If you are travelling abroad, one of the key things to plan for is currency exchange rates, as that can significantly impact your budget. For instance, if a family of four plans to travel to a country where dollars are accepted, with an estimated expense of Rs 3 lakh per person, their total travel cost would amount to Rs 12 lakh. Converting this into dollars, as of December 12, 2024 (exchange rate: $1 = Rs 84.67), the total is approximately $14,177.20. Last month, on November 8, 2024 (exchange rate: $1 = Rs 84.35), the same amount would have been $14,224.97. This minor fluctuation, caused by the rupee strengthening slightly, highlights the importance of timing currency exchanges for international travel to manage costs effectively.

How To Beat Currency Exchange Rate Woes

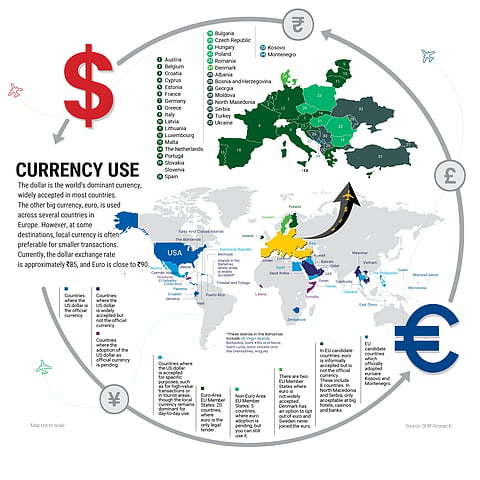

If you are travelling abroad, you will have to change your Indian rupees into either dollars or euro or to the local currency. Here's how to choose the right currency for a seamless holiday experience abroad

Currency exchange rates are often unpredictable. According to Romil Pant, executive vice president and business head - leisure, Thomas Cook India: “Foreign exchange rate fluctuations are near impossible to predict, and holiday destinations are selected based on customer interest and scheduled around school holidays or leave, rather than currency fluctuations.”

Fortunately, recent trends show that the Indian rupee has been strengthening against global currencies.

Says Pant: “Over the past month, we have witnessed a strengthening of the Indian rupee versus global currencies. This is particularly noticeable for the euro (€) , making expenses on hotels, local transportation, attractions, and shopping easier on the Indian wallet.”

This recent shift has brought a silver lining for Indian travellers heading outside the country, making their trips more affordable and budget-friendly.

Getting Around The Problem

Where you are travelling to can make a lot of difference.

Says Anil Kumar Bhansali, executive director and head of treasury at Finrex Treasury Advisors LLP, a treasury and foreign exchange consulting company: “The fluctuation of foreign exchange rates for currencies depends on demand on supply in that particular country or city. For instance, in South America or Africa where there is a shortage of foreign currency, one can get a good rate for converting.”

In India, the rates may not be as good as in some other countries. “On rare occasions when there is shortage created in the market due to Reserve Bank of India (RBI) absorbing the dollars from the market, one gets good rates,” he says.

When Bhansali’s son went to Argentina, he found that there were three rates applicable in the country and he got the best rates when he used a Mastercard/Visa card there.

How Do You Carry Your Money

Another aspect you need to keep in mind is how to carry money abroad.

Cash: One option is to carry cash after exchanging it, but there are limitations to this. When traveling abroad, it is crucial to be aware of the cash limits set by RBI. Indian residents can carry up to Rs 25,000 in Indian currency while travelling internationally. For foreign currency, individuals are allowed to carry up to $3,000 in cash while travelling abroad. Additionally, the maximum amount of cash an Indian can carry out of India in euros is less than €10,000, and if you are carrying more than this amount, you must declare it to the customs authorities. It is also important to note that different countries have varying requirements for carrying cash. For instance, in the US, you must declare cash or cash equivalents over $10,000 when entering or leaving the country.

Carrying cash also comes with risks, such as theft, loss, or misplacement, which can lead to significant inconvenience during a trip. However, carrying some amount of cash is essential for immediate expenses, such as local transportation, tips, or situations where card payments are not accepted. It is advisable to carry only the necessary amount of cash and use secure options like forex cards or credit, debit cards for larger transactions to minimise risks.

