Following the Reserve Bank of India's (RBI) repo rate cut in June 2025, banks have been revising their lending and deposit rates. Recently, the State Bank of India (SBI) and Central Bank of India (CBI) have also revised their MCLR downward by up to 25 basis points (bps) and five bps, respectively. A reduced MCLR means lower equated monthly instalments for borrowers on floating-rate loans, such as home loans, personal loans, and consumer loans. While banks revise their rates periodically, every six months or so, borrowers can also approach the banks to request a rate reduction.

SBI And Central Bank Of India Reduce MCLR, Loan EMIs To Become Cheaper

State Bank of India (SBI) and Central Bank of India (CBI) have reduced their marginal cost of fund-based lending rates (MCLR) in July 2025, by up to 0.25 per cent and 0.05 per cent, respectively

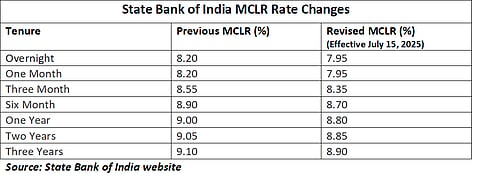

Here are the details of the SBI and CBI's MCLR rates.

State Bank Of India (SBI)

SBI revised its lending rates downward by up to 25 bps, effective July 15, 2025. The same day, it also revised its fixed deposit (FD) rates. After the revision, its MCLR ranges between 7.95 per cent and 8.90 per cent. Compared to this, the previous MCLR ranged from 8.20 per cent to 9.10 per cent.

After reducing MCLR, SBI’s interest rates for various vehicle loans range from 9.00 per cent to 9.95 per cent for vehicle loans, and 11.55 per cent to 15.05 per cent for certified pre-owned car loans.

However, the final interest rate for a loan is worked out after taking into account the credit score of the borrower. For example, if a borrower has a credit score of 800 and above, the rate of interest for a vehicle loan would be 1 year MCLR + 0.20 per cent for a 3-5 year loan, which means (8.80 per cent + 0.20 per cent = 9.00 per cent).

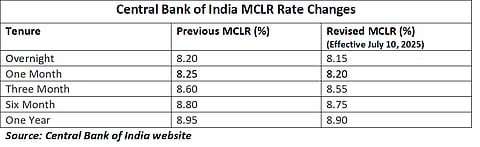

Central Bank Of India (CBI)

Central Bank of India reduced its MCLR by 0.05 per cent (5 bps) across tenures. The revision has been effective since July 10, 2025.

The MCLR changes will affect floating-rate loans with the bank, especially those loans that are reset every six months or a one-year reset. From July 10 onwards, the interest rates for these loans would be reduced. If you are taking a new loan, the new MCLR will apply after adding the spread (the difference between MCLR and the final rate of interest). The spread may vary depending on the borrower’s risk profile, credit score, and the type of loan.