rates, they can also switch to MCLR-based interest rates.

What Is MCLR?

This is the minimum interest rate at which banks can lend money, but not below this. As the rate is linked to the repo rate, any change in the repo rate affects MCLR. The result is cheaper rates for floating rate loans, including home loans, personal loans, consumer loans, etc.

The banks also consider the RBI stipulated cash reserve ratio (CRR), their operating expenses, and tenure premium in determining their MCLR rates.

When the rates are reduced, banks’ lending rates also change and make either the equated monthly instalments (EMIs) cheap or reduce the repayment period.