Unified Payments Interface (UPI) transactions saw an all-time high of Rs 24.77 lakh crore in March 2025, as per data furnished by the National Payments Corporation of India (NPCI). The figure was 12.7 per cent higher than the figure achieved in February at Rs 21.96 lakh crore. UPI transactions increased value-wise by 25 per cent and volume-wise by 36 per cent year-on-year in the same timeframe.

UPI Payments Highest Ever At Rs 24.77 Lakh Crore In March

25 per cent value growth in digital payments, with robust growth in cashless payments

The rise in the number of transactions is a sign of the growing usage of digital payments in India. UPI is a very popular payment system both for merchant payments and for peer-to-peer payments. It's easy to use, is present on most platforms, and carries out transactions instantly, and hence it is in favour with people. Today, it is utilised by everyone ranging from small-sized firms to big retailers to carry out transactions of any magnitude.

The NPCI under which UPI is operating has been created by the Reserve Bank of India (RBI) and the Indian Banks' Association (IBA) for the monitoring of digital payment systems in India. UPI enables customers to immediately transfer money from their mobile phone simply by just using their smartphone without providing bank account information, thus making it convenient and quick.

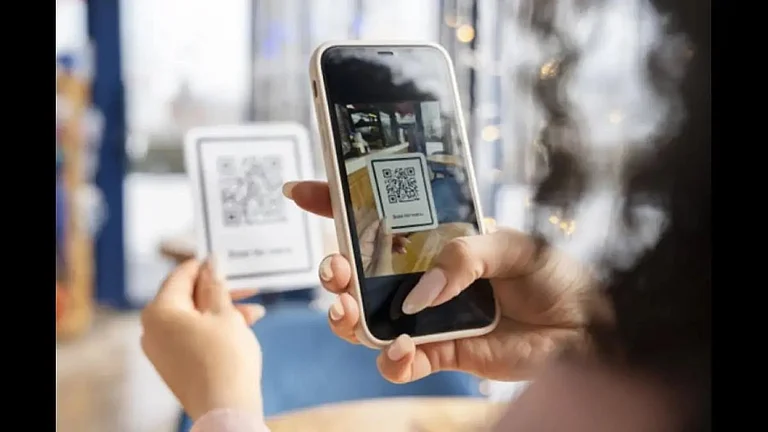

One of the key drivers of the sustained growth of UPI has been the enormous adoption of QR code payments. Shopkeepers, vendors, and service providers have adopted UPI in their day-to-day businesses, lessening their reliance on cash transactions. The government has also aided the growth of digital payments in multiple ways and hence enhanced awareness and acceptability of UPI.

UPI has also outgrown mere basic core fund transfers. Add-ons such as credit card association of RuPay cards, international transactions, and credit lines under UPI have gained popularity among users, thus adding to its growing usage. It has become a choice for individuals as well as corporations due to the ease of secure, real-time payments.

With increasing smartphone penetration and internet connectivity, the digital payment sector continues to grow. The ease of UPI, along with the ease of connectivity to the banking and payment service providers, has pushed volumes to all-time highs. With digital payment channels gaining popularity by the day, UPI will play an increasingly larger part in everyday financial transactions.

March 2025 statistics show that UPI continues to top keeping India on a digital economy track. As more and more people and institutions make use of this payment method, online transactions are bound to grow again in the coming few months.