Says Amol Joshi, founder of PlanRupee Investment Services, which offers professional advice on investments and financial planning, “There are various options like foreign currency notes, forex prepaid cards, or even your local credit card that you can use overseas. However, be mindful that some of the places might not accept cards at all and you will have to deal in currency." Check with your travel operator or your overseas contact to decide the suitable mix between cash currency and forex card amount, he adds.

Multi-Currency Travel Cards/Forex Cards: Instead of carrying all your money in cash, you can pre-load a foreign currency on a travel card or a forex card that are issued by banks and fintech companies.

In these, the exchange rates are usually fixed at the rate prevalent at the time of taking the card, and you can add to it if you fall short.

Cards are widely accepted across most countries, and these cards, typically, charge less than other options (see Where Can You Convert Your Currency).

According to Sumit Agarwal, senior vice president, MakeMyTrip, “Compared to the traditional debit or credit cards, a multi-currency travel card offers a superior user experience for the discerning traveller. First, these cards protect travellers against hefty transaction fees, poor currency rates and even hidden charges, which could be from 1-3 per cent, plus a fixed fee per withdrawal and more. Second, these cards ensure peace of mind for frequent globe-trotters as well as first-time travellers as they are widely accepted and can easily be replaced, if lost or stolen. With multi-city itineraries gaining traction, such cards can work as a one-stop solution, as travellers can load multiple currencies at favourable exchange rates.”

Mobile Payment Apps: There are several apps such as Wise and Revolut that can help you exchange currency with much better exchange rates. Most online platforms charge fees ranging from 0.4-2 per cent, depending on the transaction amount, destination, and currency. Many mobile currency exchange apps allow you to convert and spend in different currencies at the time of the transaction.

For instance, when using apps like Revolut or Wise, you can hold multiple currencies in your account and convert them to the required currency at the time of spending. These apps offer real-time currency conversion based on the live market rate, and you can use your linked card for payments directly in euros, dollars, or any other supported currency. They also come with user-friendly security measures, such as being able to freeze and unfreeze your card when required.

Use cards for shopping and making big payments, and carry local cash for making small payments as ATM withdrawals abroad is costly

While currency exchange apps offer convenience and competitive rates, there are important factors to watch out for. Ensure the app is legitimate by downloading it only from official sources. Also, check reviews to avoid fake or fraudulent apps. Fees and exchange rates should be carefully compared, not only with traditional banks, but also with prepaid travel cards, as travel cards often provide locked-in exchange rates and lower fees for international use. Additionally, some apps may charge hidden fees, higher rates during weekends, or limit free transactions. Therefore, it’s crucial to read the terms and understand the fee structure before transferring large amounts or relying solely on these services during travel.

Currency exchange apps typically charge between 0.4 per cent and 2 per cent in fees for transactions, with additional costs for certain currencies or weekend exchanges. These apps may apply a markup on the exchange rate or fixed fees per transfer. Multi-currency travel cards, on the other hand, usually charge nil to 3.5 per cent for foreign exchange, thus offering more predictable costs with some cards locking in exchange rates when loading funds. However, travel cards might charge a small fee for ATM withdrawals abroad or for certain transactions.

What Should You Do?

Says Bhansali: “If one is travelling to Europe from India, one should take the forex card which is issued by a number of banks or companies with fees at par or with small margins. Ideally, one should use the card for making payments or for shopping. Most establishments, including smaller ones, accept cards. However, one should also carry some cash. Withdrawing cash from foreign ATMs is costly, as one never knows how much the bank will charge. So the best strategy is to take a card and 20 per cent cash.”

Also, be careful about where you exchange your currency. Look at the costs and risk factor (see Where Can You Convert Your Currency). For instance, P2P platforms may be a cheaper option but may have potential risk.

Says Bhansali: “Potential risks of using P2P services are the same that we encounter when we deal with a private company. Generally, cards are issued by banks, so there’s no risk once your cards are refilled and you have checked that the amount has come to your account or card. In other options, the risk is that you pay first after which the card is filled. So, one should be careful in choosing the platform with which they are dealing with.”

It’s best to carry a combination of cash and plastic money. There are certain expenses, such as tipping, taxi fares and smaller transactions for which you might need to pay in cash. So, make sure you carry some loose change as well. For bigger spends, it’s safer to use travel cards that are acceptable everywhere.

priyanka.debnath@outlookindia.com