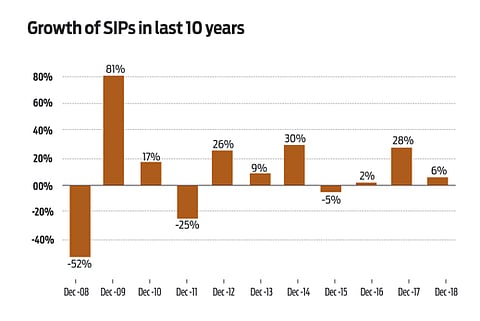

At 21 per cent, India’s household savings rate is one of the highest in the world. While in the past, a significant portion of this money was channelled into non-financial assets, such as real estate and gold, now, 49 per cent of this household savings are being invested in financial assets. More importantly, households are showing increasing appetite for stock markets. This is reflected in the rising share of equity in households’ total financial assets, though the overall share remains significantly small. Last year, due to market volatility, most asset classes generated below average returns. The mutual fund industry waited with baited breath to see how investors, who chose to invest through SIPs, would react. A huge cheer went across the mutual fund industry when the January AMFI data came across, as we tipped past the Rs8000 crore per month in the SIP book. The data highlighted that we have about 2.54 crore (25.4 million) SIP accounts through which investors regularly invest in mutual fund schemes and that the number of live SIPs have grown 2.5X in about 2.5 years. AMFI data shows that the mutual fund industry added about 9.46 lakh SIP accounts each month on an average during the Financial Year 2018–2019, with an average SIP size of aboutRs3,150 per SIP account. This trend clearly indicates that Indians have moved from being traditional savers to investors. What Indian investors have realised is that although SIP does not always guarantee profit, it can go a long way in minimising the effects of investing in volatile markets.

From Savers To Investors

SIPs are changing the way Indians multiply their money

This helps the investor not to worry about market volatility and continue investing while accumulating the wealth. SIPs have helped investors overcome the dilemma of figuring out the right time to invest. When you invest regularly over a period, irrespective of the market conditions, you would get more units when the market is low and fewer units when the market is high. This averages out the purchase cost of your mutual fund units. The trick that has really helped Indian investors build their corpus is that they have regularly increased the SIP amount helping accumulate more mutual fund units, especially when the market is low. It also helps to set expectations right, as one must remember that past performance is not an indicator for future returns. Most investors expect 10-15 per cent returns, whereas only once since 1979 has the Sensex given returns in the range of 10-15 per cent. Most of the times, market returns were either below or above the said range. The biggest advantage that people see is that they do not have to worry about micro-managing their funds and which way the market will turn or if any of a macro-economic event or an international event will impact their fund. They also have the satisfaction that even with a small amount contributed regularly, they are able to enjoy the benefits of diversification, which reduces the overall impact on the returns from a portfolio on account of a loss in a particular sector or company. For those sitting on the fence and unsure about investing, the safety and convenience that SIPs provides should help finalise the deal. Let us not be paralysed with worries ‘today’ but be invigorated by the growth prospects of ‘tomorrow’.

The author is the Head of Sales and Marketing, IDFC AMC